Fake SEC Bitcoin ETF Approval Tweet Breakdown: BTC whiplash causes $56 million liquidation in an hour

Source Fxstreet

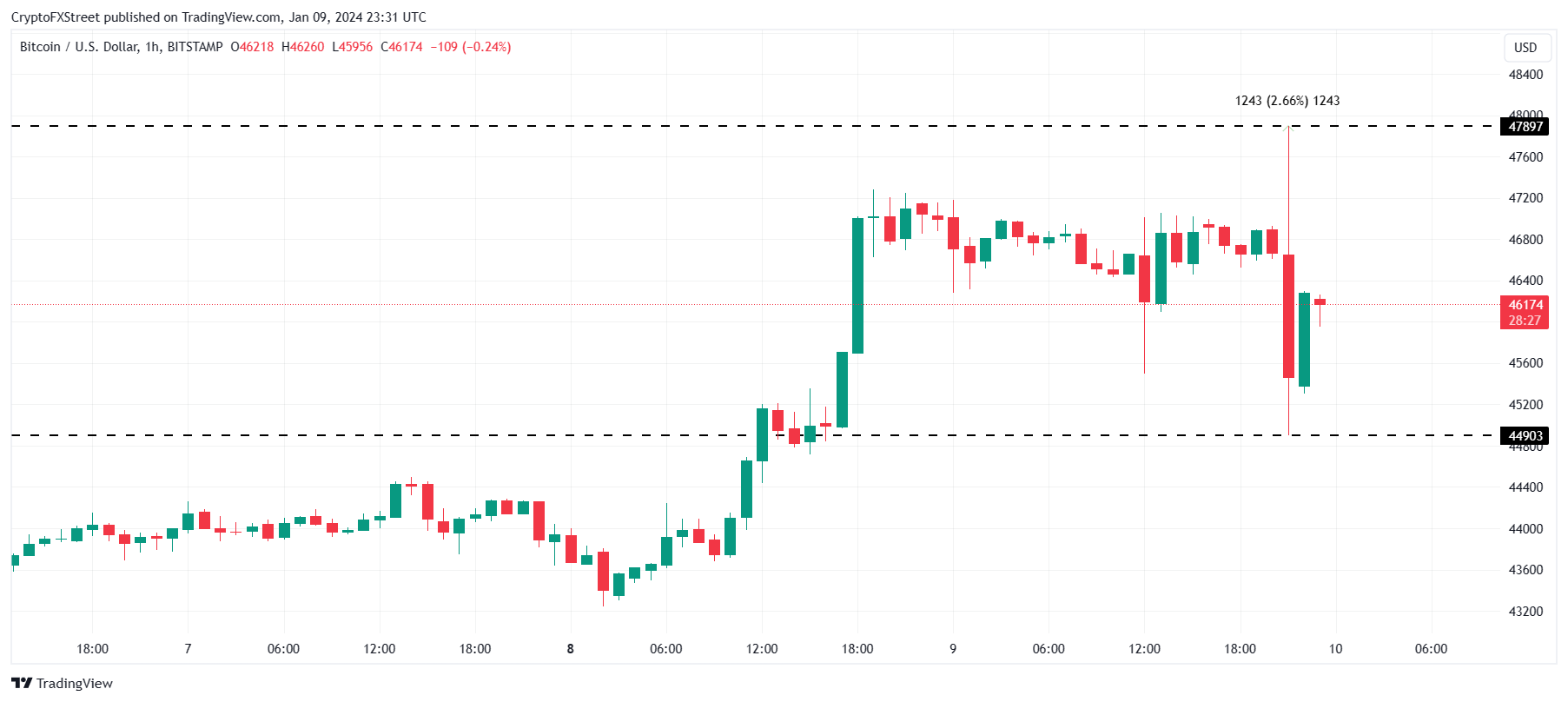

- Bitcoin price rose to $48,000 before correcting and falling below $45,000, finally recovering to $46,000.

- The SEC and Chair Gary Gensler confirmed that the regulator’s X account was hacked and that the Bitcoin spot ETF decision is still pending.

- SEC is being asked to conduct a market manipulation investigation, with Senator Hagerty saying that “Congress needs answers”.

The spot Bitcoin ETF approval is a highly influential subject in the crypto market at the moment, and just what the market feared occurred when the Securities and Exchange Commission’s (SEC) account was hacked earlier today. Here is a breakdown of what happened, when it happened, and how the market reacted to it.

Bitcoin price crashes following SEC hack

- Around 21:00 UTC, the official X, formerly Twitter, account of the SEC tweeted out that all spot Bitcoin ETF applications had been approved.

- This led to a sudden surge in the crypto market that sent Bitcoin price rallying by 2.66%, hitting $47,897 at the peak up from $46,500.

- The approval of the ETFs spread like wildfire and soon caught the attention of SEC Chair Gary Gensler, who, from his official account, tweeted,

“The SEC twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.

- This led to a correction of the rallies, and Bitcoin price dropped from the peak of $47,897 to $44,903, marking a 3.75% drop in the span of a few minutes.

BTC/USD 1-hour chart

- The news of the compromise was soon confirmed by the SEC itself as it regained control of the account, tweeting the same.

