Chainlink faces one hurdle on path to $20, on-chain metrics signal price rally

- Chainlink on-chain metrics show dwindling exchange reserves and a likely reduction in selling pressure on LINK.

- LINK price likely faces resistance at $17.64 and $18.82, on its uptrend towards the $20 target.

- Chainlink price climbed over 6% on January 15, after rallying nearly 20% in the past week.

Chainlink price hit a local peak of $17.64 on December 28, for the first time since April 2022. LINK price is $15.65, at the time of writing. The altcoin noted a mini breakout over the weekend and the price rallied to a high of $15.86, for the first time in two weeks.

LINK supply on exchanges has declined, supporting a price recovery thesis for the altcoin.

Also read: Axie Infinity and Bitcoin Cash hold up despite high ratio of shorts

Chainlink on-chain metrics support LINK price rally

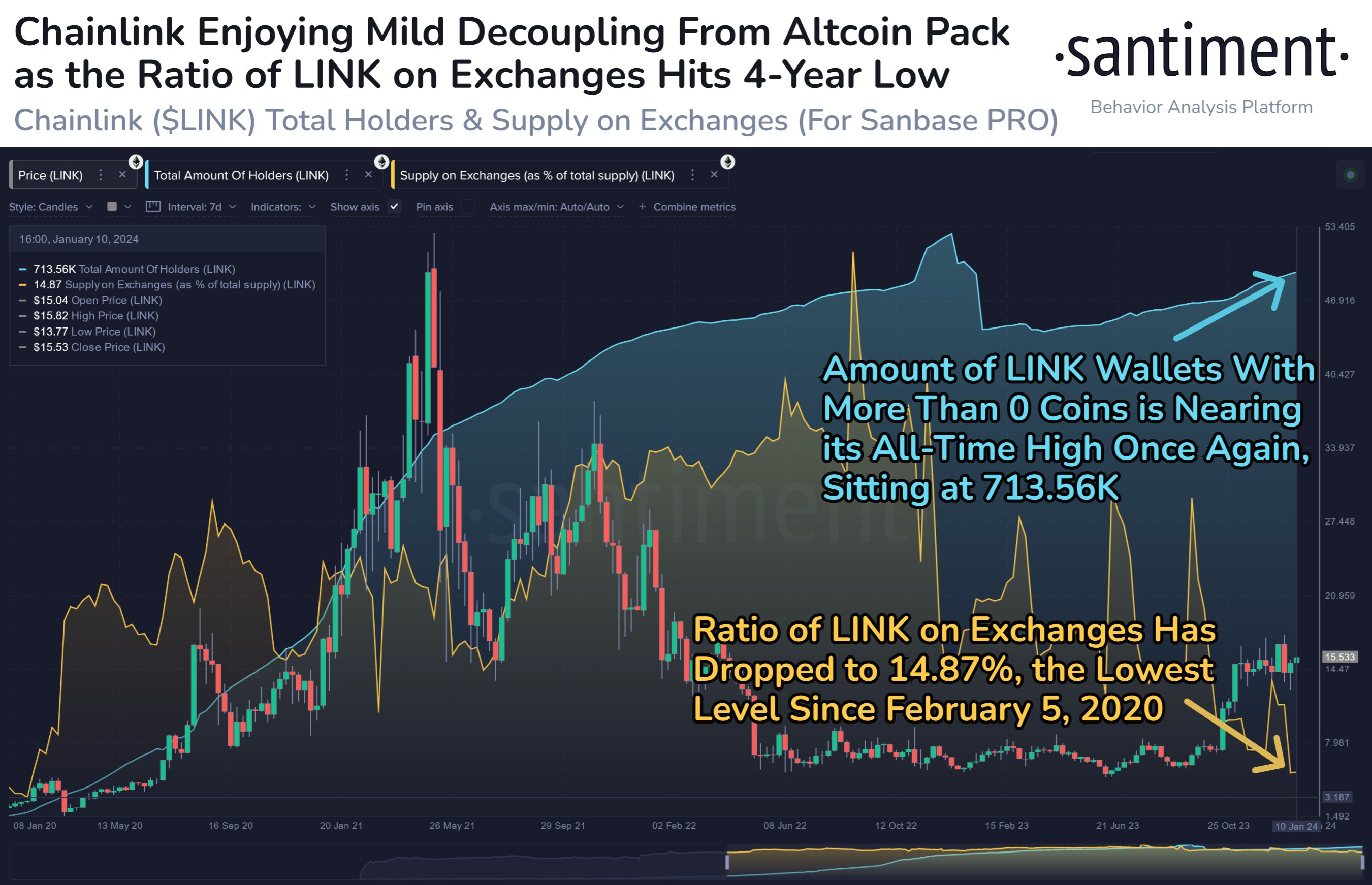

Chainlink’s supply on exchanges declined below 15% for the first time in four years, according to Santiment data. The number of wallet addresses with non-zero LINK balance is within 6% of its all-time high.

