TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

- TRON has seen over $50 billion in supply of stablecoins in Q1 of 2024.

- TRON noted positive growth across market capitalization, revenue, total value locked, and average DEX volume.

- The TRX token surged 10% since the beginning of 2024.

TRON (TRX), a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked (TVL).

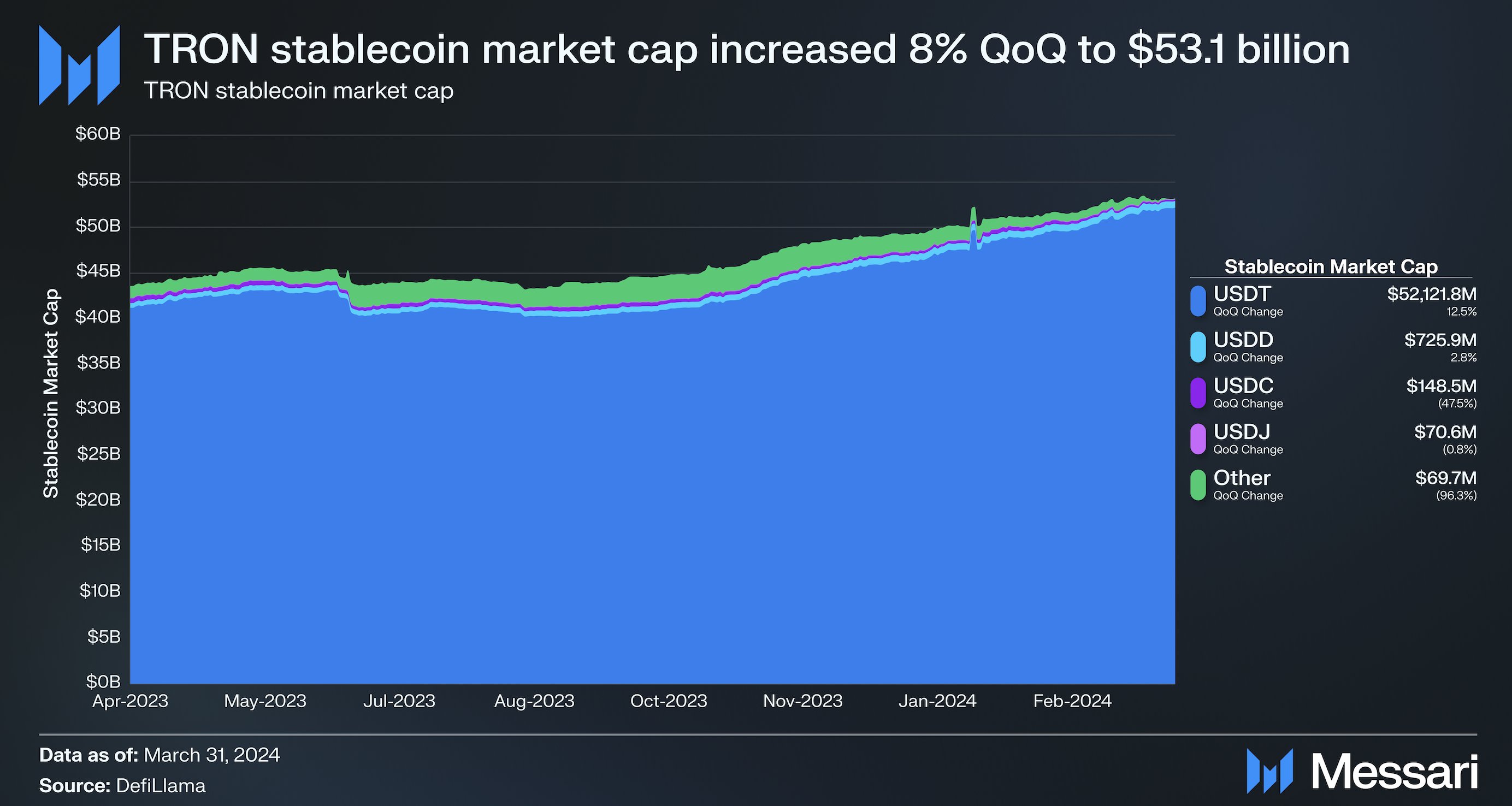

TRON sees $50 million in stablecoin flow in Q1 2024

A report from crypto intelligence tracker Messari shows that TRON noted positive growth across several key metrics in its blockchain in Q1 of 2024. The report shows that USD Tether (USDT) on Tron reached over $50 billion in Q1. This is important for market participants because stablecoin flow typically represents fiat onramps. A rising flow of stablecoin is indicative of rising demand for assets and an increase in capital inflow (fiat to crypto, through stablecoin).

TRON stablecoin market capitalization

Other key metrics are:

- Market capitalization (up 15%)

- Revenue of TRON in USD (up 7%)

- DeFi Total Value Locked (up 25%)

- Average daily DEX volume (up 142%)

Impact on TRON price

Among other metrics, circulating supply of TRON is the one that may have a direct impact on the token’s price. The circulating supply is influenced by token burn and TRX rewards. The protocol burns all transaction fees collected from users, reducing the circulating supply of TRON.

Data from Messari’s report shows that TRON’s circulating supply reduced from 88.2 billion to 87.7 billion in Q1 2024. TRON’s annualized inflation rate is negative 2.6%. This is likely one of the drivers of gains in the token’s price.

TRON price is up 10% since the beginning of 2024. The token is changing hands at $0.1184 on Binance, at the time of writing.