Top AI tokens bleed despite reports of Apple closing deal to use OpenAI features

- Apple has closed a deal with OpenAI to use the latter’s technology in its new iPhone, Bloomberg reports.

- The giant’s iOS 18 could come packed with ChatGPT features, per the report.

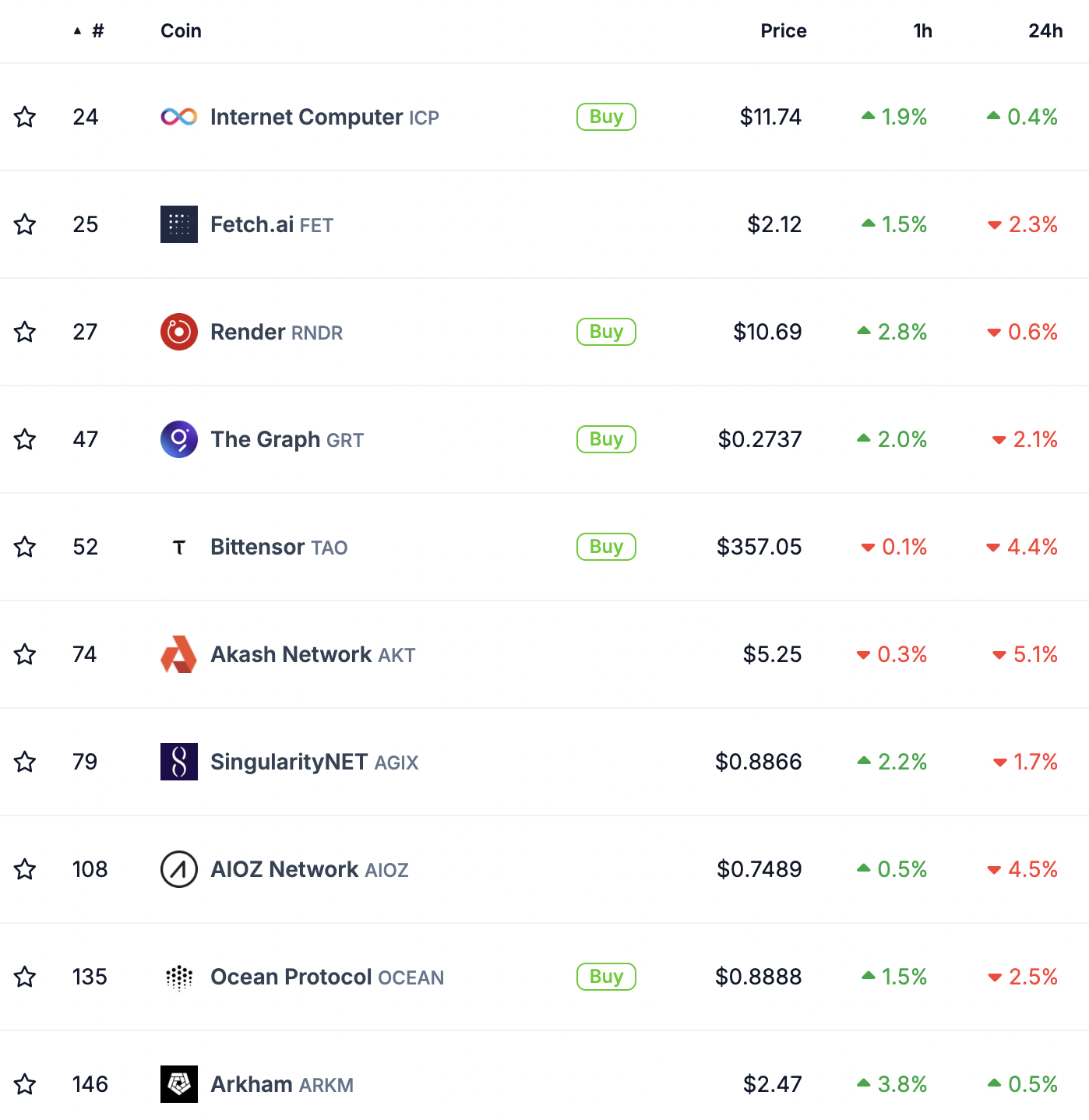

- Prices of most of the top 30 AI tokens fall in the last 24 hours.

Technology giant Apple Inc. has reportedly reached an agreement with Artificial Intelligence (AI) firm OpenAI to include the latter’s tech in the next iPhone. Bloomberg reported that the two parts have likely finalized the terms for OpenAI’s application in Apple’s iOS 18.

Apple embraces AI tech from OpenAI

Apple and OpenAI have been in talks for a pact to use the latter’s AI features in the next iPhone operating system. Bloomberg’s report cites that Apple’s agreement with OpenAI is part of the technology giant’s push to bring AI features to its devices and that the firm has previously held talks with Google regarding the Gemini chatbot.

The talks regarding Gemini are likely still ongoing, while the firm finalizes its agreement with Sam Altman-led OpenAI.

Why does this matter to AI token narrative?

OpenAI is headed by Sam Altman, who is also in charge of the token Worldcoin (WLD). There is news of partnership talks between OpenAI and Altman’s Worldcoin project. Bloomberg reported that negotiation is ongoing for a partnership that would see the AI firm provide its solutions and services to the Worldcoin project, and explore synergies.

Worldcoin’s WLD token is trading at $5.89, up 0.8% in the last 24 hours. Meanwhile, the top 30 cryptocurrencies ranked by market capitalization in the AI sector have noted a decline in their prices in the last 24 hours.

Top 10 AI coins by market capitalization

Prices of AI crypto tokens have surged previously in response to the developments in the sector.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.