Bitcoin price struggles to break above the weekly resistance around $58,500 level

- Bitcoin spot ETFs received the third consecutive day of inflows on Wednesday.

- The German Government's transfer of 10,853 BTC on Wednesday may negatively impact Bitcoin's price.

- Donald Trump will speak at the Bitcoin 2024 conference in Nashville on July 27.

- On-chain data shows that small Bitcoin wallets are getting liquidated while whales and sharks are growing in number.

Bitcoin (BTC) price edges up by 0.5% on Thursday, though it struggles to break above the weekly resistance level at around $58,500, amid on-chain data indicating liquidation among small Bitcoin wallets, alongside an increase in the number of whales and sharks. The German Government's transfer of 10,853 BTC, valued at $637.67 million, is anticipated to have a potentially adverse effect on Bitcoin's price. Meanwhile, Bitcoin spot ETFs saw inflows for the third consecutive day, totaling $147.40 million on Wednesday.

Daily digest market movers: Bitcoin spot ETF received $147.40 million in inflows on Wednesday

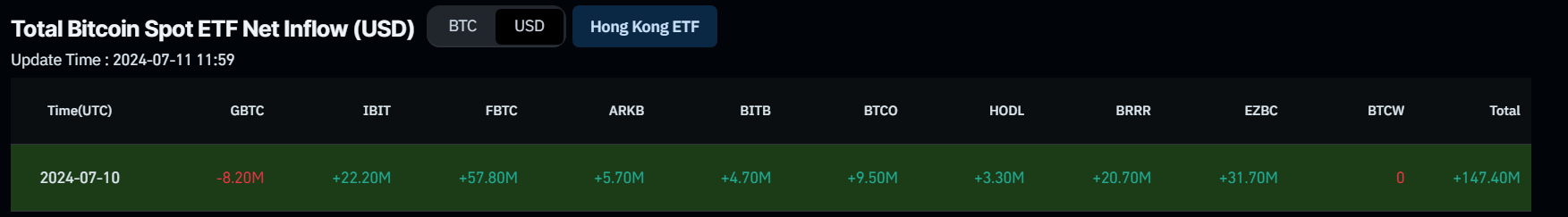

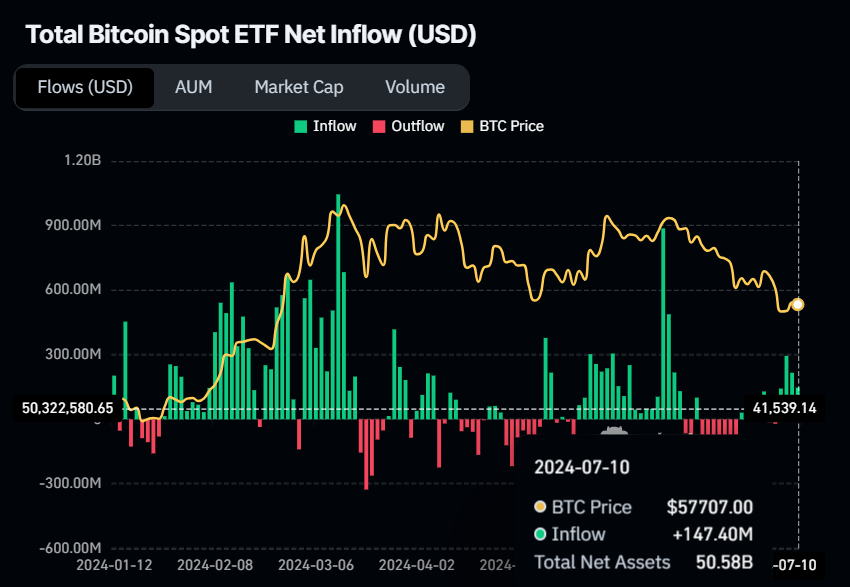

- According to Coinglass data, on Wednesday, US spot Bitcoin ETFs saw inflows for the third straight day this week, amounting to $147.40 million. This indicates increasing investor confidence and may predict a short-term rise in Bitcoin's price. Monitoring the net inflow data of these ETFs is important for grasping market dynamics and investor sentiment. Presently, the combined reserves of Bitcoin held by the 11 US spot Bitcoin ETFs amount to $50.58 billion.

Bitcoin Spot ETF Net Inflow chart

- The Bitcoin Conference Twitter account announced that Donald Trump, the 45th president of the United States, will be a featured speaker at Bitcoin 2024 event, the world's largest Bitcoin conference in Nashville, Tennessee, from July 25 to July 27. This announcement comes amid Trump's recent endorsement of Bitcoin (BTC) and the Republican party's commitment to integrating the cryptocurrency into their platform, with assurances to protect Bitcoin mining and self-custody.

- Bitcoin 2024 aims to continue the success of previous conferences held in Miami. Bitcoin 2021 gained attention when El Salvador's President Nayib Bukele declared Bitcoin as legal tender. Subsequent events in 2022 and 2023 featured significant moments, including US Presidential candidate Robert F. Kennedy Jr.'s supportive address of the Bitcoin industry.

- As Trump seeks the presidency, his backing of Bitcoin contrasts with President Joe Biden's more cautious stance towards cryptocurrencies. With Biden's attendance at Bitcoin 2024 yet to be confirmed, the event may underscore the candidates' differing approaches to Bitcoin.

