Ronin ecosystem beats Solana in daily active addresses, leaves Base and TON behind

- Ronin is second to Tron in terms of daily active addresses.

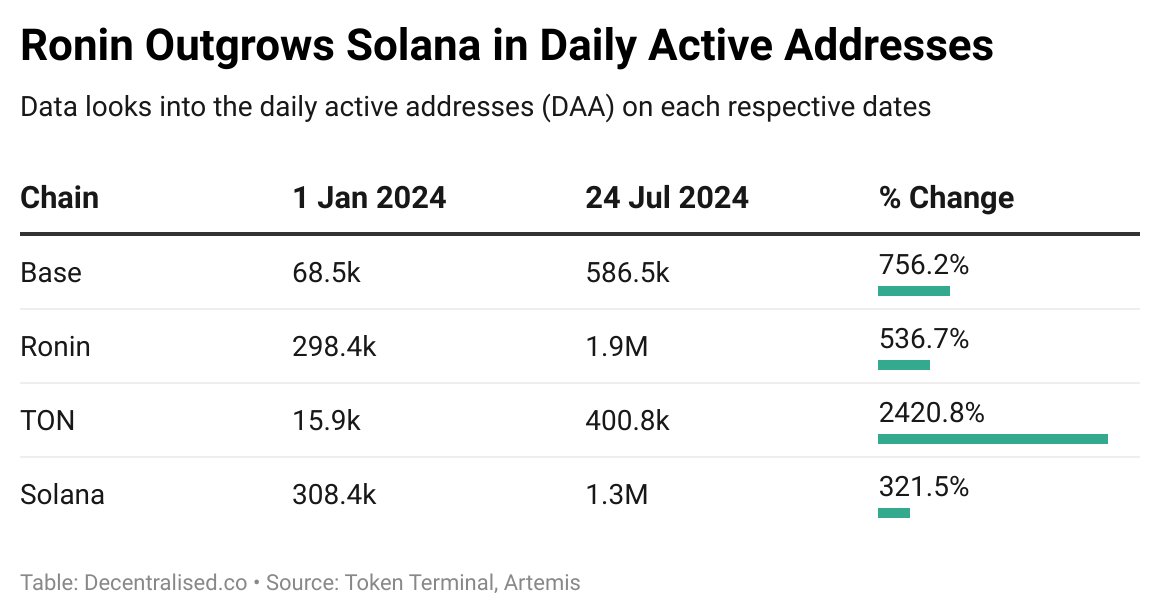

- TON and Base noted a large percentage increase in their daily active addresses since the beginning of 2024.

- RON price climbed 1% and Solana gained 3% in value on Saturday.

Solana ecosystem is not the most dominant one when it comes to daily address activity, relevance among crypto traders. Data from Token Terminal shows that a few other ecosystems have noted a steep growth curve in 2024, in terms of one key metric, daily address activity.

Tron, Ronin beat Solana in address activity

Data from crypto intelligence tracker Token Terminal shows that Tron has the highest daily active addresses, 2.2 million, while Ronin is second. TON and Base, these two ecosystems have noted the largest percentage increase in 2024, 1 million and 1.6 million respectively.

In the beginning of 2024, Solana ranked first, Ronin raked second. TON ranked last among the four ecosystems compared by the Token Terminal. In the course of nearly seven months, demand and relevance of chains among market participants shifted and Ronin observed 0.6 million more daily active addresses than Solana, as of July 2024.

Ronin outgrows Solana in terms of Daily Active Addresses

Ronin’s RON token price added 1% to its value, early on Saturday. RON noted nearly 11% decline in its price in the past seven days, The token therefore started its recovery, as market participants turned optimistic for Donald Trump’s speech at the Bitcoin conference on July 27.

Solana gained nearly 3%, up to $187.55, adding to 11% gains observed in the past seven days.