Fake SEC Bitcoin ETF Approval Tweet Breakdown: BTC whiplash causes $56 million liquidation in an hour

Source Fxstreet

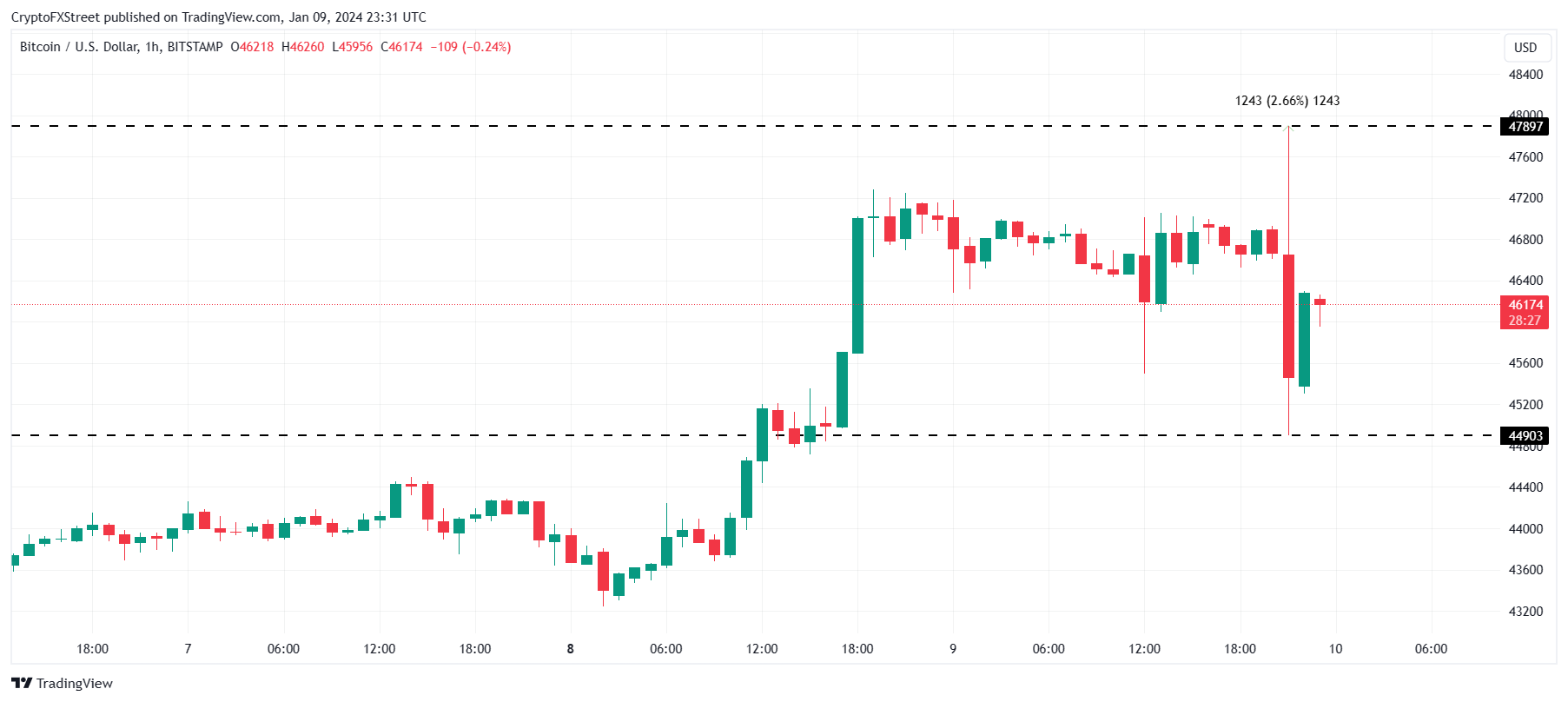

- Bitcoin price rose to $48,000 before correcting and falling below $45,000, finally recovering to $46,000.

- The SEC and Chair Gary Gensler confirmed that the regulator’s X account was hacked and that the Bitcoin spot ETF decision is still pending.

- SEC is being asked to conduct a market manipulation investigation, with Senator Hagerty saying that “Congress needs answers”.

The spot Bitcoin ETF approval is a highly influential subject in the crypto market at the moment, and just what the market feared occurred when the Securities and Exchange Commission’s (SEC) account was hacked earlier today. Here is a breakdown of what happened, when it happened, and how the market reacted to it.

Bitcoin price crashes following SEC hack

- Around 21:00 UTC, the official X, formerly Twitter, account of the SEC tweeted out that all spot Bitcoin ETF applications had been approved.

- This led to a sudden surge in the crypto market that sent Bitcoin price rallying by 2.66%, hitting $47,897 at the peak up from $46,500.

- The approval of the ETFs spread like wildfire and soon caught the attention of SEC Chair Gary Gensler, who, from his official account, tweeted,

“The SEC twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.

- This led to a correction of the rallies, and Bitcoin price dropped from the peak of $47,897 to $44,903, marking a 3.75% drop in the span of a few minutes.

