Crypto token unlocks worth over $730 million in July: DYDX, SUI, ARB, AXS, APE among top assets

- Crypto token unlock events in July are likely to flood the market with over $730 million in assets.

- DYDX, SUI, Arbitrum, Axie Infinity and ApeCoin rank among the top assets with scheduled unlocks in July.

- Large scale token unlocks typically push prices lower.

Crypto tokens valued at upwards of $730 million are set to be unlocked in July 2024. The vesting period for nearly 40 crypto tokens is coming to an end in the coming month.

During the vesting period, crypto token holders are shielded from the impact of mass sell-off since investors and team members are held back from selling their assets through a lock down, or “vesting.”

Crypto token unlocks lined up for July

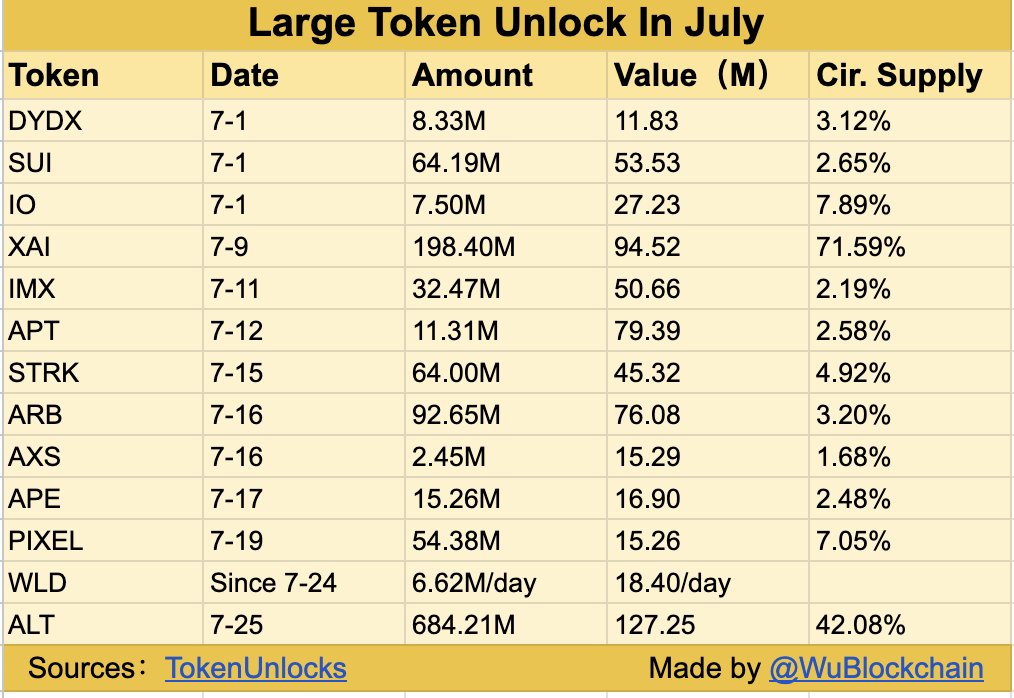

Data from token tracker TokenUnlocks shows dYdX (DYDX), Sui (SUI), io.net (IO), Xai (XAI), ImmutableX (IMX), Aptos (APT), Starknet (STRK), Arbitrum (ARB), Axie Infinity (AXS), ApeCoin (APE), Pixels (PIXEL), Worldcoin (WLD), Altlayer (ALT) are set to unlock over $730 million in July 2024.

ALT unlock exceeds $120 million, the tokens will be distributed to the team, consultants and investors. WLD begins unlocking 6.62 million tokens a day, starting July 24.

The following chart shows the date and the amount of unlock.

Large token unlocks in July

The unlocked tokens represent between 1.68% and 71.59% of the circulating supply. Typically an unlock of over 3% of the circulating supply is expected to have an impact on the asset’s price.

APT traders have shed their token holdings as Aptos wipes out over 25% of its value this month. Aptos could present sidelined traders the opportunity to buy the token unlock dip. At the time of writing, APT trades at $6.81, down nearly 2% on Sunday.

The $76.08 million Arbitrum token unlock could usher a correction in the DeFi token. ARB erased nearly 4% of its value in the past week, the asset is trading at $0.7747 at the time of writing.

What to expect from the unlock?

The high volume token unlocks can usher volatility in asset prices and assets could offer a buy-the-dip opportunity to sidelined buyers. Specifically, of all the tokens lined up for unlock, SUI, XAI, IMX, APT, ARB and ALT could suffer a decline.

Sidelined buyers could scoope up the tokens at relatively lower prices, close to the unlock or post the event.