These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

- Crypto analyst Thor Hartvigsen calculated the Fully Diluted Valuation of altcoins and identified tokens that could face selling pressure.

- Hartvigsen noted that four months into 2024, there is a massive increase in the supply of several altcoins.

- New tokens expected to be launched this year, alongside unlocks could push supply higher.

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Crypto tokens likely to battle selling pressure

Thor Hartvigsen, Blockchain and DeFi investor has evaluated altcoins and their supply. Four months into 2024, the analyst notes that there has been a massive increase in the supply of altcoins. Hartvigsen has made a list of altcoins:

Cryptocurrencies evaluated by Thor

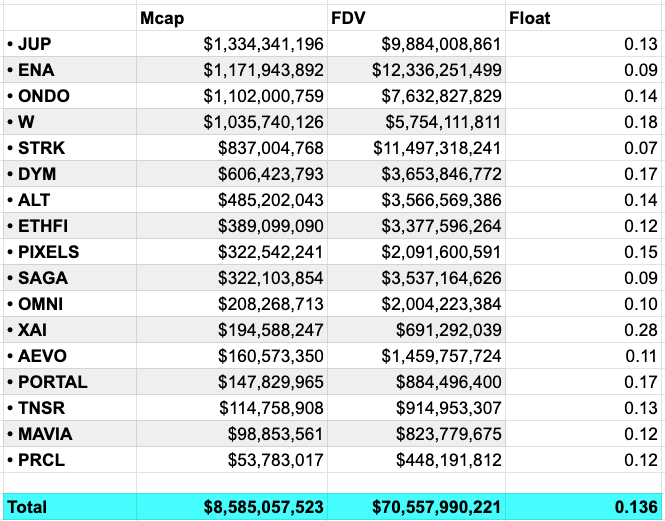

Hartvigsen has evaluated the market capitalization, and Fully Diluted Valuation (FDV) of altcoins including Jupiter (JUP), Athena (ENA), Ondo (ONDO), Wormhole (W), Starknet (STRK), and Dymension (DYM) among others.

The expert states that $8.6 billion in additional liquid supply has been injected into the market, within the past four months of 2024. Another $70.5 billion in total unlocks is lined up in the coming years, says Hartvigsen.

The metric float is derived by dividing the market capitalization of an asset with its FDV. The average float for new tokens is 13.6%, and the analyst notes that this is the tip of the iceberg when it comes to new tokens coming in 2024.

Several categories, modular infrastructure, bridges/ cross-chain messaging, liquid re-staking tokens, EigenLayer, Ethereum scaling Layer 1, 2 and 3, Perp DEXes are set to see several new tokens.

Add this to the scheduled unlocks from 2023 and prior, several cliffs are ending this year. Cliff unlocks refer to the release of tokens held in a locked state on a specific date. Several altcoins will see their cliffs ending in 2024, meaning a large supply of these tokens will enter circulation, in a market that is already flooded with consistent liquidity injections.

Prominent assets among the above are JUP, END, ONDO and W, the top four cryptocurrencies with market value that exceeds $1 billion. Several other assets in the list are Binance Initial Exchange Offering (IEO) tokens.

Market participants need to take a note of these altcoins and watch for increase in circulating supply, rising selling pressure could push prices lower.