Why Litecoin active addresses spike is not a bullish sign

- Litecoin active addresses exceeded those of Bitcoin and Ethereum in the past 24 hours, hitting 718,200 temporarily.

- In the first week of 2024, a total of 2 million ordinals have been inscribed on Litecoin, partly explaining the sharp increase.

- LTC price movement is slow despite rising address activity, retail traders begin accumulation.

Ordinals made headlines for congestion on the Bitcoin blockchain, the NFT-like assets have caused a spike in active addresses on Litecoin (LTC). The surge in address activity is therefore unlikely to fuel a rally in LTC as the hype surrounding ordinals increases.

Litecoin price has fallen nearly 12% weekly and 18% monthly.

Also read: Chainlink supply on exchanges hits six-month low, fueling LINK price recovery thesis

Ordinals hype increases, Litecoin active addresses rise

Litecoin blockchain’s active addresses crossed 697,000 (at the time of writing) in the past 24 hours, according to data from BitInfoCharts. The number eclipsed Bitcoin and Ethereum’s active addresses, supporting the thesis of rising activity on the Litecoin blockchain.

Typically, a rise in address activity is considered a bullish sign for LTC price. However, in this case, it is related to the surge in ordinals inscription in Litecoin. These NFT-like assets inscribe data, text, images, and video in on-chain data on the LTC blockchain.

Litecoin tweeted through its official X account that a total of two million ordinals have been inscribed on the LTC chain in the first week of 2024.

Litecoin price fails to deliver expectations

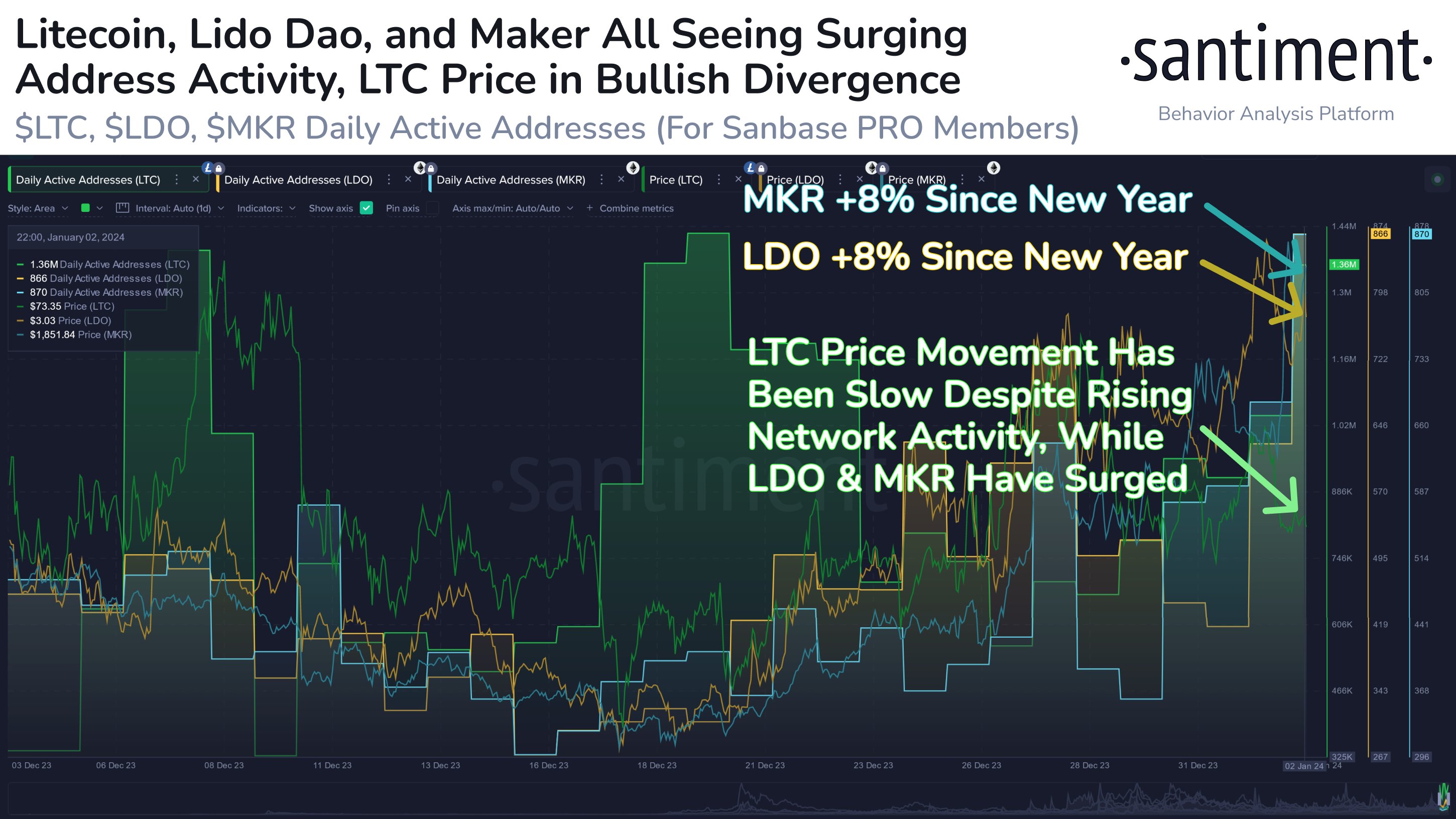

Data from crypto intelligence tracker Santiment suggests that as of January 5, Litecoin, Maker (MKR) and LidoDAO (LDO) noted a rapid increase in addresses. This increase is typically associated with a rise in market capitalization. While both Maker (MKR) and LidoDAO (LDO) delivered, Litecoin is yet to see a price rally.

Litecoin, LidoDAO and Maker address activity and prices. Source: Santiment

At the time of writing, Litecoin price is $64.55 on Binance. In the past week, LTC holders were hit by a 12% decline in the altcoin’s price and an 18% decline in a monthly time frame. Since the recent address activity surge cannot be considered a bullish sign for LTC price recovery, it remains to be seen where LTC price is headed.