Crypto AI token comeback likely after Apple's potential on-device LLM

- Apple is likely working on an on-device Large Language Model, per Bloomberg correspondent Mark Gurman.

- The news is one of the catalysts that likely fueled the Artificial Intelligence narrative.

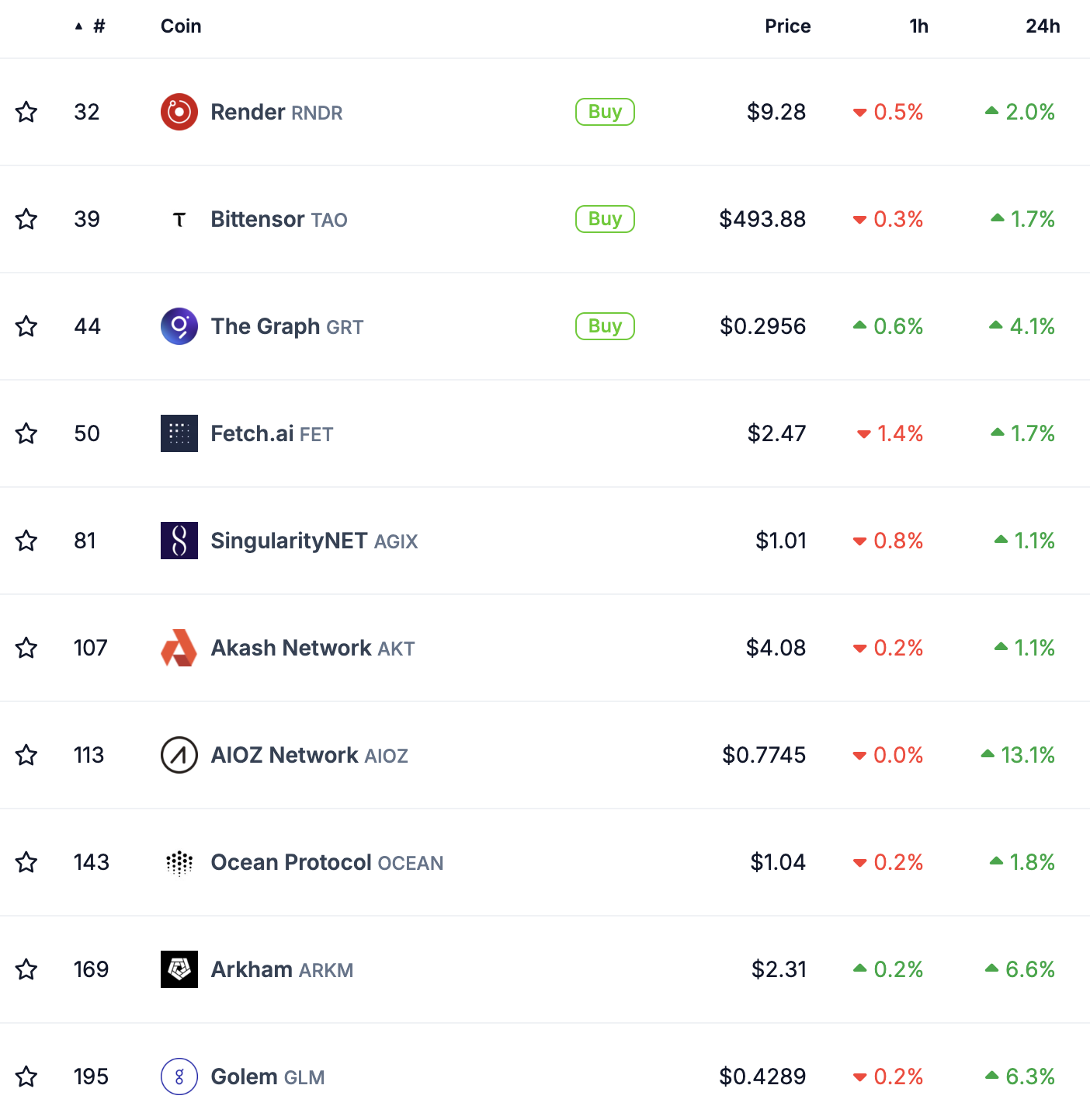

- AI token prices rally on Monday, with RNDR, TAO, GRT, AIOZ, ARKM, GLM, TRAC and RSS3 posting gains.

Artificial Intelligence (AI) crypto tokens Render (RNDR), Bittensor Tao (TAO), The Graph (GRT), AIOZ Network (AIOZ), Golem (GLM), OriginTrail (TRAC) and RSS3 (RSS3) prices rally on Monday.

Apple is likely working on an on-device Large Language Model (LLM), according to Bloomberg Correspondent Mark Gurman. The report, alongside other AI-related developments in the past week, has fueled the AI token rally.

Crypto AI tokens gain riding on updates in Artificial Intelligence from giants

AI firms made several announcements in the past week. Meta, OpenAI, Sora, Microsoft, Google DeepMind, Boston Dynamics and Tencent among others, announced AI-related updates. Gurman said that Apple is likely working on its on-device LLM. LLMs are AI programs that recognize and generate text and train on huge sets of data. ChatGPT is among the most popular ones.

Power On: Apple needs a low-end iPhone and a push into emerging markets to get back on track. Also: Apple’s next big thing is an on-device LLM; iPad availability dwindles; Vision Pro loses steam; and iOS 17.5 includes a change that may upend the App Store. https://t.co/A5gdasXhIA

— Mark Gurman (@markgurman) April 21, 2024

In the past week, Meta introduced two out of three versions of Llama 3, while OpenAI and TED shared a new Sora-generated AI video. Additionally, Microsoft announced a new model to turn a single photo or piece of audio into a deep fake and researchers at Google DeepMind shared a demo of autonomous ALOHA 2 robots.

The updates from AI giants have likely catalyzed token gains. Prices of RNDR, TAO, GRT, AIOZ, GLM, TRAC and RSS3 rally on Monday. The AI tokens postd between 2% and 13% gains on the day.

Crypto AI tokens

AI token resurgence

Digital Bank Sygnum’s quarterly research report states that crypto use cases are evolving.

The report states that Web3 sector performance is driven by a strong narrative around AI-related protocols and decentralized physical infrastructure networks (DePIN), and a growing demand for decentralized computing resources, interoperability solutions, and data sharing services.