BTC/USD 1-hour chart

- The news of the compromise was soon confirmed by the SEC itself as it regained control of the account, tweeting the same.

- The confirmation from the SEC stabilized the market, and Bitcoin price began recovering gradually, reaching $46,174 at the time of writing.

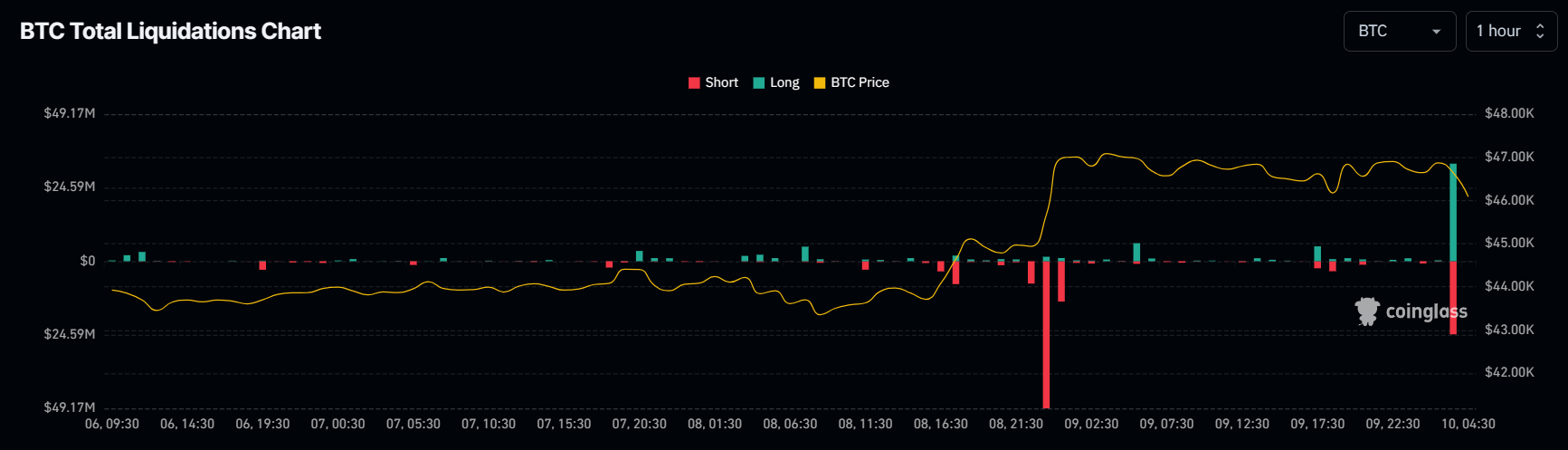

- However, the damage was already done as over $56 million worth of open positions were liquidated. This included $32 million worth of long positions and $24 million worth of short positions.

Bitcoin liquidations

- Soon after, Fox Business reporter Charles Gasparino tweeted that Securities lawyers stated that the SEC must investigate itself for “market manipulation”. Not much later, Senator Bill Hagerty also commented on the incident, saying that Congress needs answers. His tweet read,

“Just like the SEC would demand accountability from a public company if they made such a colossal market-moving mistake, Congress needs answers on what just happened. This is unacceptable.

- The Bitcoin spot ETF is a volatile topic since it would mark a historic moment for the crypto market. The deadline for the approval of the more than a dozen applications is Wednesday, January 10, and the expectations of a green light from the SEC are running high as it would create a precedent for spot crypto ETFs in the future.

- Nevertheless, the crypto market recovered from the incident quickly and made its move at trolling the SEC for their breach of security with the likes of Twitter Chief Technology Officer (CTO) David Schwartz joining, tweeting,

Disclaimer: For information purposes only. Past performance is not indicative of future results.

Recommended Articles

Goldman Sachs Raises Oil Price Forecasts and Warns Oil May Break All-Time Highs if Strait of Hormuz Disruption PersistsTradingKey - As tensions in the Middle East continue to escalate, concerns over supply disruptions in the energy market are heating up rapidly. Goldman Sachs' latest report raised its crude oil price

TradingKey - As tensions in the Middle East continue to escalate, concerns over supply disruptions in the energy market are heating up rapidly. Goldman Sachs' latest report raised its crude oil price

The SEC and the CFTC entered into a memorandum of understanding to work together on a regulatory framework.

Gold (XAU/USD) trades with a negative bias for the second consecutive day on Thursday, though it lacks follow-through selling and stalls the intraday slide near the $5,125 area.

Breaking: WTI rises above $92.50 amid supply disruption fears, geopolitical turmoilWest Texas Intermediate (WTI), the US crude oil benchmark, is trading around $92.65 during the early Asian trading hours on Thursday. The WTI price climbs over 6.5% on the day as fresh attacks on ships in the Strait of Hormuz worsen supply disruption fears.

West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $92.65 during the early Asian trading hours on Thursday. The WTI price climbs over 6.5% on the day as fresh attacks on ships in the Strait of Hormuz worsen supply disruption fears.

Related Instrument