Solana could cross $200 if these three conditions are met

- Solana’s total value locked climbs 18% in July to $5.38 billion, as seen on DeFiLlama.

- Solana sustains over 20% gains in the past seven days, corrects nearly 3% on Monday.

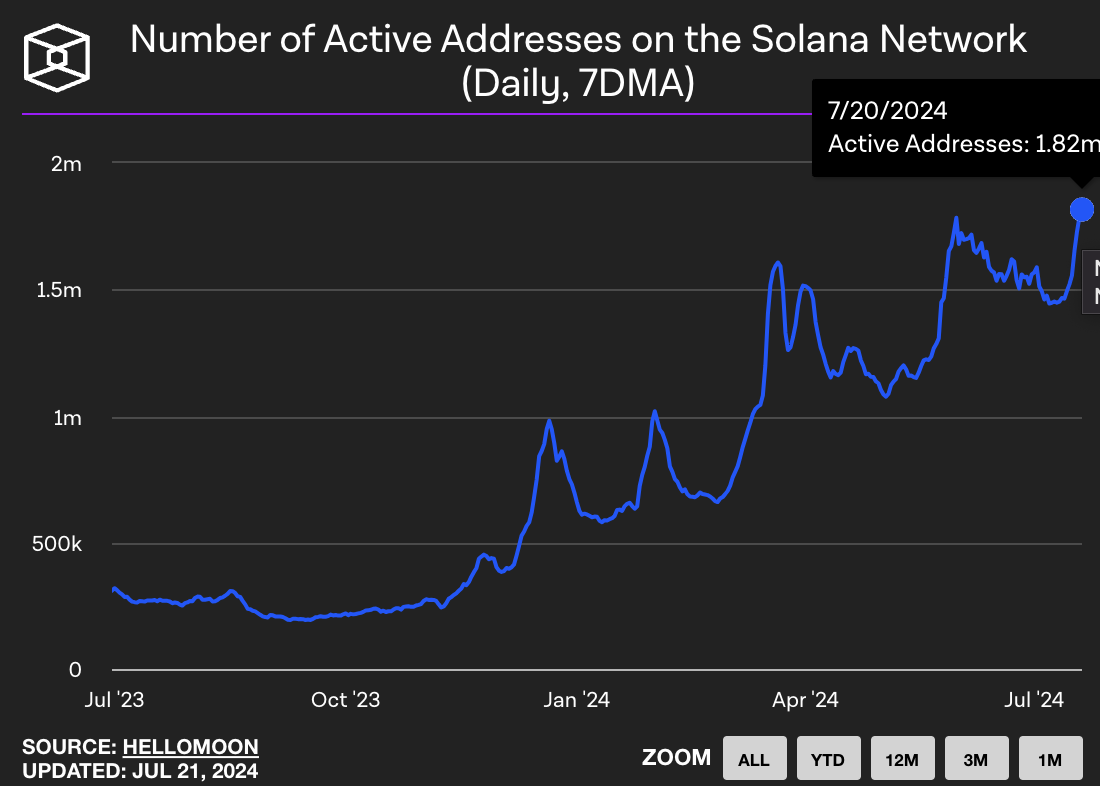

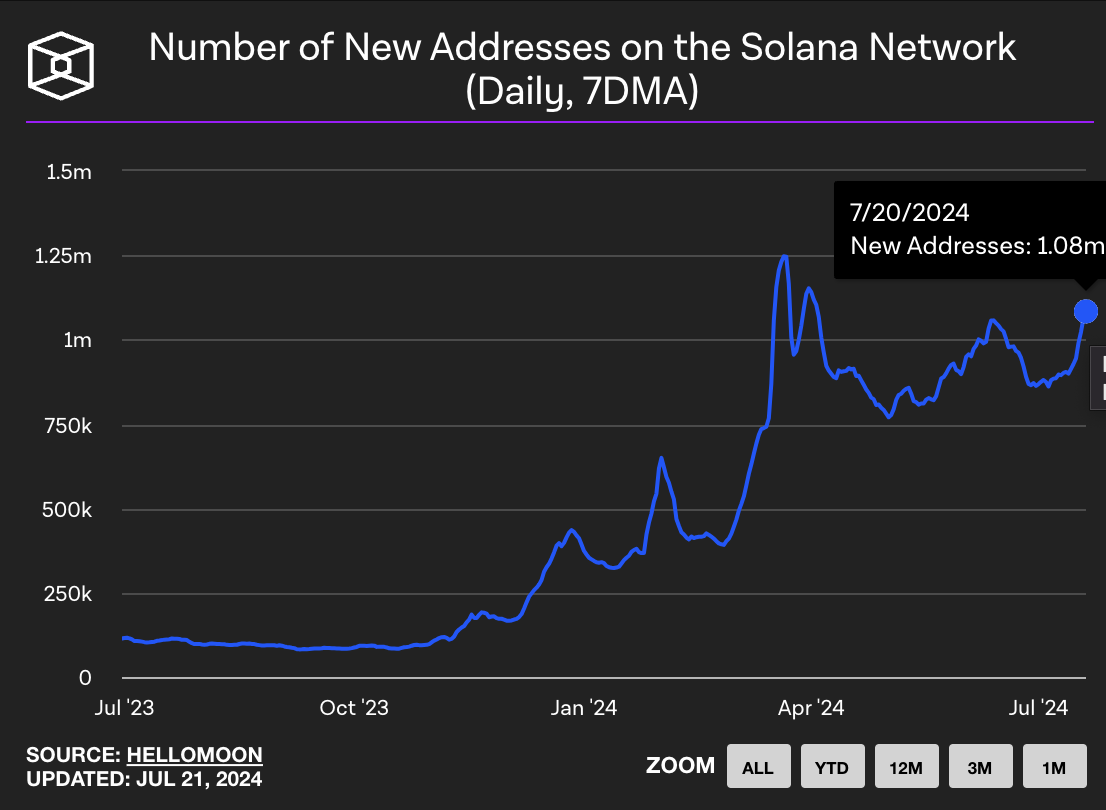

- Active addresses and new address count in the Solana network have increased throughout July.

Solana (SOL) corrects lower at around $180 and halts its rally towards the psychologically important $200 level early on Monday. The Ethereum competitor has noted a consistent increase in the number of active and new addresses in its network throughout July.

Solana’s Total Value of assets Locked (TVL) has climbed to $5.38 billion in July, per DeFiLlama data, as the chain continues to gain relevance and see demand among crypto traders. A higher TVL is positive for the token because it implies that a larger value of cryptocurrencies is locked in the chain, implying higher trust among traders.

US President Joe Biden bowed out of the Presidential race for the November election. This catalyzed a flurry of activity in Solana-based meme coins Jeo Boden (BODEN), Jill Boden (JILLBODEN), Hunter Boden (HUNTBODEN), and Kamala Horris (KAMA), among others.

BODEN, JILLBODEN and HUNTBODEN erased 57%, 82% and 31% of their value in the past 24 hours, per CoinGecko data. KAMA added 77% to its value in the same timeframe.

Solana could extend gains if these conditions are met

-

Active addresses and new addresses

Address count (active and new) is a key on-chain metric to determine whether an asset is relevant among traders and there is demand for the crypto. Data from Hellomoon shows a climb in the two metrics in July. This supports a bullish thesis for Solana.

Number of active addresses on the Solana network

Number of new addresses on the Solana network

-

TVL climbs 18% in July

Data from DeFi aggregator DeFiLlama shows that the value of cryptocurrencies locked in the Solana network has increased by 18% in July. The double-digit gain supports the chain’s rising utility relevance among traders.

