Solana, Base and AI meme coins rally, are speculative tokens making a comeback?

- Solana and Base-based and AI meme coins have seen a resurgence in their price in the past day.

- Venture Capitalists and crypto funds have expressed interest in meme coins and the total market cap has crossed $51.47 billion.

- Crypto analyst predicted meme coin supercycle citing interest from hedge funds.

Meme coins are typically considered more speculative than the rest of cryptocurrency categories. Despite the label, hedge funds and institutional investors have warmed up to meme coins this cycle.

A recent Bloomberg report says hedge funds are finding the “siren song” of meme coins irresistible.

Meme coins see price rally

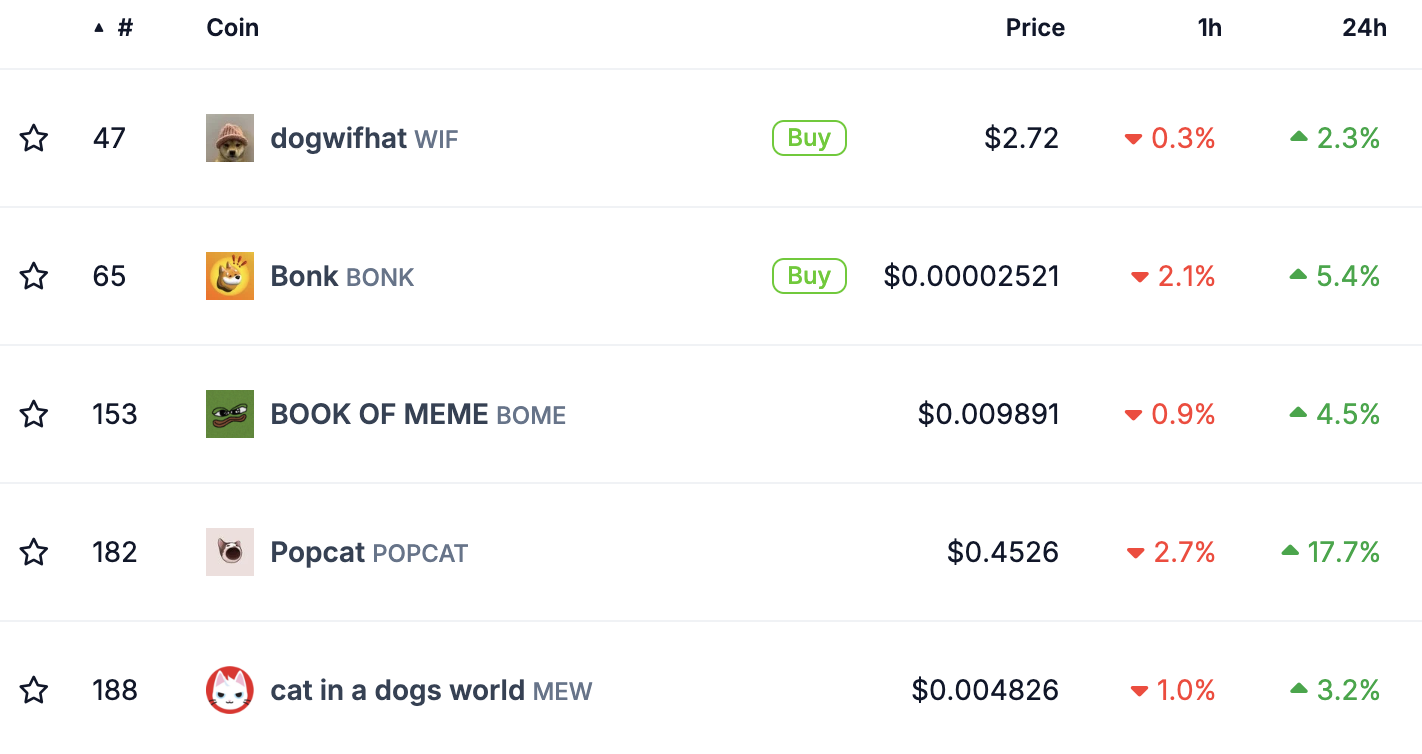

Dogwifhat (WIF), Bonk (BONK), Book of Meme (BOME), Popcat (POPCAT) among others have seen a resurgence in their prices on Sunday. A Bloomberg report from last week cites the gains in WIF and notes how meme coins like this have drawn venture capitalists and hedge funds to meme coins.

Stratos is one of the hedge funds that dived into the sector. Pantera Capital commented on the sector and said, “meme coins are here to stay.” Data from Dex Screener has shown meme coins registering the highest trading volume on DEXes. The overall market capitalization of the sector is $51.47 billion, as seen on CoinMarketCap.

