Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Altcoins come ashore after BTC halving arrival

- Bitcoin price could drop to $60,000 or lower as investors cash in on BTC halving news.

- Ethereum price could make a bullish breakout if altcoin market cap seesaws against BTC price.

- Ripple price holds above support, could reclaim above $0.5783 as XRP bulls reawaken.

Bitcoin (BTC) price remains lull, but the outlook seen among altcoins is different with Ethereum (ETH) and Ripple (XRP) holding above key levels. It comes following the successful arrival of the fourth BTC halving, which has Bitcoiners and market enthusiasts euphoric.

BITCOIN 'HALVING' CUTS IN HALF REWARDS PAID TO MINERS

— *Walter Bloomberg (@DeItaone) April 20, 2024

The highly awaited Bitcoin halving finally happened on Saturday, with the Bitcoin block height hitting 840,000. In the aftermath, the global cryptocurrency market capitalization has increased by 3.22% to $2.32 trillion. It comes as altcoins begin to reawaken, with most flashing green to outperform the pioneer cryptocurrency.

Also Read: Bitcoin halving concludes successfully as BTC miner rewards reduce to 3.125

Bitcoin price could drop to $60,000

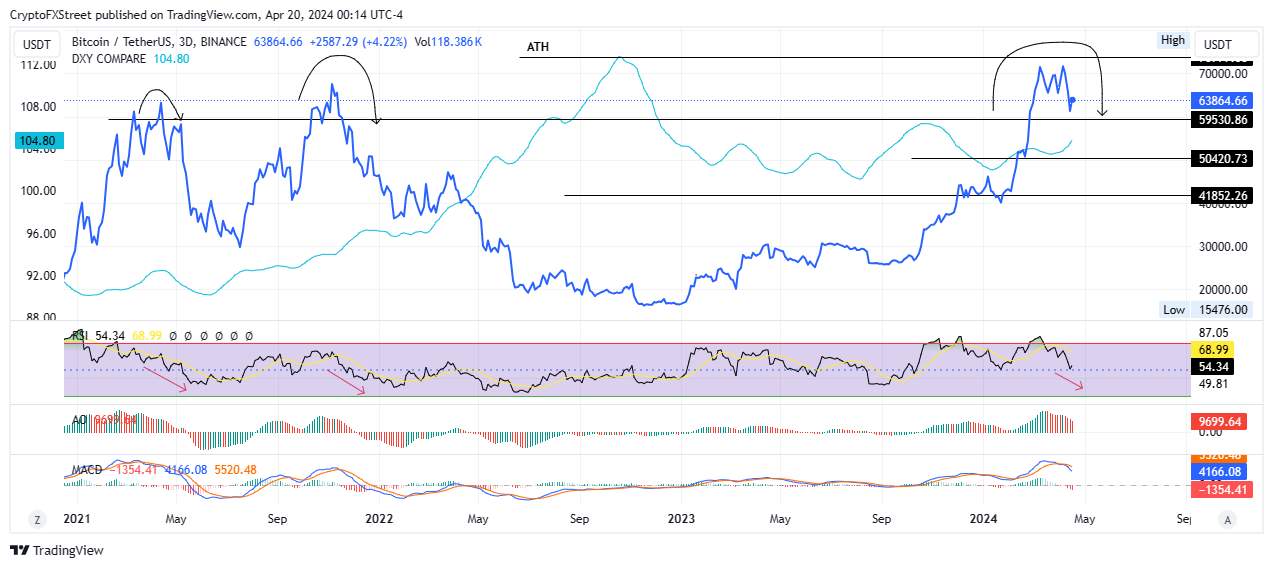

Bitcoin price remains lull following the conclusion of the BTC halving, and in the ‘sell the news’ situation the big crypto risks a correction to $60,000 or lower. Notice the lower lows and lower highs on the Relative Strength Index (RSI), showing momentum is dropping.

In its place, the Awesome Oscillator (AO) is edging toward negative territory as the red shade intensifies. Similarly, the Moving Average Convergence Divergence (MACD) has slipped below the orange band of its signal line, suggesting a potential bearish cycle.

Bitcoin price could drop below $60,000 to test the $59,530 support or extend lower to the $50,420 threshold.

BTC/USDT 3-day chart

Conversely, a surge in buying pressure could send Bitcoin price further north. A decisive candlestick close above the $70,000 psychological level on the 3-day time frame would confirm the continuation of the uptrend. This could see BTC price reclaim its $73,777 peak, or higher to record a new all-time high.

Also Read: Bitcoin Price Outlook: When should BTC peak post-halving?

Ethereum price coils up for a breakout

Ethereum price is consolidating within a falling wedge pattern, a bullish reversal technical formation that could see the largest altcoin rise. ETH is back above the $3,000 level and could record a bullish breakout as the market capitalization of altcoins seesaw against that of Bitcoin.

The RSI is tipping north, primed to recover above the 50 mean level. If it does, it could precipitate a strong move north for Ethereum price to extend higher.

ETH/USDT 3-day chart

Conversely, early profit booking among the bears could see Ethereum price drop, with a slip below $2,850 support negating the bullish thesis. This could see the fall extend to the depths of $2,500.

Also Read: Ethereum resumes consolidation after brief dip, buyback yield exceeds that of major S&P 500 companies

Ripple price shows strength

Ripple price could move up as it holds above the ascending trendline. The RSI seems primed for a pullback as it rejects further downside as it holds above 34. If XRP bulls are able to haul above 50, it could kick off a strong move north, sending Ripple price above the $0.5783.

A decisive candlestick close above this level on the three-day timeframe would encourage more buy orders. To confirm the continuation of the uptrend, bulls should watch for a candlestick close above $0.7630, the mean threshold of the supply zone between $0.7277 and $0.7959.

XRP/USDT 3-day chart

On the other hand, if the bears pull XRP price below the ascending trendline, it could encourage a sell off to send the Ripple price to the $0.4183 support. In a dire case, the altcoin’s price could drop all the way to the $0.3078 support.

Also Read: XRP fails to break past $0.50, posting 20% weekly losses

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.