Bitcoin price could be primed for correction as bearish activity grows near $66K area

- Bitcoin price has dropped almost 3% already with prospects for additional losses.

- Volume profile shows significant bearish activity between $68,000 and $64,806 range.

- $71 million longs have already been liquidated in past 24 hours as global crypto market cap shrinks to $2.41 trillion.

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Also Read: Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Daily digest market movers: Bitcoin dumps, liquidates $71M longs as volume of bearish activity grows

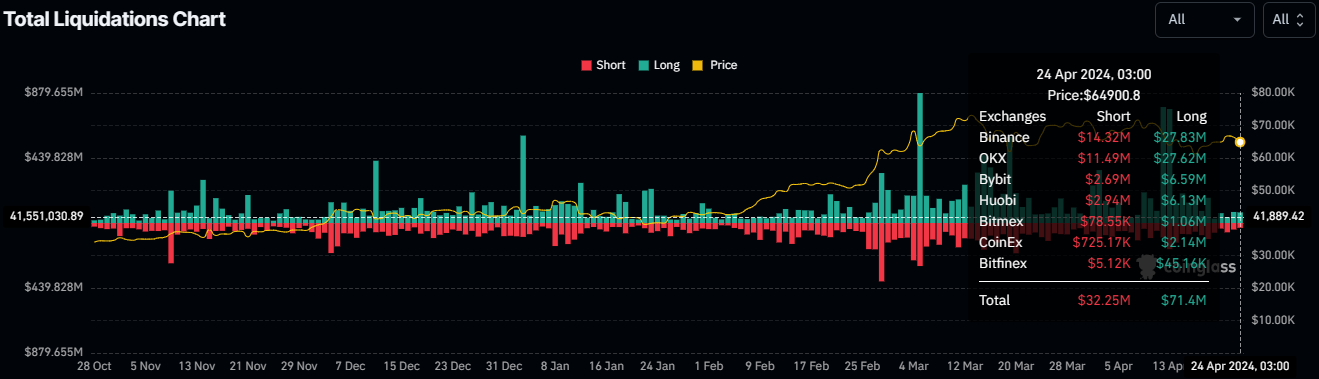

Bitcoin price has dropped by nearly 3% after the $67,500 level proved impenetrable for now. The rejection has seen up to $71.4 million in long positions liquidated across the market, alongside $32.25 million worth of shorts. Total liquidations are to the tune of $103.65 million as of Wednesday, 15:51 GMT.

Total liquidations

The whiplash has caused a 2% drop in global cryptocurrency market capitalization in 24 hours, now recorded at $2.41 trillion. One user on X, @invest_answers, ascribes the move to the work of market makers, saying they are hunting leveraged longs.

#Bitcoin market makers are hunting your levgd longs - heading to 65K or lower.... expect a nice V Shape recovery shortly pic.twitter.com/ty4aknnJJr

— InvestAnswers (@invest_answers) April 24, 2024

To some, this is a typical capital rotation in favor of altcoins following the halving. While a significant bull market peak is expected between 518 and 546 days after the halving, according to @rektcapital, the bullish sentiment inspired by the landmark event tends to bode well for altcoins.

#Altcoins are looking prime for an explosive rally after the recent correction.

— Mikybull Crypto (@MikybullCrypto) April 24, 2024

If you observe closely, Alts pullback happened in 2020 at a fib .618 level which coincidentally happened at the same level recently.

This year Alts cap is closely following the 2020-2021 price… pic.twitter.com/3wY4UCPR5s

Meanwhile, reports indicate that BTC and Ether spot exchange-traded funds (ETFs) are set to commence trading in Hong Kong, starting from April 30. It comes after an official approval to launch. Among them, the $230 billion Harvest Fund’s BTC ETF will begin trading on the same day with a 0% fee.

While this is a relatively small ETF market, it will be interesting to watch much younger capital ready for more risk. James Seyffart, ETF analyst from Bloomberg Intelligence, says that he anticipates a potential fee war in Hong Kong over these BTC and ETH ETFs.

A potential fee war could break out in Hong Kong over these #Bitcoin & #Ethereum ETFs. Harvest coming in hot with a full fee waiver and the lowest fee at 0.3% after waiver. Tables are from my colleagues @RebeccaSin_SK & @thetrinianalyst! pic.twitter.com/zI1XobrTwZ

— James Seyffart (@JSeyff) April 24, 2024

Nevertheless, it is a bold move by China, not letting people self-custody their Bitcoin but allowing access in a regulated way via ETFs. There is speculation that Japan and South Korea could be next for ETF approvals.

Technical analysis: Extended sell-off expected if Bitcoin price drops below $62,300

Bitcoin price is sitting on support due to the 50-day Smooth Moving Average (SMMA) at $64,809, but this may not hold as a cloud of bearish activity hovers above the price. This is shown by the gray spikes seen on the volume profile relative to the yellow spikes on the right side of the chart.

The 12-hour chart shows that the area between $68,000 and $64,806 bears significant selling activity, which is weighing down on BTC price. The first area of support is expected between $61,579 and $63,090, with a break and close below its midline at $62,374 confirming a further downside. Bitcoin price could extend the fall to the $60,000 psychological level or lower.

The position of the Moving Average Convergence Divergence (MACD) in negative territory suggests a bearish trend. The Relative Strength Index (RSI) is also dropping. If it records a lower high below the 50 mean level, it would solidify the trend reversal in Bitcoin price.

BTC/USDT 12-hour chart

On the other hand, a re-entry among the bulls could see the Bitcoin price recover. Confirmation of a move north will occur after the price forges past the area where the bears are populous. A decisive candlestick close above $70,000 on the 12-hour time frame would set the tone for Bitcoin price to reclaim its $73,777 all-time high.

In a highly bullish case, BTC could foray into the $74,000 range and record a new cycle top above this level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.