Ethereum Annual Price Forecast: ETH poised for growth in 2026 amid regulatory clarity and institutional adoption

- Ethereum needs to break above $5,000 in 2026 to escape its four-year shadow, following a mixed 2025 in which it both hit significant lows and set new all-time highs.

- The launch of corporate ETH treasuries, favorable crypto policies and ETF inflows provided Ethereum with the momentum it lacked for years in 2025.

- Regulatory clarity, institutional adoption and major network upgrades could serve as tailwinds for Ethereum in 2026.

Ethereum (ETH) lost 12% of its value in 2025, declining from $3,336 at the beginning of the year to $2,930 as of the third week of December, a stark contrast from 2024's 48% gain. But that percentage doesn't do justice to the wild year ETH had in 2025.

In Q1, ETH was headed toward the shadows, diving 45% as the impact of President Donald Trump's tariffs erased nearly all of its gains from 2024. While the entire crypto market was in a downtrend during the period, ETH fell harder than most top cryptos, strengthening its underperformance narrative against Bitcoin. Hedge funds added to the selling pressure, unwinding short positions from their ETH basis trade.

However, the top altcoin showed resilience, bouncing back in Q2 following the Pectra upgrade. After establishing a bottom at $1,385 in early April, ETH went on a parabolic run, ending the quarter with a 37% gain.

Unlike the last two years, when ETH saw a downtrend, its price growth accelerated in Q3, posting gains of 66% — its best Q3 performance on record. Supercharged by strong buying activity from corporate treasuries and Ethereum exchange-traded funds (ETFs), ETH went on to establish a new all-time high of $4,956 in August after four years.

However, Trump's tariff threats on China came knocking again on October 10. Combined with a proposal by index provider MSCI to exclude corporate crypto treasuries from its equity indices, both events sparked crypto's largest single-day liquidation on record, worth over $19 billion.

Since then, ETH has remained under pressure, declining by about 29% so far in Q4.

Going into 2026, the market's underlying structure shows neutral sentiment, with excessive leverage already wiped out. Investors anticipate ETH rising above its all-time high if the macro picture improves and institutions continue embracing tokenization.

