Bitcoin Multi-Year Lifeline Faces Critical Test as Supreme Court Weighs Trump’s Tariffs | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee. Bitcoin’s multi-year lifeline is on the line—not because of anything it did, but because of decisions being made in a courtroom far from Wall Street.

Crypto News of the Day: Supreme Court Ruling on Trump’s Tariffs Poised to Shake Markets and Bitcoin

Bitcoin and risk assets in general face heightened volatility on February 20, 2026, as the U.S. Supreme Court prepares to issue its long-awaited ruling on the legality of President Trump’s 2025 tariffs.

The decision, expected at 10:00 AM ET, could have sweeping implications for trade, government revenue, and global markets.

The case, consolidated as Learning Resources, Inc. v. Trump and Trump v. V.O.S. Selections, Inc., challenges whether Trump had the legal authority to impose broad tariffs under the International Emergency Economic Powers Act (IEEPA) of 1977.

While IEEPA allows the President to address “unusual and extraordinary threats” to national security or the economy, it does not explicitly authorize sweeping trade tariffs.

Lower courts have twice ruled against the administration, setting the stage for the Supreme Court’s opinion.

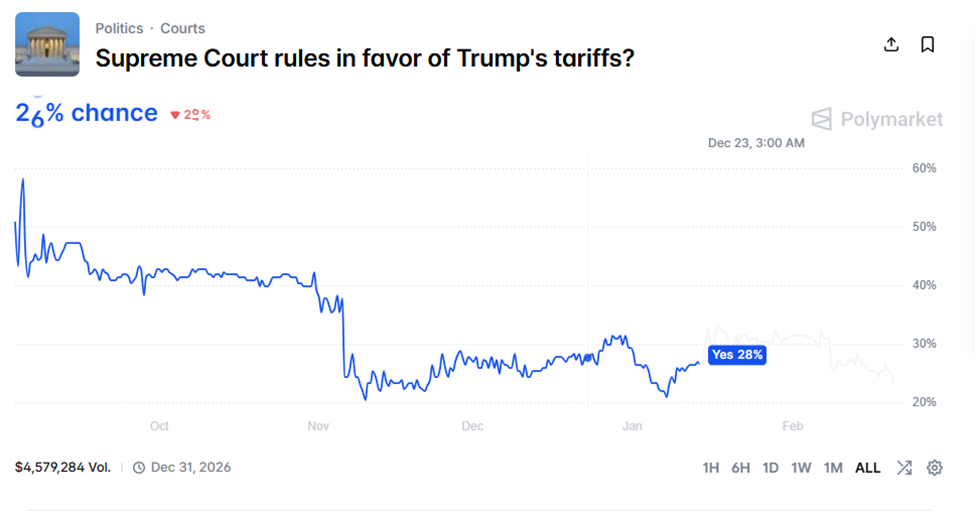

Prediction markets suggest a high likelihood of illegality, with Polymarket pricing roughly a 26% chance that the Supreme Court will uphold the tariffs.

Odds of the Supreme Court Ruling in Favor of Trump’s Tariffs. Source: Polymarket

Odds of the Supreme Court Ruling in Favor of Trump’s Tariffs. Source: Polymarket

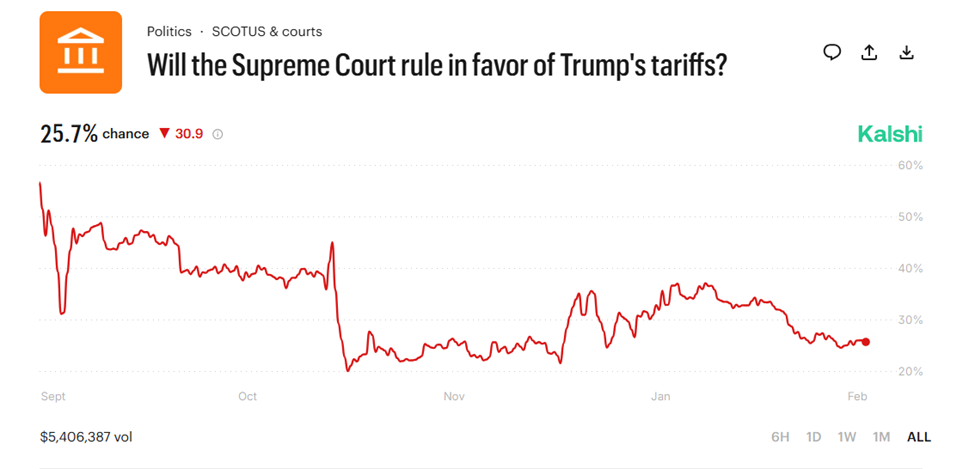

The odds are almost identical on prediction market Kalshi, where bettors wager on a 25.7% chance that the court rules in favor of Trump’s tariffs. Notably, crowd bets on Kalshi are gaining more authority of late.