A key category of tokens that supports rising activity and TVL on Solana is meme coins. Recent events in the US Presidential election campaign, such as the shooting at former US President Donald Trump’s rally and President Joe Biden bowing out of the elections, have driven a surge in activity of Solana-based meme coins.

Solana chain TVL

Coingecko data shows the Solana meme coin price trend from the last 24 hours and seven days.

-

Solana meme coins

Nate Geraci of the ETF Institute predicts combined Bitcoin, Ethereum, and Solana ETF

Nate Geraci, considered an ETF expert and the co-founder of the ETF Institute, predicted that an issuer will soon file for a combined spot Bitcoin, Ethereum, and Solana ETF within the next few months.

In a recent tweet on X, Geraci notes that the industry is heading towards index-based and actively managed crypto ETFs.

Prediction…

— Nate Geraci (@NateGeraci) July 22, 2024

An ETF issuer will file for combined spot btc, eth, & sol ETF in next few months.

We’re quickly heading down path towards index-based & actively managed crypto ETFs.

Solana eyes nearly 17% gains

At the time of writing, Solana is in an upward trend, forming higher highs and higher lows since July 6, and hovering around $180 on Monday, as seen in the SOL/USDT daily chart. The Ethereum competitor is likely to extend gains further by 17% and revisit its March 18 peak of $210.18.

A rally to the March top would erase losses from the last three months. The altcoin faces resistance at $190.03 and $193.69, the 78.6% Fibonacci retracement of the drop from March 18 to April 13, and the Fair Value Gap (FVG), respectively.

The Moving Average Convergence Divergence (MACD) momentum indicator supports gains in SOL, as the green histogram bars above the neutral line suggest underlying positive momentum in Solana.

SOL/USDT daily chart

In the case of a correction in the altcoin, Solana could find support at $174.20, the 61.8% Fibonacci retracement level. A daily candlestick close below this level could invalidate the bullish thesis for Solana.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.