Artificial intelligence tokens gain 10% despite Bitcoin’s struggle to break past $64,000

- AI tokens Fetch.AI, Render, The Graph, Akash Network, and SingularityNET have noted nearly 10% and higher gains in the past 24 hours.

- AI tokens rallied despite modest gains in Bitcoin and the recent correction in the broader crypto market.

- A crypto analyst has identified AI-related tokens as the top-performing category among top 300 coins.

Artificial Intelligence (AI) tokens have posted nearly 10% to 26% gains in the last 24 hours, as Bitcoin is hit by a correction and drops below $62,000. The AI sector emerges as the one with relatively high gains amid a volatile Friday, with assets such as Bitcoin (BTC) swinging from almost $64,000 to below $62,000.

AI tokens bounce as Bitcoin tumbles below $62,000

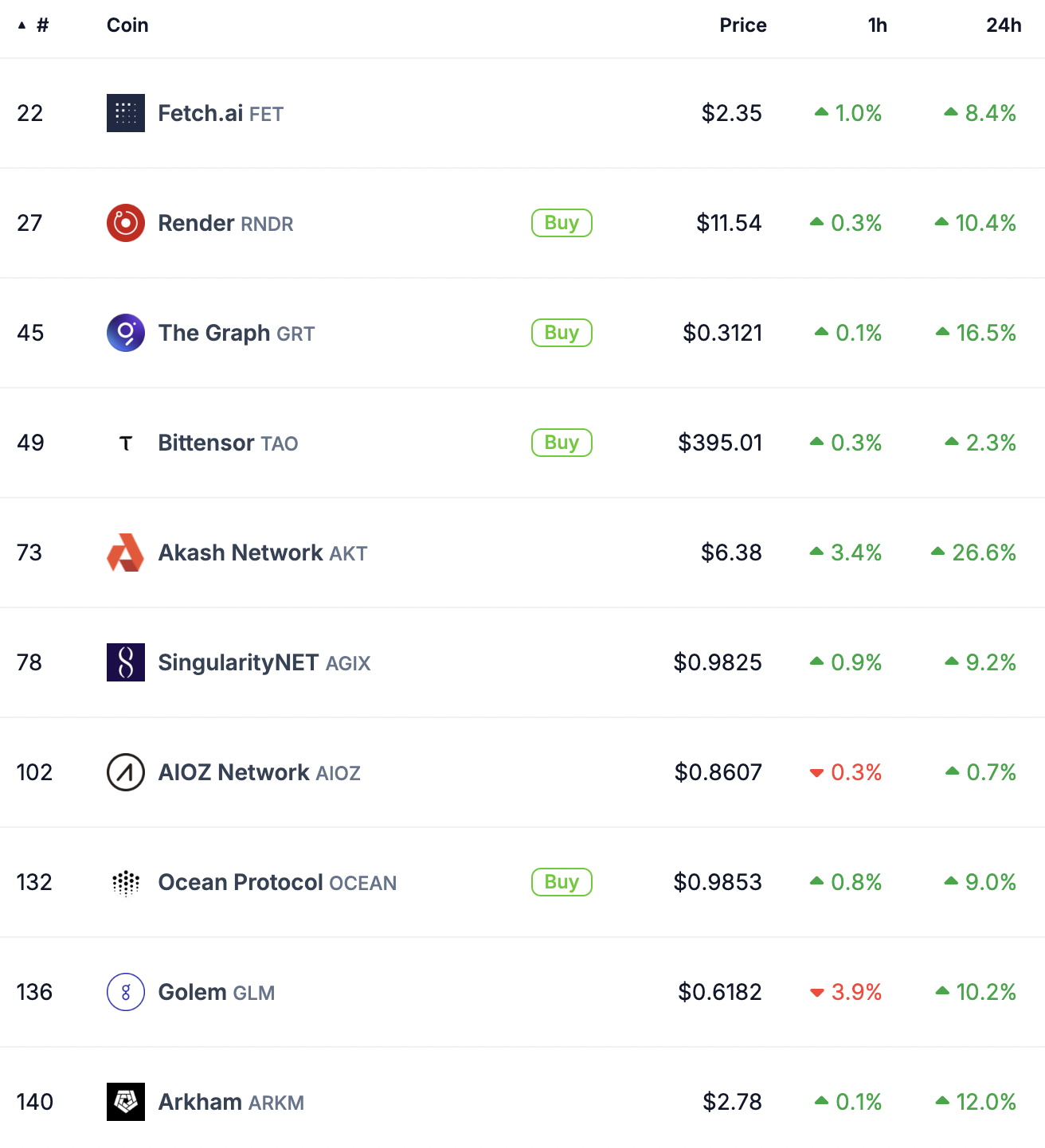

AI tokens Fetch.ai (FET), Render (RNDR), The Graph (GRT), Bittensor (TAO), Akash Network (AKT), SingularityNET (AGIX), AIOZ Network (AIOZ), Ocean Protocol (OCEAN), Golem (GLM) and Arkham (ARKM) rank in the top 10 assets by market capitalization within the category.

Of these assets, RNDR, GRT, AKT, GLM and ARKM have yielded between 10% and 26% gains in the past 24 hours, as seen on CoinGecko.

AI token gains on Friday

The recent developments in the AI sector have likely catalyzed the gains. Computers and IT technology company OpenAI is reportedly preparing to launch its own search engine on Monday, per a Reuters report, in a bid to compete with Google.

The report states that the target date is a day before Google kicks off its annual I/O conference, where the firm is expected to present its AI offerings Gemini and Gemma. Several sources have identified Monday as the target date for Open AI’s search feature’s debut.

Crypto analyst identifies AI as top-performing category of coins

Crypto analyst Murad shared on X his analysis of the top 300 cryptocurrencies’ price performance in the past 30 days. Identifying the top gainers and losers, Murad observed that meme coins based on cats and frogs and AI-related assets rank among gainers.

Top Gainers and Losers in the last 30 days among the TOP 300 coins.

— Murad (@MustStopMurad) May 10, 2024

TLDR:

- Top Cat, Top 2 Frogs and AI are WINNING.

- High FDV / new Tech / non-AI Tech LOSING.

This MEGATREND will continue for MONTHS to COME. pic.twitter.com/fDXq4dfPxX