Solana-based meme coins

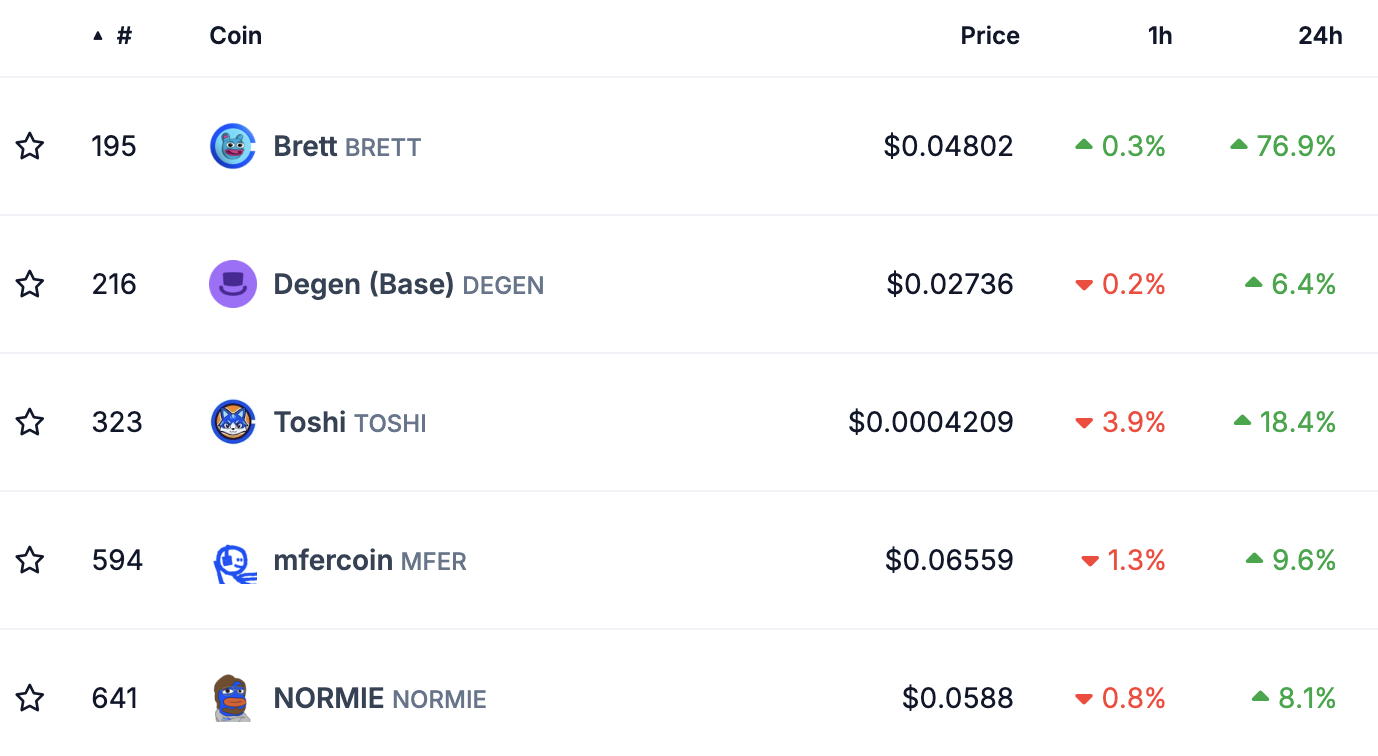

Base-based meme coins Brett (BRETT), Dege (DEGEN), Toshi (TOSHI), mfercoin (MFER), NORMIE have noted between 6% and 76% gains in the past day.

Base-based meme coins

The difference between previous cycles and the ongoing ones is that the meme coin infrastructure has become relatively more robust. Liquidity for several meme coins on Solana, Base and in the AI category has increased this cycle, there is higher trade volume across centralized exchanges. These developments have likely contributed to hedge fund’s interest in the category.

Crypto analyst behind the X handle @0x_gremlin says a meme coin supercycle is incoming and states that the massive spike in meme coin market capitalization, simple and easy to understand nature of the assets and the rising popularity of gambling are few of the factors influencing these tokens.

Several memecoins have hit the $1 billion mark this year, outperforming 90% of the tokens in the crypto sector.

— Xremlin (@0x_gremlin) April 27, 2024

Many held strong even when the market got shaky.

With increasing interest from retail and funds, it looks more likely than ever that we're heading into a supercycle,… pic.twitter.com/GTb6i3UsnU