ANNOUNCING: PRESIDENT DONALD J. TRUMP TO SPEAK AT #BITCOIN2024 pic.twitter.com/F2mwECVMTW

— The Bitcoin Conference (@TheBitcoinConf) July 10, 2024

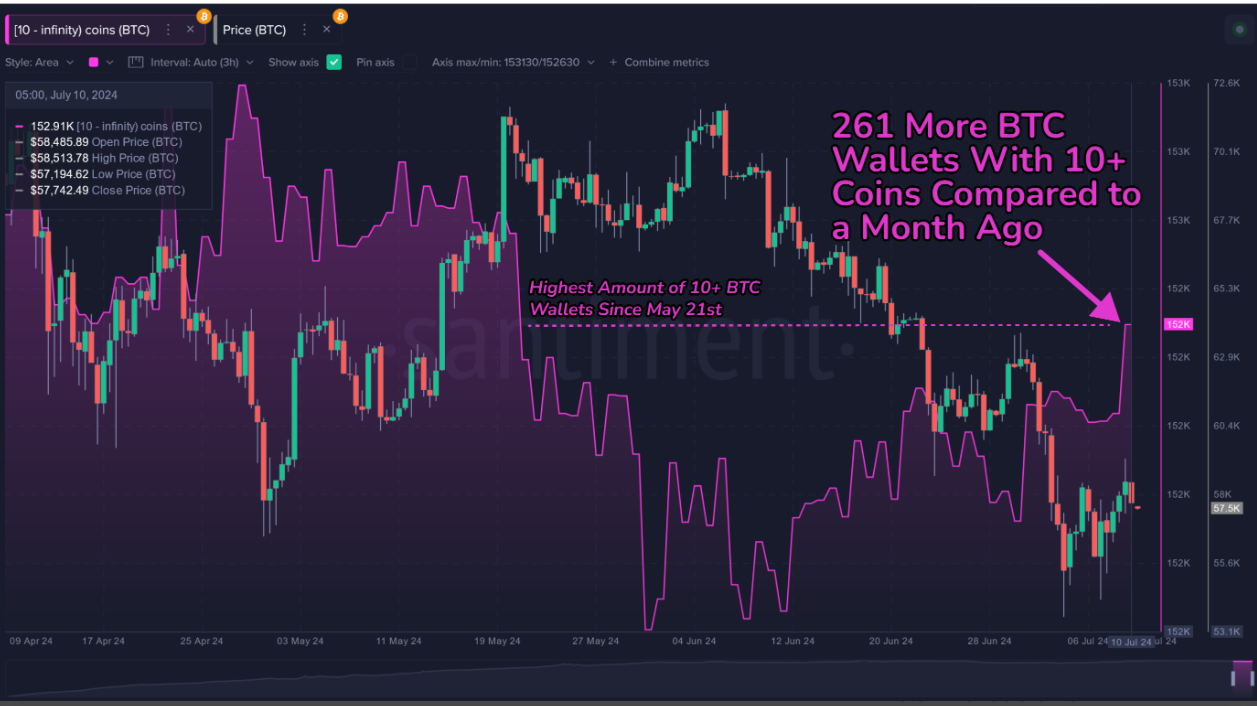

- Sentiment data for 10 BTC wallets show wallets holding more than 10 BTC. Bitcoin whale and shark wallets are increasing while small traders sell off their bags during this dip period. July has seen a net increase of 261 wallets holding at least 10 BTC, which should give traders comfort in a long-term bullish future.

Bitcoin 10 BTC holdings chart

- According to data from Lookonchain, the German Government transferred 10,853 BTC, valued at $637.67 million, out and received 2,442 BTC worth $140.47 million on Wednesday.

- The 8,441 BTC, valued at $497.2 million, was transferred from its wallet to Cumberland, Flow Traders, Kraken, Bitstamp, and Coinbase. This significant constant transfer activity from the German Government may have triggered FUD (Fear, Uncertainty, Doubt) among traders, potentially contributing to a decline in Bitcoin's price.

Update:

— Lookonchain (@lookonchain) July 11, 2024

In the past 24 hours, the German government wallet transferred 10,853 $BTC($637.67M) out and received 2,442 $BTC($140.47M).

The #German government may have sold 8,411 $BTC($497.2M) and currently holds 15,552 $BTC($907.44M). pic.twitter.com/WX31iN3EMu

- Furthermore, as per Arkham Intelligence, the German Government's status as a "Bitcoin billionaire" ended on Wednesday, with 13,360 BTC worth $784.96 million remaining, representing 26.8% of the Bitcoin initially seized from Movie2k. Notably, Blackrock's wallet is actively purchasing the Bitcoin sold by the German Government.

The German Government is selling.

— Arkham (@ArkhamIntel) July 10, 2024

But Blackrock is buying. pic.twitter.com/7ViHl3GK82

Technical analysis: BTC faces resistance on weekly level of around $58,500

Bitcoin price has faced resistance around the weekly resistance of $58,375 for the last five days. At the time of writing, BTC trades 0.5% up at $57,974 on Thursday.

Additionally, BTC trades below a descending trendline, which is drawn from joining multiple swing high levels from early June to mid-July.

If BTC closes above the weekly resistance at the $58,375 level and breaks above the descending trendline, it could rise 9% to revisit the daily resistance at $63,956.

Moreover, the formation of a lower low in the daily chart on July 5 contrasts with the Relative Strength Index's (RSI) indicator higher high during the same period. This development is termed a bullish divergence and often leads to the reversal of the trend or a short-term rally.

BTC/USDT daily chart

However, if BTC closes below the $52,266 daily support level and forms a lower low in the daily time frame, it could indicate that bearish sentiment persists. Such a development may trigger a 4% decline in Bitcoin's price to revisit the February 23 low of $50,521.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.