Odds of the Supreme Court Ruling in Favor of Trump’s Tariffs. Source: Kalshi

Odds of the Supreme Court Ruling in Favor of Trump’s Tariffs. Source: Kalshi

If upheld, tariffs would remain in place, potentially escalating trade tensions with Canada, the EU, China, and other partners. If struck down, importers could be entitled to refunds of duties collected since early 2025.

The $600 Billion Tariff Claim: Reality vs. Hype

Notably, some media and crypto commentators have cited Trump’s repeated claim that his tariffs generated $600 billion in revenue. However, neutral analyses, including the Penn-Wharton Budget Model, place the actual exposure at $133–$179 billion, a fraction of the widely referenced figure.

Notwithstanding, even at these lower levels, the financial impact could ripple through markets, with traders anticipating “pure chaos” as markets price in:

- Potential refunds

- Emergency replacement tariffs, and

- Retaliatory actions from trade partners.

Crypto, equities, and bond markets are all expected to experience turbulence, with liquidity swings and risk-off sentiment particularly affecting Bitcoin in the short term.

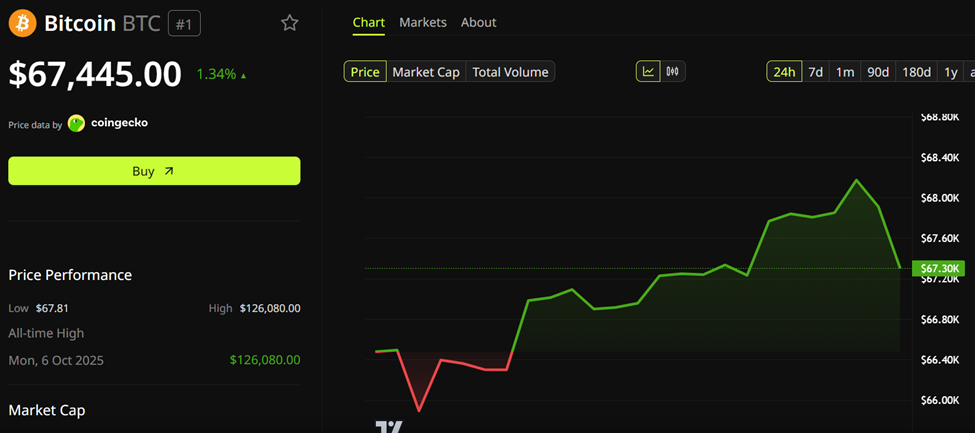

BTC’s market capitalization was $1.35 trillion, with prices trading for $67,445 as of this writing.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

A Perfect Storm: Supreme Court Ruling Meets Key Economic Data

The timing of the Supreme Court ruling coincides with other key US economic data releases, including Q4 GDP, the PCE Price Index, and the Manufacturing PMI. These may amplify market volatility.

Meanwhile, the Supreme Court’s decision carries broader implications for executive authority and fiscal policy.

A ruling against Trump could require the Treasury to process hundreds of billions in refunds, widening deficits and potentially prompting emergency legislation or alternative trade measures.

For crypto traders, this translates into a period of elevated uncertainty, in which macro shocks and risk sentiment can drive market swings independent of fundamentals.

Whether Bitcoin holds its multi-year lifeline or succumbs to a volatility surge will depend in large part on the legal and economic fallout of this landmark decision.

Chart of the Day

Bitcoin (BTC) Price Performance. Source: TradingView

Bitcoin (BTC) Price Performance. Source: TradingView

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Metaplanet CEO fires back at critics as $1.2 billion Bitcoin paper losses mount.

- US spot Bitcoin ETFs post largest cycle drawdown, balances fall by 100,300 BTC.

- Silver supply crisis looms as Binance hits $70 billion volume in precious metals like gold.

- Ethereum struggles below $2,000, yet BitMine sees a rebound: Here’s what they’re watching.

- Blue Owl halts redemptions amid private credit stress: Will crypto feel the impact?

- Bitcoin hashrate shows a V-Shaped recovery — Will Bitcoin price follow?

- CZ networks freely at Mar-a-Lago amid Binance’s USD1 surge.

Crypto Equities Pre-Market Overview

| Company | Close As of February 19 | Pre-Market Overview |

| Strategy (MSTR) | $129.45 | $130.53 (+0.83%) |

| Coinbase (COIN) | $165.94 | $167.03 (+0.66%) |

| Galaxy Digital Holdings (GLXY) | $21.63 | $21.54 (-0.42%) |

| MARA Holdings (MARA) | $7.96 | $8.00 (+0.50%) |

| Riot Platforms (RIOT) | $16.22 | $16.20 (-0.12%) |

| Core Scientific (CORZ) | $17.98 | $17.68 (-1.67%) |