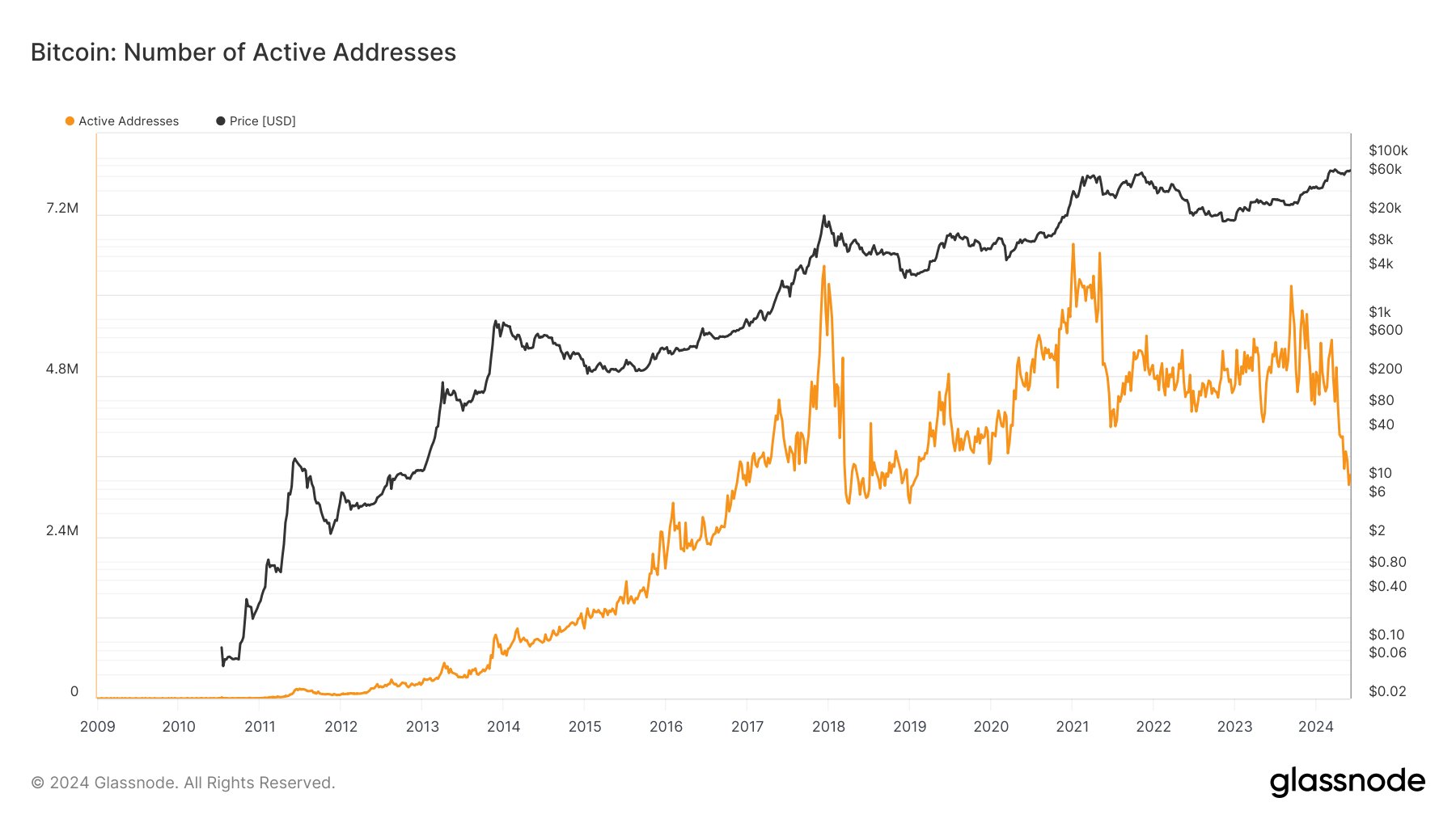

Bitcoin active addresses hit lowest level in five years, BTC ranges below $67,000

- Bitcoin network’s active address count is down to its lowest level in 2,000 days.

- BTC whale transactions valued at $100,000 and $1 million and higher have declined gradually since March 5.

- Bitcoin holders have consistently taken profits since October 23, realizing losses on some occasions.

Bitcoin (BTC), the largest asset by market capitalization, has noted a decline in its active address count per data from Glassnode. A decline in active addresses is typical at a time during a surge in Bitcoin transaction fees.

Bitcoin on-chain data shows massive decline in active addresses

Data from crypto intelligence tracker Glassnode shows that active addresses are down to the lowest level in 2,000 days. A dip in active addresses would be considered bearish, however, on-chain data shows that volume is relatively high, despite dip in active addresses.

Bitcoin: Number of Active Addresses

Santiment data shows that whale transactions in two segments, valued at $100,000 and higher and $1 million and higher have consistently declined since March 5. The chart below shows a significant drop since March 2024.

[14.03.36, 16 Jun, 2024]-638541279747838399.png)

Bitcoin whale transaction count (>$100,000) and (>$1 million)

BTC holders have consistently realized gains on their holdings since October 2023. Despite profit taking by holders, Bitcoin rallied to $71,000 on June 5. The chart below shows the spikes in Network Realized Profit/Loss metric, NPL, that tracks the daily gains and losses of all Bitcoin moved by holders on a given day.

[14.06.38, 16 Jun, 2024]-638541280059067566.png)

Bitcoin network realized profit/loss and supply on exchanges

While on-chain metrics show reduction in active addresses, and mass profit-taking, several positive spikes in NPL, Bitcoin price has sustained its year to date gains of 56%. BTC wiped out nearly 5% of its value in the past week and the asset is trading at $66,329, at the time of writing.