Unstoppable Bitcoin? CryptoQuant’s CEO Foresees Bull Run Extending To 2025

According to Ki Young Ju, CEO of CryptoQuant, the Bitcoin current market dynamics suggest a bullish phase that could extend well into April 2025.

Ju’s analysis comes amid BTC’s current uptrend, which appears to be a continuation of that seen in March, when BTC achieved a new all-time high, surging above $73,000 for the first time.

Bitcoin Market Cap Growth Indicates Prolonged Uptrend, Says CryptoQuant CEO

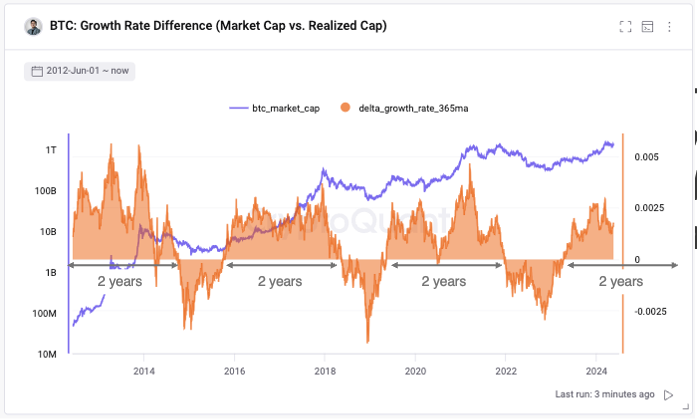

Notably, Ki Young Ju’s prediction stems from an analysis of Bitcoin’s market capitalization growth, which has been outpacing its realized capitalization — a measure of the market’s aggregate cost basis.

This trend is a classic indicator of a strong bullish cycle and has been a reliable harbinger of sustained upward momentum in past market cycles.

Ju’s analysis highlights that the market cap’s rapid growth compared to the realized cap suggests increased investor confidence and market momentum.

This pattern has historically signaled prolonged bullish phases. If the current trends persist, this cycle is expected to continue, leading to significant gains in Bitcoin’s value over the next year and a half.

#Bitcoin is in the middle of the bull cycle.

Its market cap is growing faster than its realized cap, a trend that typically lasts around two years.

If this pattern continues, the bull cycle might end by April 2025. pic.twitter.com/o4k8B1Rkhv

— Ki Young Ju (@ki_young_ju) May 17, 2024

Bitcoin has shown a positive trend, with a 1.9% increase in the past 24 hours and an over 12% rise in the past two weeks. At the time of writing, it is trading around $67,201.

Institutional Adoption And Market Sentiments Underpin Bullish Outlook

The optimistic outlook for BTC is not just based on historical trends and market cap analysis. Recent developments in institutional adoption provide further support for this positive trajectory.

Anthony Scaramucci, the founder and managing partner of SkyBridge Capital and a notable Bitcoin advocate, recently discussed on CNBC’s Squawk Box how US pension funds are beginning to invest in BTC.

“When you do the homework on Bitcoin, you go towards Bitcoin…sometimes when you’re early you get some bumps and scrapes, but I think it pays to be early in Bitcoin and we are still early in Bitcoin,” says SkyBridge Capital’s Anthony Scaramucci. pic.twitter.com/HTfbwH5VJG

— Squawk Box (@SquawkCNBC) May 16, 2024

This move by institutional investors, such as the State of Wisconsin Investment Board’s approximately $100 million investment in BTC, signals a broader acceptance and integration of BTC into traditional financial portfolios.

Scaramucci emphasized that institutional BTC adoption is unfolding rapidly, and he anticipates more pension funds will pursue Bitcoin investments. He pointed out that regulatory approvals have opened the doors for large-scale institutional participation in BTC.

This endorsement will make Bitcoin a staple in these institutions’ long-term asset allocation strategies. According to Scaramucci, understanding Bitcoin and the history of money is key to recognizing its potential.

He remarked, Being early in Bitcoin is profitable, and “we are still early… sometimes when you’re early you get some bumps and scrapes.”

Featured image created with DALL·E, Chart from TradingView