Ethereum could attempt new all-time high as Grayscale files 19b-4s for ETH Mini Trust

- Ethereum ETFs may not allow staking as Fidelity amends S-1 registration.

- Grayscale's 19b-4 filings reveal SEC may have conceded that ETH isn't a security if they approve spot ETH ETFs.

- Ethereum's recent price action shows new all-time high is in sight.

Ethereum (ETH) continued its rally on Tuesday following filings on the Securities & Exchange Commission's (SEC) website showing Fidelity and Grayscale filed an amended S-1 registration and initial 19b-4, respectively, for their spot ETH ETF products.

Also read: Ethereum sees a 16% spike as Bloomberg analysts surprisingly increase approval odds to 75%

Daily digest market movers: Spot ETH ETFs could be almost here

Asset manager Fidelity filed an amended S-1 registration application with the SEC for its spot Ethereum ETFs after reports stating the regulator asked issuers to send in their revised 19b-4s filings on Tuesday.

The 19b-4 filings are what national exchanges like the NASDAQ or the New York Stock Exchange (NYSE) submit to the SEC to seek approval for listing new products on their trading platforms. In the context of ETFs, S-1s refer to the initial registration forms detailing how a fund would be managed and track the underlying asset's price.

In the amended filing, Fidelity removed all words related to staking and staking rewards. The asset manager had planned to offer investors who buy into the fund the option of staking their funds for additional rewards.

Read more: Ethereum rallies 5% as Vitalik Buterin responds to criticism from community amid Coinbase ETH ETF prediction

Bloomberg analyst Eric Balchunas considers Fidelity's amendment a sign that the SEC will not allow the staking of assets within spot ETH ETFs if approved. Furthermore, Scott Johnsson, General Partner at Van Buren Capital, said that "no changes to the commodity grantor trust structure and disclosures" in Fidelity's amendment points to the SEC abandoning its argument that Ethereum is a security.

Shortly after, Grayscale filed an initial 19b-4 with the SEC for its Ethereum Mini Trust, according to Bloomberg analyst James Seyffart. As Scott Johnsson pointed out in an X post, the filing would still be listed under the "Commodity-based Trust Shares" rule.

Jake Chervinsky, chief legal officer at Variant Fund, replied that approving spot ETH ETFs would require the SEC to admit that unstaked ETH isn't a security.

This means if the SEC approves the spot ETH ETF, it will have to admit that unstaked ETH is not a security.

— Jake Chervinsky (@jchervinsky) May 21, 2024

That would be a major policy move from a Commission that has consistently refused to acknowledge any asset other than BTC as a non-security commodity.

Have we earned it? https://t.co/gJx0PDY2At

Following recent occurrences, Balchunas and James Seyffart have increased their approval odds for a spot ETH ETF to 75%, expecting the SEC to give the final greenlight "as soon as Wednesday."

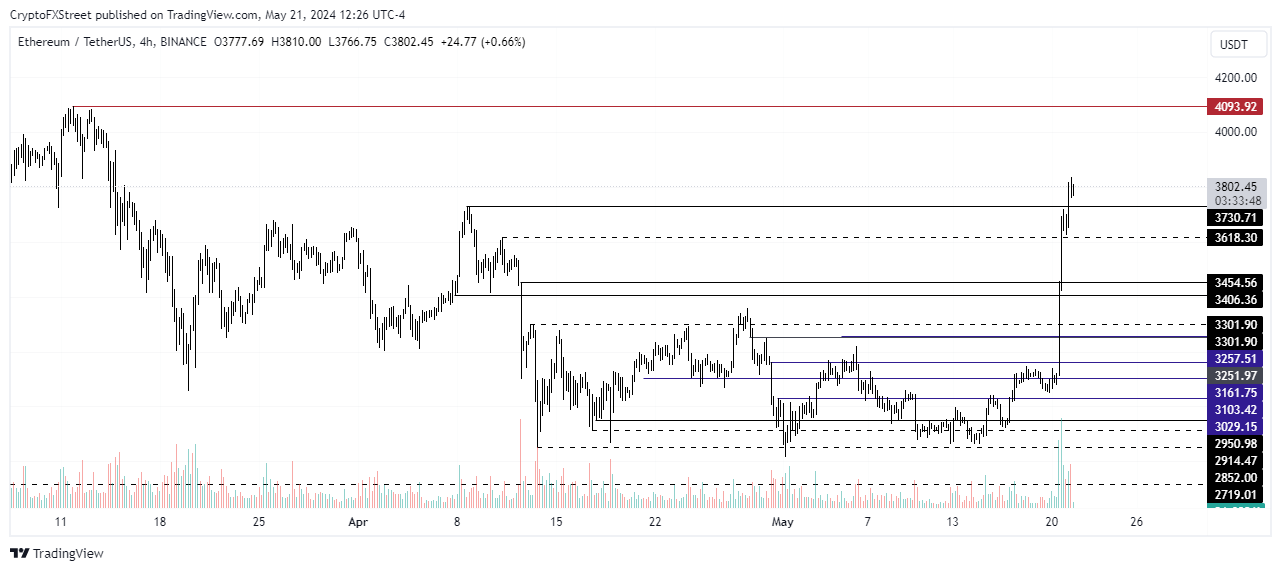

ETH technical analysis: ETH aiming for new all-time high

Ethereum broke the $3,730 resistance on Tuesday following news of the SEC potentially approving spot ETH ETFs. The number one altcoin rose nearly 22% in the past 24 hours, breaking out of the $2,852 to $3,300 range.

Also read: Week Ahead: Ethereum and DeFi to come under spotlight this week

With the current bull momentum and the SEC potentially approving spot ETH ETFs on May 23, Ethereum could defile the $4,093 resistance of March 11 and aim for a new all-time high above $4,878. As earlier predicted, reports of the potential SEC U-turn on Ethereum sparked ETH short liquidations of over $103.95 million in the past 24 hours, putting bulls in control.

ETH/USDT 4-hour chart

ETH open interest also rose by 35% from $11.6 billion to $15.1 billion in the past 24 hours, signaling increased investor confidence in the digital asset.

The bullish thesis would be invalidated if Ethereum falls below the $3,300 key price level.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.