XRP slips below $0.50 support as Ripple, SEC prepare to file Omnibus letters

- Ripple, SEC and any third parties are expected to file letters to seal proceedings and supporting evidence by Monday.

- Ripple CEO voiced concerns over the SEC’s treatment of the largest stablecoin, USD Tether.

- XRP declined below $0.50 support, down 1.38% on Monday.

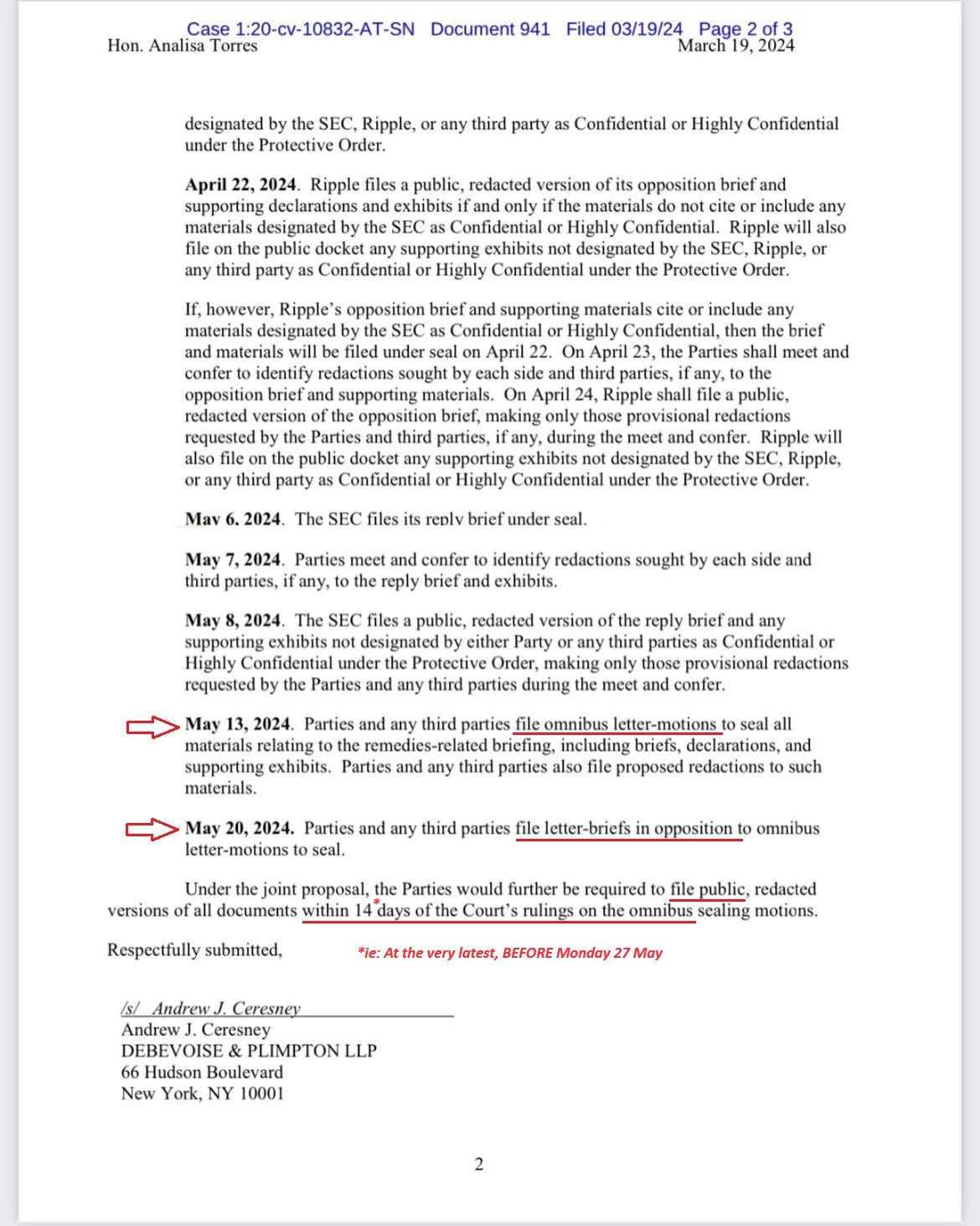

XRP trades at $0.4940, losing more than 1% at the time of writing, as the Securities and Exchange Commission (SEC) and Ripple are set to file the so-called “Omnibus letter motions” on Monday, which will seal materials and supporting evidence related to the remedies-related court phase. The filing of this motion is one of the last steps before the judge rules on whether Ripple needs to pay a penalty for its institutional sales of XRP and, if so, which amount should it pay.

Meanwhile, Ripple CEO Brad Garlinghouse criticized the SEC on the US financial regulator’s approach towards USD Tether (USDT) on a podcast.

Daily Digest Market Movers: SEC vs. Ripple lawsuit draws closer to end

- The SEC alleges that payment remittance firm Ripple sold unregistered securities (XRP tokens) to institutional investors. The regulator has asked for $2 billion in penalties. Ripple responded with a counter of $10 million and proposed another round of litigation.

- XRP holders are waiting on two important updates in the lawsuit: the court’s ruling on fines imposed on Ripple and whether the SEC chooses to appeal the ruling in the Second Circuit.

- SEC, Ripple and other involved parties – meaning friends of the court or amicus curiae –, are expected to file Omnibus letter motions on Monday. These motions seal recent court filings and supporting evidence in the remedies phase of the lawsuit.

SEC vs. Ripple lawsuit important dates

- The next key date is May 20, the deadline for parties and third parties to file letter-briefs opposing the Omnibus letter motions.

- The court is expected to rule on the penalty to be imposed on Ripple for the alleged sale of securities to institutional investors in late May.

- Ripple CEO Brad Garlinghouse shared his thoughts on the largest stablecoin USD Tether in a recent podcast on YouTube. Garlinghouse slammed the SEC for their approach on USDT.

- Garlinghouse’s take on the SEC’s approach towards stablecoins is key to Ripple’s narrative since the payment remittance firm is launching its stablecoin later this year.

Technical analysis: XRP slips below key support at $0.50

Ripple price is declining, with negative momentum in the altcoin’s trend on the weekly, daily and 4-hour time frame. XRP slipped below key support at $0.50 on Sunday and extends its downward movement to a low of $0.4866 on Monday, a level previously visited on May 1.

If the decline continues, Ripple could sweep support at $0.4665, the low from April 19 and an important support level for XRP/USDT on the weekly time frame. The red histogram bars below the neutral line on the Moving Average Convergence Divergence (MACD) indicator imply there is negative momentum in XRP price trend.

The Relative Strength Index (RSI) reads 37.46. This level was last seen on April 19, when the price dipped to a low of $0.4665. XRP remains well above the oversold zone at 30, leaving more room for the downside before being oversold.

XRP/USDT 1-day chart

If Ripple price closes above the May 12 high of $0.5088, it could invalidate the bearish thesis and XRP could climb towards resistance at $0.5310. This level marks the 50% Fibonacci retracement level of the decline between April 9 top of $0.6431 and April 13 bottom of $0.4188.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.