Ethereum 2025 review: ETH lacklustre Q1 versus Bitcoin

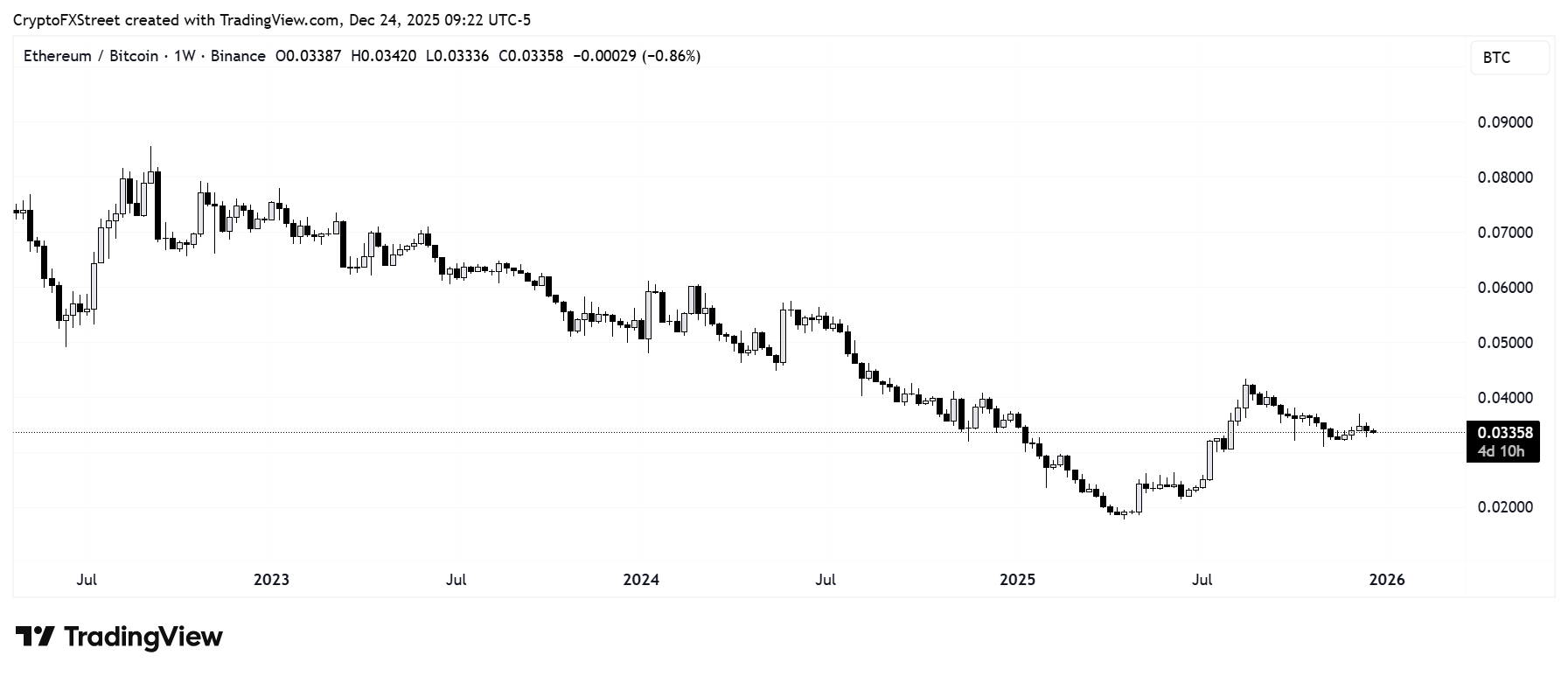

2025 marked a halt to ETH's underperformance relative to Bitcoin, a trend that lasted for over two years. However, it wasn't all rosy at the beginning, as the pair crashed in Q1 to a five-year low of 0.01766, a level last visited in January 2020.

The underperformance wasn't only relative to Bitcoin, considering ETH's market dominance fell below 7% for the first time in its history.

Amid other factors, hedge funds and arbitrageurs were major contributors to the sharp plunge. These funds had engaged in a basis trade from November/December 2024, when the ETH CME basis was around 20%.

Basis is the difference between a futures contract's price and the spot price of its underlying assets.

The 20% basis — greater than US Treasury yields at the time — attracted arbitrageurs, especially hedge funds. They bought US spot Ethereum ETF shares, while simultaneously shorting ETH on the CME.

However, the basis gap closed to about 5% after Trump's tariffs and the Federal Reserve's (Fed) hawkish tone caused a market-wide correction across crypto assets and stocks. As a result, these arbitrageurs sold their spot ETH ETF holdings, causing ETH to fall faster than BTC.

-1766586262353-1766586262354.png)

The unwinding shorts were only a part of the problem. As selling pressure intensified, the Ethereum community showed signs of cracking, with the Ethereum Foundation facing strong backlash over its vision for the top Layer 1 network.

A few core developers jumped ship, key community members sold off their holdings, and others resigned from advocating for ETH. The criticality of the situation forced the Ethereum Foundation to make its first major leadership change in years.

A new leadership takes over the reins

Earlier in the year, the non-profit responsible for managing Ethereum protocol upgrades, the Ethereum Foundation (EF), had its first major leadership overhaul in seven years.

Former executive director Aya Miyaguchi transitioned into the role of president, with Tomasz Stańczak and Hsiao-Wei Wan taking over the reins as co-executive directors in March. Wang focused on technical coordination and Stańczak on operational execution.

The Foundation also established an advisory council comprising key community members.

The new leadership outlined three goals: scale the L1, scale blobs and improve the user experience.

