ImmutableX extends recovery despite $69 million IMX token unlock

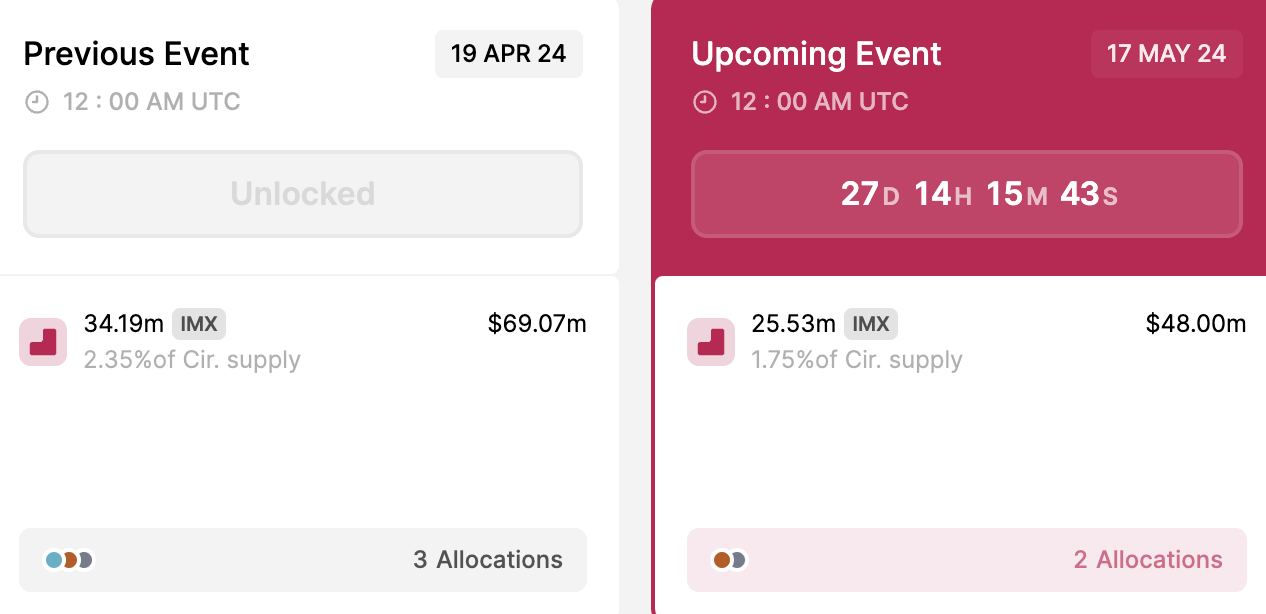

- ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday.

- IMX circulating supply increased over 2% following the unlock.

- The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

ImmutableX (IMX) price climbs nearly 3% on Friday despite its token unlock, finding some support at the $1.80 region and extending the 7% gain from the previous day. The project, which ranks among the top 15 Ethereum Layer 2 solutions by market capitalization, unlocked 34.19 million IMX tokens on Friday for ecosystem and project development and private sales.

IMX price resists correction despite massive token unlock

ImmutableX’s IMX token held its gains despite the $69 million token unlock on Friday. Typically, token unlock events negatively influence asset prices since they increase the volume of assets under circulation.

IMX unlocked 2.35% of the token’s circulating supply. The unlocked tokens will be used for private sales, ecosystem development and project development, according to Tokenunlocks.

IMX token unlock

Immutable’s layer swap rewards program is likely the driver of the recent IMX gains. On Wednesday, the project announced a rewards program in which users bridge to Immutable zkEVM from any support chain via a faster bridge and get 100% of the fees back. The program is on until April 29.

Immutable @layerswap rewards program is LIVE!

— Immutable (@Immutable) April 17, 2024

Bridge to Immutable zkEVM from any supported chain via https://t.co/wdllZqHpE0 and get 100% of fees back

Only available until 29 April 2024, 00:00 UTC!

Visit https://t.co/VVP7r8IM1z for even more ways to get $IMX rewards! pic.twitter.com/hgHEI5GoJ4

IMX price is $2.06 at the time of writing and climbs nearly 3% in the day. However, ImmutableX’s token declined nearly 20% in the past week amidst the broad marketwide correction in cryptocurrencies.