Chainlink on exchanges hits lowest level since 2020. Souce: Santiment

Chainlink’s supply on exchanges declined to 14.89% of LINK’s total supply, as seen in the Santiment chart below. A decline in exchange supply typically signals a decline in selling pressure, followed by an increase in LINK price.

%20[12.16.14,%2015%20Jan,%202024]-638409218038303771.png)

Chainlink supply on exchanges. Source: Santiment

Chainlink faces one resistance on path to $20

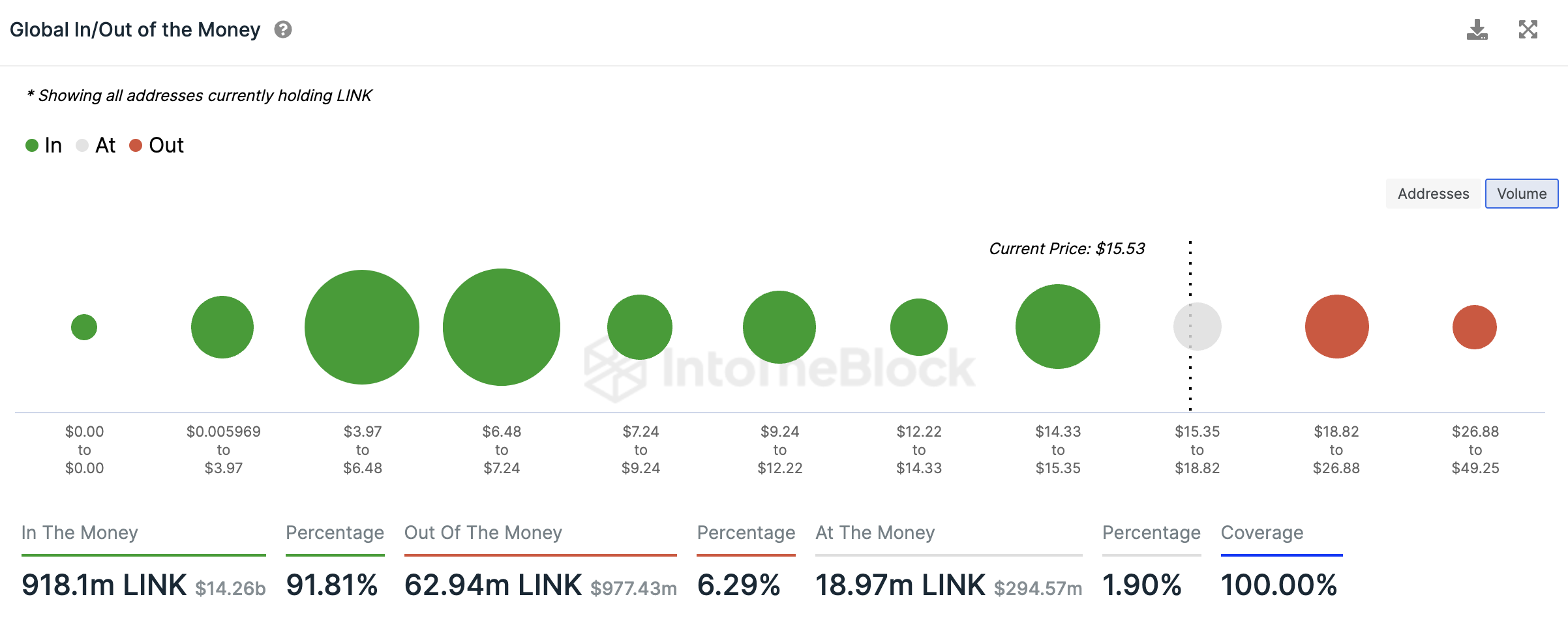

According to IntoTheBlock data, on its path to $20, Chainlink faces resistance at $18.82. LINK price is currently in a support zone, between $15.35 and $18.82, where 53,510 wallet addresses accumulated 18.97 million LINK tokens.

LINK’s key resistance zone is between $18.82 and $26.88. The $20 target lies within this zone where 92,530 addresses bought 50.35 million LINK. This makes it a key zone to watch for LINK price. Once LINK breaks into this zone, a rally to $20 is more likely.

Global In/out of the Money. Source: IntoTheBlock

As seen in the LINK price chart below, LINK price could rally to the bearish imbalance zone between $19.54 and $20.01, once Chainlink breaks past resistance at $17.64, the 2023 peak for the altcoin.

LINK/USDT 1-day chart

A daily candlestick close below the 50-day Exponential Moving Average (EMA) at $14.47 could invalidate the bullish thesis for LINK.