- The confirmation from the SEC stabilized the market, and Bitcoin price began recovering gradually, reaching $46,174 at the time of writing.

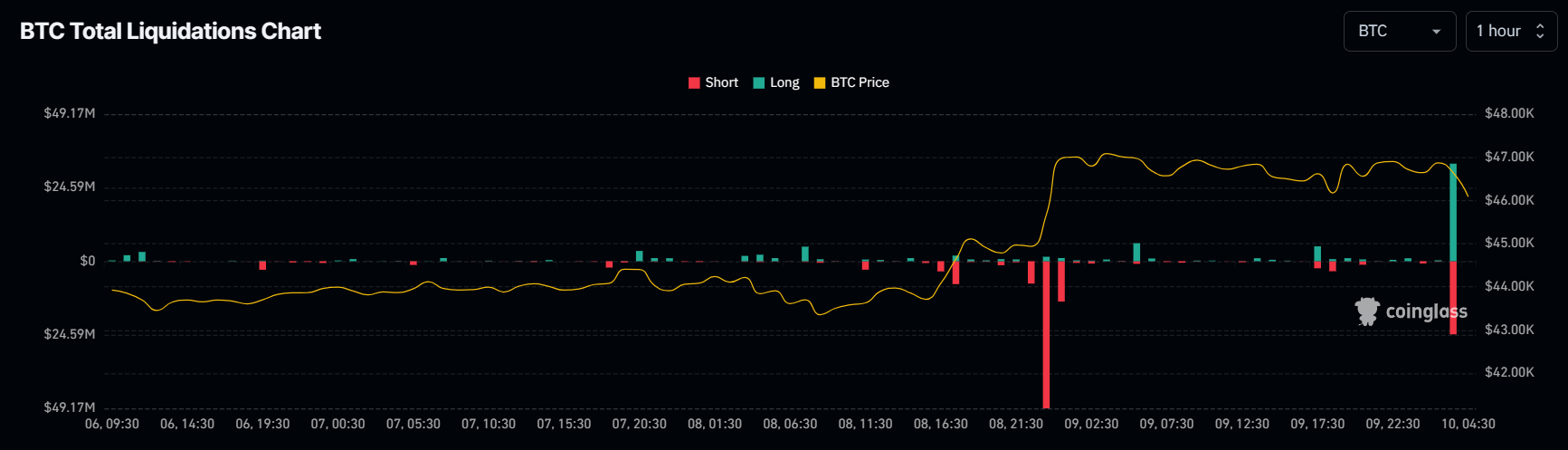

- However, the damage was already done as over $56 million worth of open positions were liquidated. This included $32 million worth of long positions and $24 million worth of short positions.

Bitcoin liquidations

- Soon after, Fox Business reporter Charles Gasparino tweeted that Securities lawyers stated that the SEC must investigate itself for “market manipulation”. Not much later, Senator Bill Hagerty also commented on the incident, saying that Congress needs answers. His tweet read,

“Just like the SEC would demand accountability from a public company if they made such a colossal market-moving mistake, Congress needs answers on what just happened. This is unacceptable.

- The Bitcoin spot ETF is a volatile topic since it would mark a historic moment for the crypto market. The deadline for the approval of the more than a dozen applications is Wednesday, January 10, and the expectations of a green light from the SEC are running high as it would create a precedent for spot crypto ETFs in the future.

- Nevertheless, the crypto market recovered from the incident quickly and made its move at trolling the SEC for their breach of security with the likes of Twitter Chief Technology Officer (CTO) David Schwartz joining, tweeting,

Disclaimer: For information purposes only. Past performance is not indicative of future results.

Recommended Articles

Once again, the price of Ethereum (ETH) has risen above $3,900. This bounce has hinted at a further price increase for the altcoin before the end of the year.

ECB Policy Outlook for 2026: What It Could Mean for the Euro’s Next MoveWith the ECB likely holding rates steady at 2.15% and the Fed potentially extending cuts into 2026, EUR/USD may test 1.20 if Eurozone growth proves resilient, but weaker growth and an ECB pivot could pull the pair back toward 1.13 and potentially 1.10.

With the ECB likely holding rates steady at 2.15% and the Fed potentially extending cuts into 2026, EUR/USD may test 1.20 if Eurozone growth proves resilient, but weaker growth and an ECB pivot could pull the pair back toward 1.13 and potentially 1.10.

West Texas Intermediate (WTI) US Crude Oil prices attract fresh buyers on Wednesday and climb back closer to the highest level since January 2025, touched the previous day.

Gold price (XAU/USD) extends its gains for the second successive session on Thursday as traders seek safety amid the ongoing war in the Middle East.

Gold slumps to near $5,050 on oil-driven inflation fears, stronger US DollarGold price (XAU/USD) falls to around $5,065 during the early Asian session on Monday, pressured by a stronger US Dollar (USD) and inflationary risks. Traders will closely monitor the developments surrounding the US-Iran conflicts and geopolitical risks in the Middle East.

Gold price (XAU/USD) falls to around $5,065 during the early Asian session on Monday, pressured by a stronger US Dollar (USD) and inflationary risks. Traders will closely monitor the developments surrounding the US-Iran conflicts and geopolitical risks in the Middle East.

Related Instrument