Injective price surged 2,700% in 2023, outshining Solana rally due to one key factor

- Injective price rallied from $1.27 to $39.70 last year, shooting up by more than 2,700%.

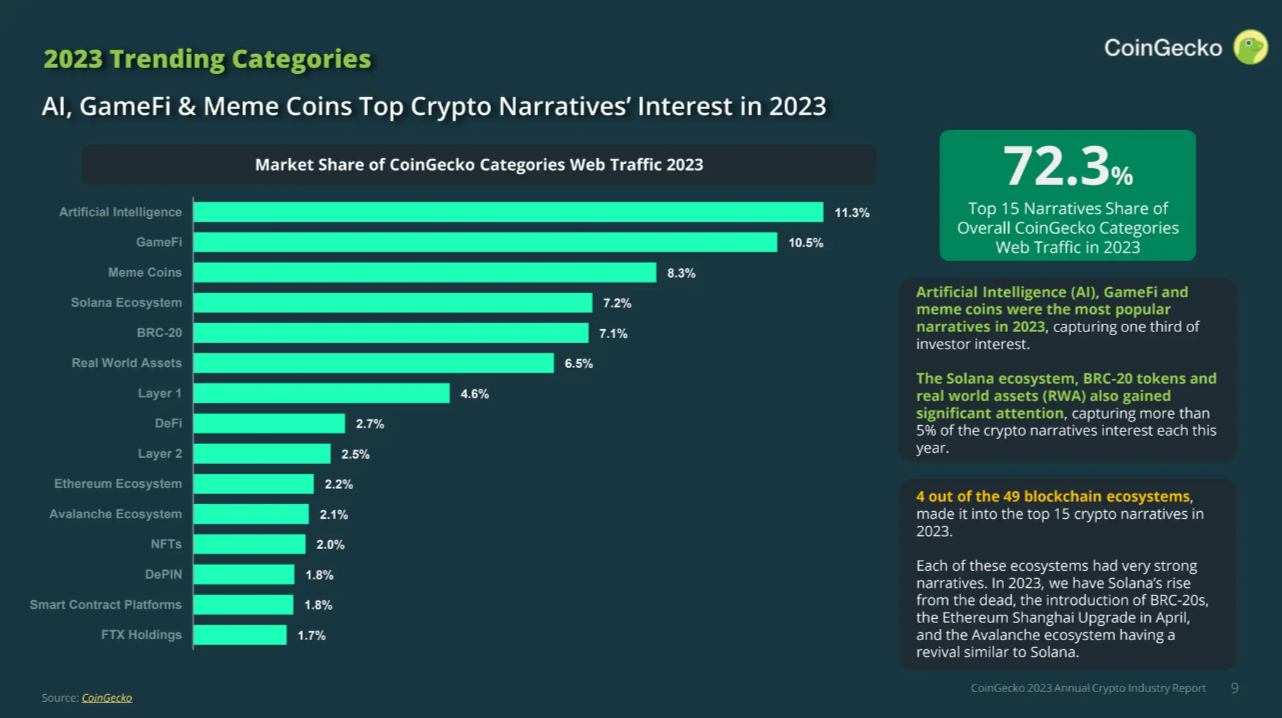

- Artificial Intelligence emerged as the most popular crypto narrative in 2023, accounting for 11% of market share.

- Solana, despite performing phenomenally, underperformed INJ and continues to lose stature in the crypto market.

The trade-off between the top position in the crypto market takes place every day in terms of gains, but beating out Solana on a yearly basis is a different thing altogether, and Injective price rise in 2023 did that exactly. This was caused by the hype surrounding its core principle more than the investors' support.

Injective outshines Solana

Injective had a great 2023 as it became one of the biggest and most gaining cryptocurrencies in the previous 12 months. While Solana witnessed a 920% rally in the previous year, INJ ended up shooting up by 2,701% in the same duration.

Up from $1.27 to $39.70 at the time of writing, Injective price has managed to earn its investors a significant chunk of profit. At the same time, it helps the project gain more credibility in the crypto market since the rally is still sustained.

INJ/USD 1-week chart

In fact, as of this moment, the AI token has managed to chart further growth since the beginning of the year, rising by 12% to trade at $39.70 at the time of writing. One of the biggest reasons, other than network developments, is the core principle of the altcoin, which was the talk of the market throughout 2023.

Artificial Intelligence (AI) took the market by surprise despite the bullishness surrounding spot Bitcoin ETF investment products. This technology essentially is considered the first step in bringing web3 closer to every person, and with the arrival of ChatGPT, Bard, and other AI tools, the narrative blew up.

This is verified by CoinGecko as well in their 2023 Annual Crypto Industry Report, where they highlighted that AI was the most popular narrative last year. GameFi, meme coins and Solana ecosystem all came in other spots as Artificial Intelligence took the first spot.

Top crypto narratives 2023

Whether this growth is replicated in 2024 is something to keep an eye out for, as it would drive the asset and the entire associated market up considerably.

Solana loses ground

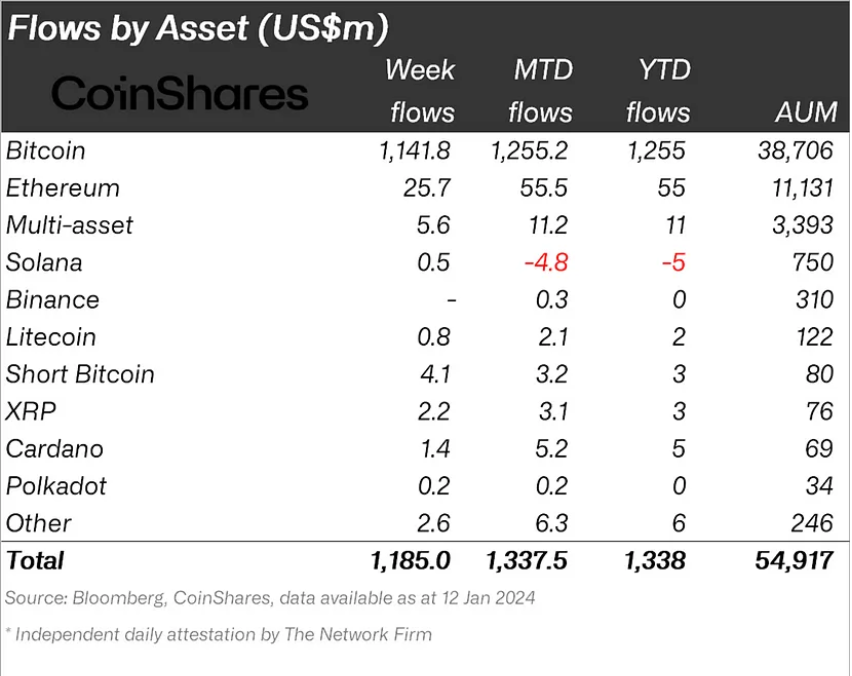

Solana not only lost the spot in terms of altcoin performance but also lost a spot in the institution's portfolio or is at least actively losing it. According to the weekly institutional investment report from CoinShares, Solana is presently witnessing outflows on the month-to-date timeframe, with total outflows hitting $5 million.

Institutional flows

While this is not an exceptionally bearish development, it does suggest that institutions are moving their funds out of Solana to book profits likely. Nevertheless, the performance could change before the end of the month, and SOL could take back its place and prevent losing its stature in the crypto market.