FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

- FBI has warned US market against using unregistered Bitcoin and crypto money service businesses.

- US SEC has accused MetaMask of acting as an unlicensed Broker Dealer engaged with trading securities on behalf of clients.

- Consensys (MetaMask) has sued the SEC first for being unlawful, calling for the regulator to stop overextending its authority.

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Also Read: SEC hit by lawsuit brought by Blockchain Association and Crypto Freedom Alliance of Texas

FBI issues alert on crypto money services business

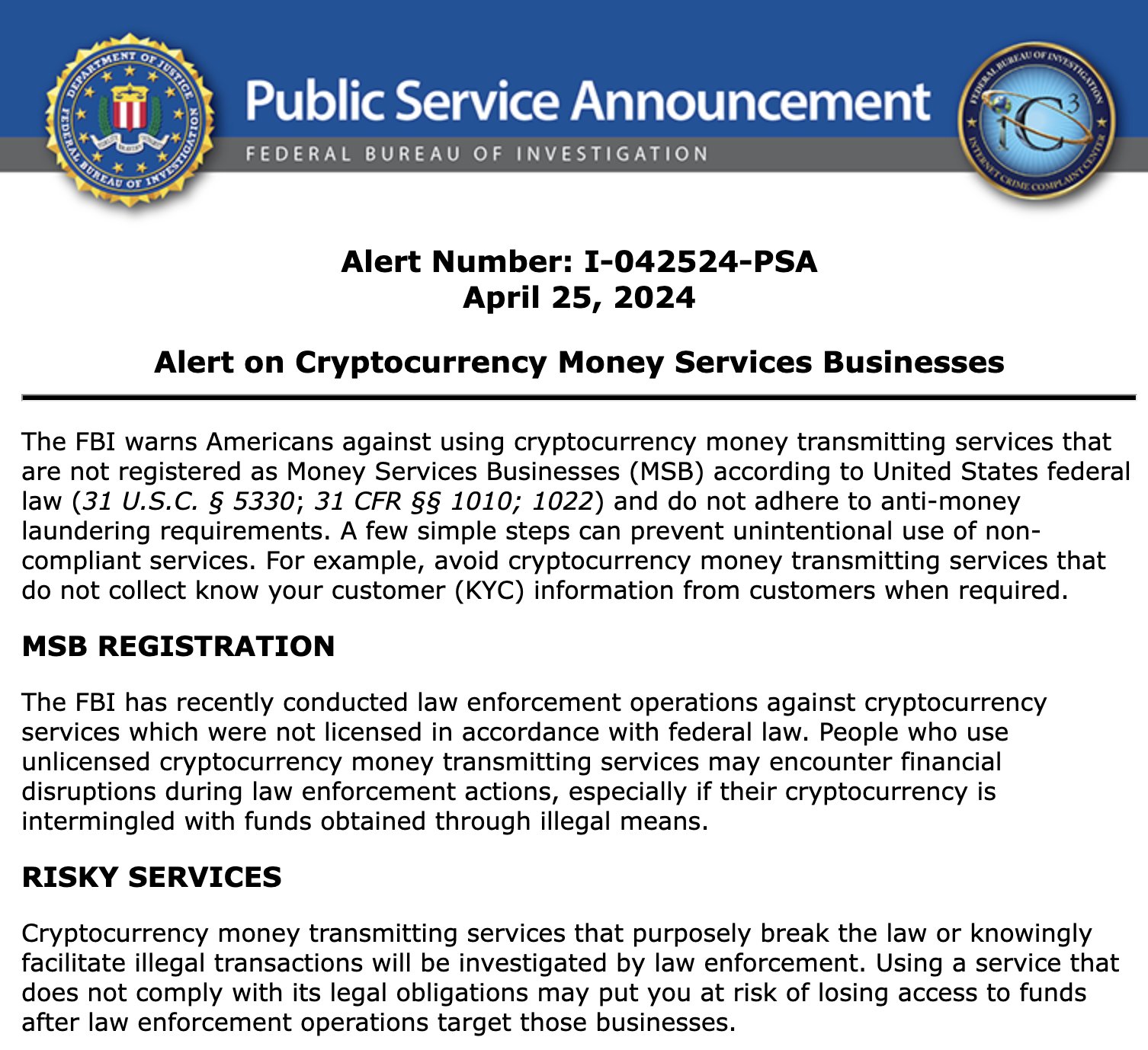

The US FBI has cautioned the American populace against using unregistered crypto money transmitting services unless they are registered as Money Services Businesses (MSB). Urging Americans to watch out for incompliant operators who do not adhere to anti-money laundering (AML) protocols, the FBI's Internet Crime Complaint Center (IC3) said in the Thursday statement:

“People who use unlicensed cryptocurrency money transmitting services may encounter financial disruptions during law enforcement actions, especially if their cryptocurrency is intermingled with funds obtained through illegal means.”

The statement comes after the FBI probed crypto services, looking for those that are not licensed in line with Federal laws. Calling such services “illegal transactions,” the bureau warned Americans that using incompliant services could see them lose access to funds once law enforcement clamps down on these businesses.

FBI Alert

The statement urges customers to avoid crypto money transmitting services that do not collect know-your-customer (KYC) information from customers when required.

SEC calls out MetaMask for unlicensed broker dealership, Consensys pushes back

In the same spirit, the US SEC has accused MetaMask wallet of acting as an unlicensed broker dealer, citing violation of securities laws. A broker dealer is a financial entity that engages with trading securities on behalf of clients, but which may also trade for itself. It acts as a broker or agent when it executes orders on behalf of its clients and as a dealer or principal when it trades for its own account.

BREAKING: SEC has accused MetaMask of acting as an unlicensed BrokerDealer. pic.twitter.com/9HskcwnLs0

— Radar (@RadarHits) April 25, 2024

MetaMask did not immediately respond to FXStreet’s request for comment.

As if to push back, Consensys, the Ethereum startup behind MetaMask wallet defends that the SEC is overreaching its hand, trying to “seize control over the future of cryptocurrency."

Today, Consensys filed a lawsuit against the Securities and Exchange Commission.

— Consensys (@Consensys) April 25, 2024

The goal behind this is to ensure that Ethereum remains a vibrant and indispensable blockchain platform and to preserve access for the countless developers, market participants, and institutions…

An excerpt from the 34-page complaint reads:

The U.S. Securities and Exchange Commission (the “SEC” or the “Commission”) seeks to regulate ETH as a security, even though ETH bears none of the attributes of a security—and even though the SEC has previously told the world that ETH is not a security, and not within the SEC’s statutory jurisdiction.

Filing a precautionary suit against the financial regulator, Consensys revealed having received a Wells Notice over MetaMask, with the document known to precede a regulatory action. This is why Consensys is pushing back, asking a federal court to declare that ETH is not a security so that it stops the SEC from overextending its authority.

The status of Ethereum as a security or commodity remains unclear, given there has not been any straightforward response from the SEC, unlike Commodity Futures Trading Commission (CFTC), which called ETH a commodity. A security designation would be detrimental to many companies in the US, who could face the wrath of the SEC for dealing in unregistered securities.

Ethereum co-founder and Consensys founder and CEO Joe Lubin highlighted in a press release that its pushback against the regulator “is intended to preserve access for the thousands of developers, market participants, and institutions who have a stake in” Ether.

Also Read: Ethereum looks set to resume consolidation as Consensys sues SEC over ETH security status