Dogecoin price bottom is in, but is DOGE ripe to buy amid tasty outlook among meme coins?

- Dogecoin price is up 13% on the day, charging alongside a widespread meme coin mania.

- DOGE has confirmed support at $0.1290, and could hit $0.2000 if Bitcoin price remains bullish

- A break and close below $0.11451 would invalidate the bullish thesis.

Dogecoin (DOGE) price is trading with a bullish inclination, steadily leading the charge as meme coins go on a tear. While it appears the speculative sector tokens being the main indicator of whether a broader market uptrend is here, it remains to be seen whether the Bitcoin of meme coins will sustain the rally.

Also Read: Meme coins lead way as PEPE, BONK hint at possible marketwide uptrend

Dogecoin price confirms bottom

Dogecoin price has confirmed the bottom at $0.1290 after three successive retests. It is en route north, accompanied by its peers, Shiba Inu (SHIB), Pepe (PEPE), Dogwifhat (WIF), and Floki Inu (FLOKI), which are posting double-digit gains.

TOP 7 TOKENS WITHIN THE BLOCKCHAIN

— Crypt01 Daily (@Crypt01_Daily) May 4, 2024

1⃣WIF - @dogwifcoin

2⃣STX - @Stacks

3⃣FLOKI - @RealFlokiInu

4⃣DOGE - @dogecoin

5⃣GRT - @graphprotocol

6⃣PEPE - @pepecoineth

7⃣RNDR - @rendernetwork#Altcoins #BTCs #Cryptos #ETH pic.twitter.com/pb4EFxOaCP

Investors looking to take long positions on DOGE should exercise caution as Dogecoin price is at an inflection point. This is because:

- Dogecoin price has not confirmed a move above the centerline (Simple Moving Average) of the Bollinger indicator on the one-day timeframe.

With the price has trending higher and now reaching the centerline, it could indicate a shift in momentum and a possible trend reversal to the downside.

With the Dogecoin price near the centerline, it may indicate that DOGE is experiencing lower volatility. This could precede a period of increased volatility and potentially a strong price movement in either direction.

- The Relative Strength Index (RSI) still contends with the mean level of 50, despite rising momentum. At 48 and rising, it shows that no strong trend is currently dominating the market.

- Bitcoin price remains below the critical level of $67,133, beyond which it could have a shot a solidified uptrend for the short term.

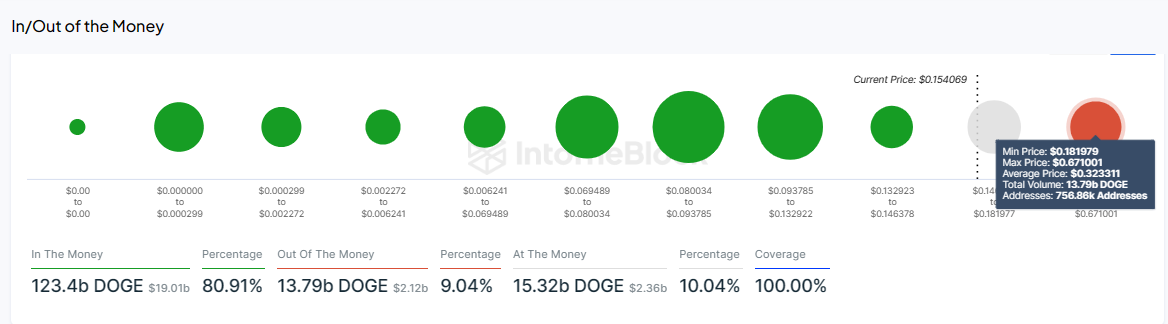

- Data from IntoTheBlock’s Active Addresses by Profitability metric shows that a large number of DOGE addresses (81.45%) are 'In the Money'

While this suggests a bullish sentiment, it could hint at potential selling pressure as holders might sell to realize profits.

DOGE active addresses by profitability

Dogecoin price prediction

If DOGE bulls are able to haul Dogecoin price above the $0.1498 centerline of the Bollinger indicator, confirmed by a decisive move of the RSI above the mean level of 50, it would be a good buy. For conservative bulls, however, you may want to wait for a retest of the Dogecoin price above the centerline, and confirmed by a higher high on the RSI.

A strong move above the $0.1649 roadblock would encourage more buy orders, enough to see Dogecoin price move beyond the $0.1800 threshold. In a highly bullish case, Dogecoin price could extend the gains to the $0.2000 psychological level, or higher to the $0.2288 range high, in a highly ambitious turnout where Bitcoin price marks a new all-time high above $73,777.

DOGE/USDT 1-day chart

On the other hand, a rejection from the centerline at $0.1498 could see Dogecoin price pull back, and while losing the support at $0.1290 would be concerning, the bullish thesis would only be invalidated after a candlestick close below $0.1151 on the one-day time frame.