Franklin Templeton’s Ethereum ETF listed on DTCC, no guarantee of SEC approval

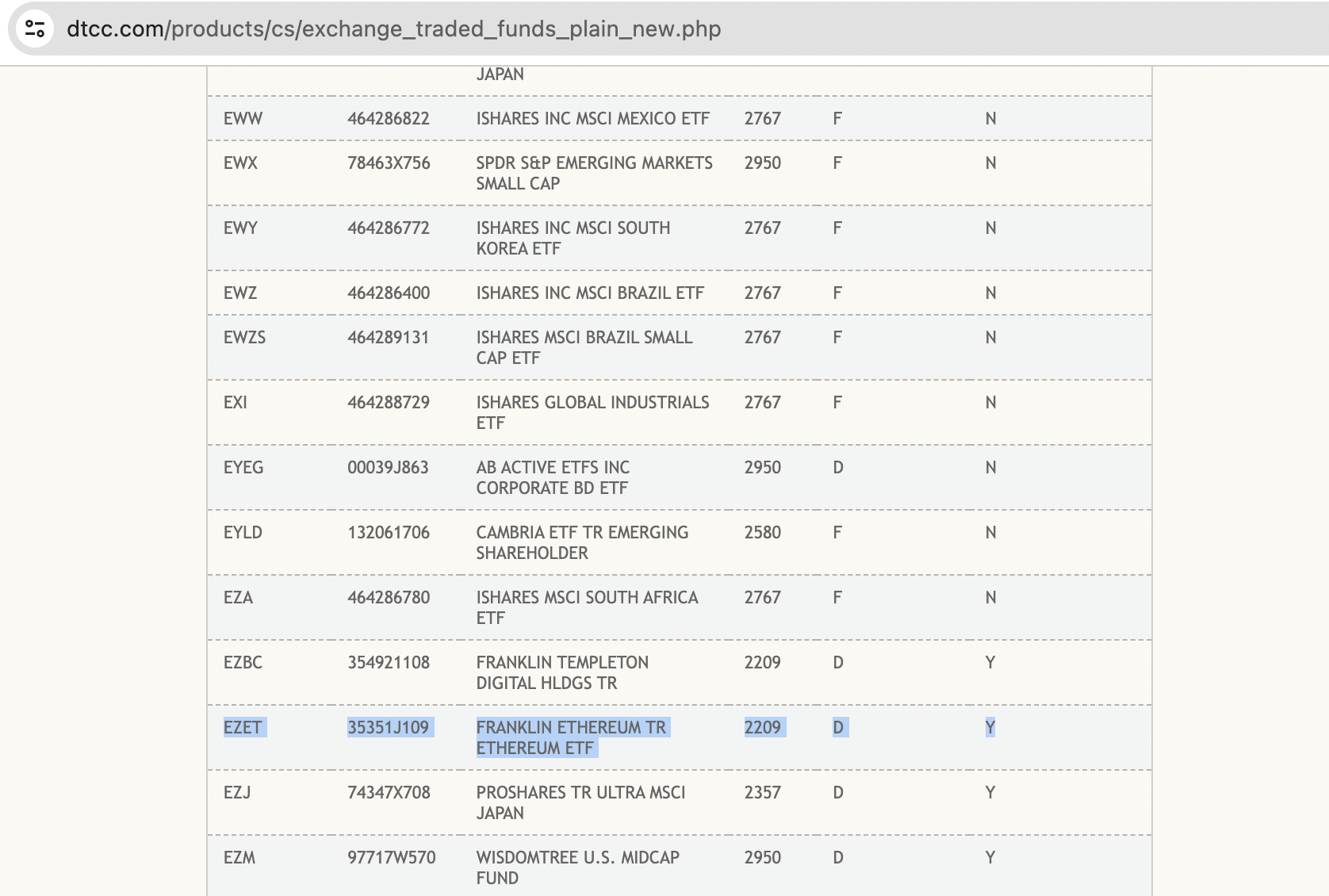

- Franklin Templeton has launched its Ethereum ETF coded as EZET, as seen on the DTCC website.

- Franklin Templeton’s Spot Ethereum ETF listing on DTCC does not guarantee S-1 filing approval by the US SEC.

- ETH price is $3,125 at the time of writing, down nearly 3% from Monday’s close.

Ethereum (ETH) holders have long awaited the approval of the Spot Ethereum ETF by the US Securities and Exchange Commission (SEC). The firm’s ETH ETF, dubbed Franklin Ethereum TR Ethereum ETF was listed on the Depository Trust and Clearing Corporation (DTCC) website.

Spot Ethereum ETF approval anticipation brews

Franklin Templeton, the $1.5 trillion asset management firm has listed its Ethereum ETF on the DTCC website. The website lists the ETF and indicates that it is available for creation and redemption. The DTCC listing however does not imply an approval of the S-1 filing with the US Securities and Exchange. Franklin Templeton submitted its Spot ETH ETF application on February 12.

Ethereum ETF appears on DTCC website

While not directly related to the S-1 filing, listing on the DTCC is a crucial step that allows for supply adjustment of ETF shares to help keep up with their demand in the market. It helps keep an ETF’s market price closer to its net asset value (NAV).

In previous instances, the website has listed securities that are eligible for trading and settlement once ETFs complete registration and compliance procedures. The SEC postponed its decision on Franklin Templeton’s Ethereum ETF application on April 23. The final deadline is now June 11, this offers the regulator an additional 45 days to make its decision on the Spot Ethereum ETF application.

Eric Balchunas, Bloomberg ETF analyst says that the chances of an approval by the SEC are 35%.

ETH price is $3,125 at the time of writing, down nearly 3% from Monday’s close.