Dogecoin’s dilemma offers day traders opportunity to scalp DOGE

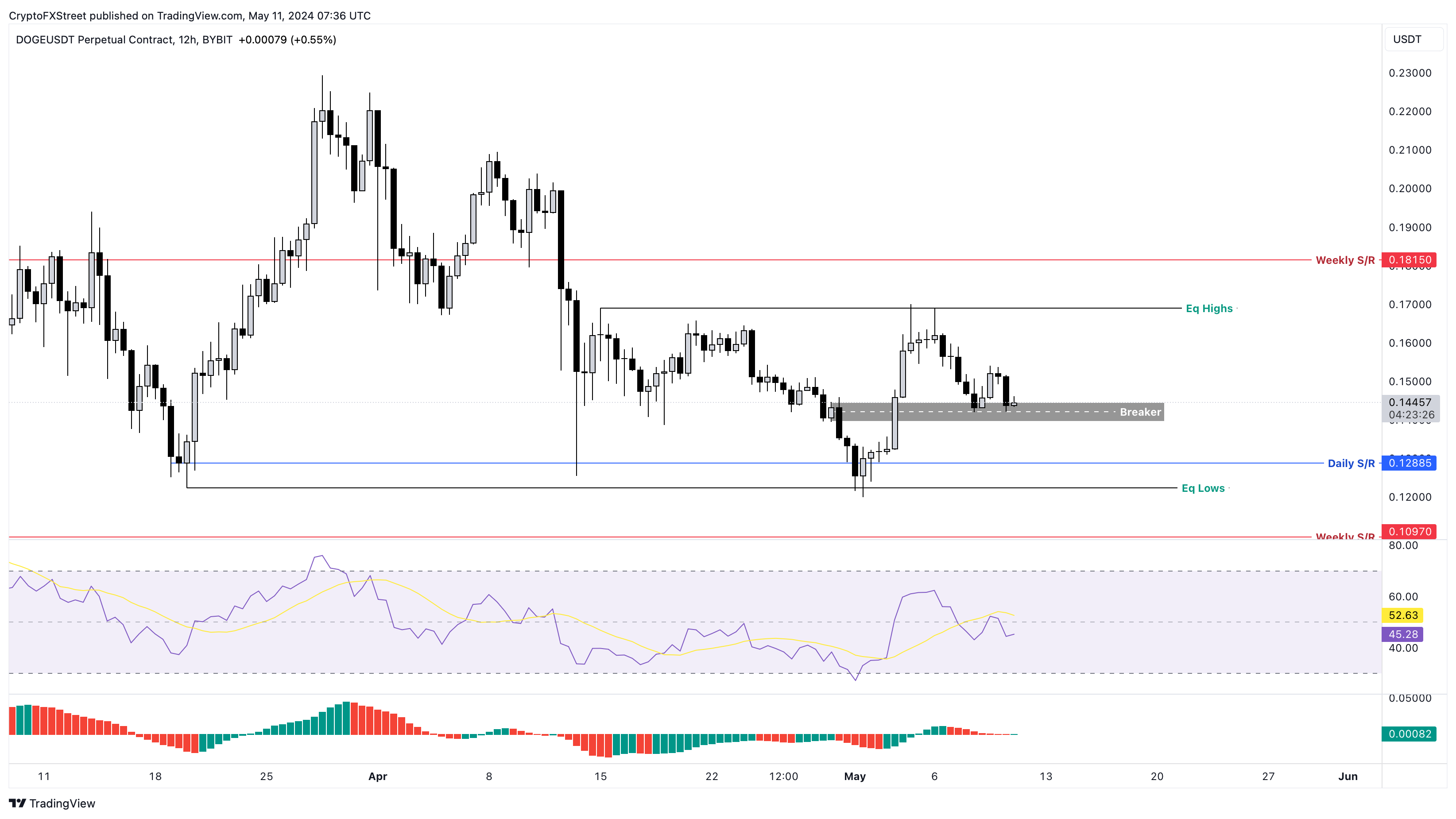

- Dogecoin price is finding its footing as it tags the $0.139 to $0.144 order block.

- A bounce from the order block could push the dog-themed crypto to sweep the equal highs at $0.168.

- A breakdown of this order block could see DOGE sweep the equal lows at $0.122.

Dogecoin (DOGE) price is stuck trading between two key levels. Additionally, DOGE has no directional bias and will likely continue its rangebound movement for the next few days.

Also read: Dogecoin appears headed for golden cross

Dogecoin price at crossroads

Dogecoin price crashed 45% between March 28 and April 13 in conjunction with the correction noted across the broader crypto market. After April 13, however, DOGE slid into consolidation and is trying to find its footing to establish a directional bias.

But for Dogecoin price to either move higher or lower, it needs the crypto market, and specifically, Bitcoin, to kickstart a move. Additionally, DOGE needs to sustain above the $0.139 to $0.144 order block, which could attract sidelined buyers and propel the dog-themed crypto to tag $0.168 and climb higher. In this case, the $0.139 to $0.144 order block is the up candlestick formed on April 29.

This move would constitute a 17% gain. But in some cases, DOGE could eye a retest of $0.181, pushing the total profit to 25%.

Until the Bitcoin outlook improves, DOGE's upside will most likely be capped at $0.181, the weekly resistance level.

DOGE/USDT 12-hour chart

While the bullish thesis for Dogecoin price makes sense, it is unlikely the market moves that way. In some cases, DOGE could breach the $0.139 to $0.144 order block, triggering a 12% to 15% crash for the altcoin, leading to the sweep of the equal lows formed at $0.122. This move would constitute a 12% crash, but it is likely the meme coin could stablize around the $0.128 daily support level.