Nearly $450 million worth of tokens unlock to look forward to this weekend and into next week

- Yield Guild Games and SingularityNET have small volumes of cliff unlocks this weekend, setting the tone for next week.

- MEME, DYDX, OP, PRIME, SUI, and ENA tokens worth millions are due for cliff unlocks next week.

- Token holders should brace for volatility as unlocks are typical bearish catalysts.

Data according to TokenUnlocks app shows that several projects are lining up to increase their circulating supplies starting this weekend and into the coming week.

Crypto token unlocks are events that influence prices of cryptocurrencies. Typically an unlock increases the volume of assets in circulation, contributing to the selling pressure.

Also Read: Expect more from altcoins with BTC stuck in range trade

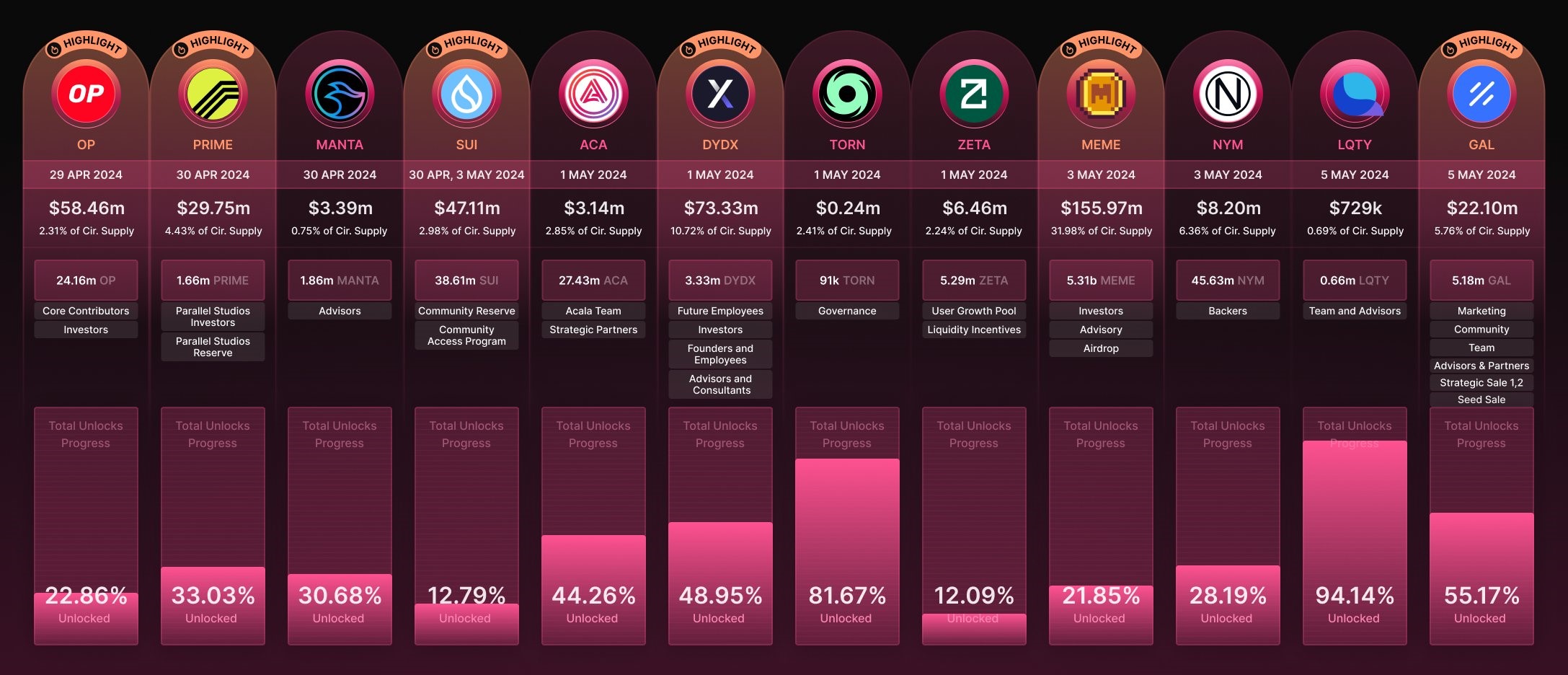

MEME, DYDX, OP: High value tokens unlocks to watch

- Memecoin (MEME)

Over 5.31 billion MEME tokens worth $155.98 million to be unlocked on May 3, comprising 31.97% of the circulating supply, this will be cliff unlock event. The tokens will go towards a community airdrop, advisory, and to investors.

The network is also running a linear unlocks, with 49.47 million MEME tokens worth $1.45 million lined up for daily unlocking beginning May 3.

- dYdX (DYDX)

The dYdX ecosystem also has an unlock event lined up for May 1, where 33.33 million DYDX tokens worth $73.33 million will be unlocked. Accounting for 10.72% of the circulating supply, these tokens will be issued to founders, employees, future employees, advisors, and consultants.

- Optimism (OP)

Ethereum Layer-2 (L2) network Optimism is also on the line up with a $58.47 million worth unlock, where 24.16 million OP tokens will be issued to core contributors and investors on April 29.

- Echelon Prime (PRIME)

On April 30, the Echelon Prime network will unlock 1.66 million PRIME tokens worth $30.03 million and comprising 4.43% of the circulating supply.

- Sui (SUI)

On the same day, Sui ecosystem will be allocating 4 million SUI tokens worth $4.88 million as the Manta Network unleashes 1.87 MANTA tokens worth $3.40 million.

Next week token unlocks

- Ethena (ENA)

The Sensational Ethena will also unlock 53.60 ENA tokens worth $46.71 million and making, composed of 3.76% of the tokens in circulation.

Ethena is a synthetic dollar protocol on Ethereum, leveraging delta-hedged Ethereum and Bitcoin collateral to offer a stable, crypto-native currency and yield-generating 'Internet Bond'.

— Token Unlocks (@Token_Unlocks) April 26, 2024

TokenUnlocks is now tracking@ethena_labs

( $ENA )

Link : https://t.co/AoqWF0DR0f pic.twitter.com/bxzVlSnhzC

Token unlocks this weekend

- Yield Guild Games (YGG)

The Yield Guild Games ecosystem will unlock 16.69 million YGG tokens worth $15.12 million this Saturday, April 27, making up for 4.57% of the circulating supply. Recipients will be the community, investors, the treasury and founders.

- SingularityNET (AGIX)

On Sunday, April 28, AI crypto ecosystem SingularityNET will see 8.84 million AGIX tokens unlocked. The tokens, worth $8.32 million, will comprise 0.69% of the tokens in circulation. The tokens will be issued toward the AGIX-ADA utility.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.