Ethereum traders uncertain following recent price movement, declining CEXs ETH holdings hints at rally

- Ethereum holdings on centralized exchanges continue to decline despite recent whale sales.

- With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

- Ethereum could see a decline to key support level before attempting a bounce back to the $3,300 key level.

Ethereum's (ETH) price movement on Monday is leaning toward short traders following investors' uncertainty in the wider crypto market. However, ETH holdings in centralized exchanges (CEXs) has been on a steady decline following low flows in Hong Kong's ETH ETFs and Robinhood Crypto receiving a Wells notice from the Securities & Exchange Commission (SEC).

Read more: Ethereum trades above key level, Michael Saylor calls ETH a security

Daily digest market movers: ETH whale sale, declining CEXs holdings, Robinhood Crypto

Ethereum whales could be the determining factor in ETH's move for a potential rally. Here are the top market movers for the number one crypto altcoin:

- A notable Ethereum whale recently withdrew 7,000 ETH from Lido and deposited them on Binance on Monday following Ethereum's recent price drop, according to data from Lookonchain. According to their previous transaction, the whale is in profit of more than $16 million. They withdrew 12,906 ETH at $1,890 from Binance and staked in Lido.

- Despite the recent whale sale, Ethereum on CEXs has been on a steady decline, dropping from 16% in March to 10.66% on May 5, according to data from Glassnode. This indicates increasing investors' confidence in the number one altcoin regardless of recent price drops. For example, a whale who lost $4.63 million from an ETH long position opened another long position again on Sunday, according to data from Lookonchain. He withdrew 6,965 ETH from Binance on Sunday and deposited it into Compound, then borrowed 14.5 million USDT.

- Hong Kong Bitcoin and Ethereum ETFs saw a total trading volume of $7.72 million at the close of the Asian market on Monday. In comparison, the trading volume of Bitcoin ETFs in the United States on the previous trading day was around $1.88 billion - 268x that of Hong Kong ETFs. In an X post, Bloomberg analyst Eric Balchunas commented on the ETFs' trading volume, "Yeah, as we advised, don't expect big numbers in HK vs US." This further strengthens a previous analysis that Hong Kong's ETH ETFs would have minimal effect on Ethereum's price.

Also read: Robinhood gets SEC warning against crypto unit for alleged violation of Securities Act

- The SEC slapped Robinhood Crypto with a Wells notice on May 4, alleging that the exchange violated Section 15(a) and 17A of the Securities Act of 1934. This comes as the May 23 deadline for the SEC to decide on Van Ecks' spot ETH ETF application draws near. With recent actions targeted at Ethereum-related firms and crypto platforms that offer provisions for buying and selling ETH, many have predicted that the SEC will deny applications for spot ETH ETFs.

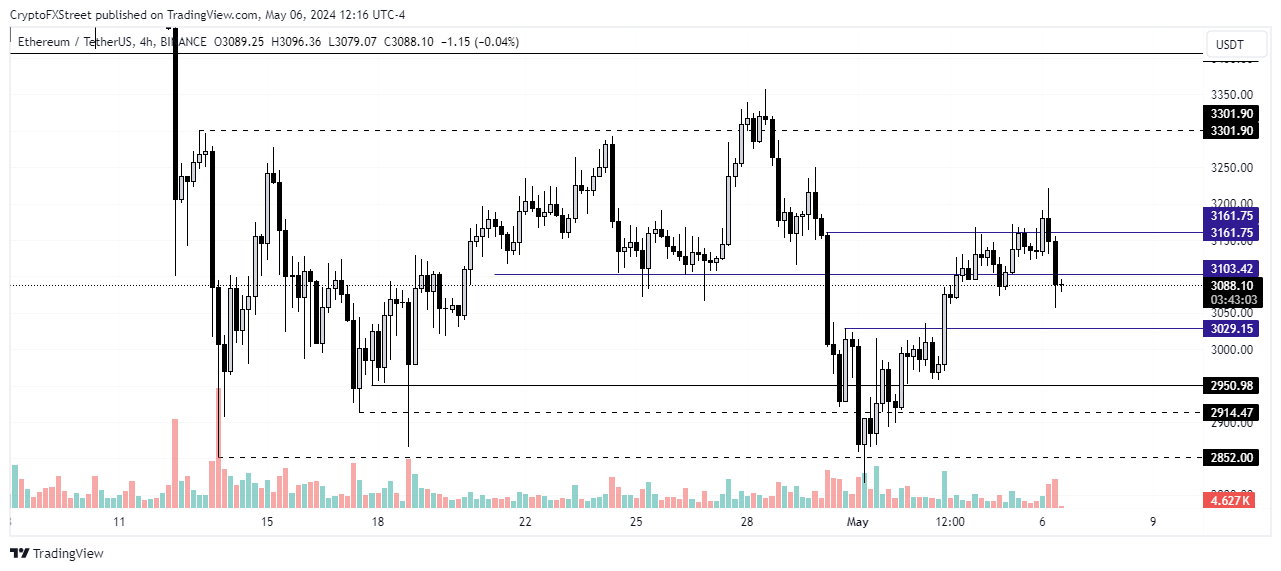

ETH technical analysis: Ethereum price movement shows investors uncertainty

After moving above the $3,161 key resistance, Ethereum appears to be on a downtrend, shedding about 2.7% of its value on Monday. With the absence of key macro and crypto events in the coming days, traders seem uncertain about the market's direction. However, recent price movements seem to be tilting toward the short direction, as long traders have seen liquidations worth $34.22 million in the past 24 hours.

Read more: Ethereum to break out of bearish move, ETH ETFs unlikely in 2024

ETH/USDT 4-hour chart

If the decline sustains, ETH may fall close to the $3,029 support level, which may prove a good buying opportunity. A move below the level would indicate a resumption of a bearish trend. However, a move upwards will see ETH attempting to break above the $3,300 key level.

Considering that the level has proven to be strong resistance in the past three weeks — with ETH trading above it only on April 27 and 28 — Ethereum may see a pullback at that level. Hence, it may prove to be a good selling level for traders. The price of BTC could change the dynamics of this prediction as it still largely influences ETH's price movement.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.