The change in the EF comes after a series of criticisms of its long-term goals and leadership, particularly Miyaguchi.

With ETH significantly underperforming Bitcoin and Solana in Q1, many called for Miyaguchi's resignation. They touted Danny Ryan, who spearheaded Ethereum's transition to a Proof-of-Stake (PoS) network, as a potential replacement.

However, after receiving an EF grant, Danny Ryan eventually co-founded Etherealize with Vivek Raman to educate traditional financial institutions about Ethereum's capabilities.

Ambitious Ethereum Foundation ships two major upgrades in 2025: Pectra and Fusaka

Ethereum core developers shipped two major upgrades in a year for the first time since 2021. After the Merge in 2022, developers had favoured one upgrade per year. However, 2025 marked a shift toward an accelerated twice-a-year cadence for the EF.

The Pectra upgrade

After facing initial delays, Pectra launched in May as the combination of the Prague execution-layer and Electra consensus-layer upgrades. Pectra introduced code changes from eleven Ethereum Improvement Proposals (EIPs) to mainnet, making it the network's most ambitious upgrade at the time.

The most anticipated changes to the network were primarily from three EIPs: EIP-7702, EIP-7691 and EIP-7251.

EIP-7702 laid the groundwork for account abstraction, allowing regular wallets, or Externally Owned Accounts (EOAs), to temporarily exhibit smart contract functionality. Several wallet providers have implemented support for the EIP, allowing users to perform transaction batching, sponsored transactions and social recovery.

EIP-7691 scaled blobspace (blobs) capacity in Ethereum by increasing the target and maximum blobs per block from 3 and 6 to 6 and 9, respectively. The change allowed L2s to post more data to the L1 while keeping costs low, thereby boosting Ethereum's appeal as a data availability layer.

EIP-7251 enabled a more streamlined and efficient staking process. By increasing the maximum staking effective balance from 32 ETH to 2,048 ETH, validators were able to consolidate operations and compound returns.

The Fusaka upgrade

Launched roughly seven months after Pectra, Fusaka consisted of 12 EIPs, introducing features that optimize storage, enhance data verification, increase the block gas limit, and more.

The most notable is EIP-7594 Peer Data Availability Sampling (PeerDAS), which allows validators to verify Layer 2 transactions using only a small portion of a rollup's data rather than downloading the entire blobs. The approach allows for the expansion of blobs on the L1 without increasing the bandwidth requirement for nodes. Hence, scaling Layer 2 throughput while keeping costs low.

The update also introduces a blob fee minimum to keep fees predictable and enable consistent ETH burns during periods of low or high L2 demand.

EIP-7825 strengthens the network's capacity against DoS attacks by scaling the default gas limit. By implementing a transaction gas limit cap of 16.78 million, no single transaction will consume an entire block.

Following Fusaka, core developers have implemented Blob Parameter Only (BPO) 1 to scale the target and maximum blobs per block to 10 and 15, respectively. Developers will activate BPO 2 in January.

Developers have turned attention to the Glamsterdam upgrade, scheduled to launch in the first half of 2026.

DATs supercharge ETH, but could they be a curse in 2026?

While a change in the EF's leadership and a successful Pectra upgrade provided relief and modestly boosted prices, ETH needed something more to break out of Bitcoin's underperformance. The two key market forces that proved to be heavy demand drivers for Bitcoin — enter digital-asset treasuries (DATs) and ETF flows.

DATs are publicly listed companies that hold cryptocurrencies as their primary reserves through stock offerings, private placements, or debt. These firms aim to outperform their underlying assets in the long term by maximizing yield.

SharpLink Gaming (SBET) announced the first Ethereum DAT in May, following the launch of a $1 billion offering to purchase ETH.

The Minnesota-based firm's move ignited a flurry of Ethereum treasury launches, with Bit Digital, The Ether Machine, BTCS Inc, and BitMine joining the train.

SharpLink Gaming initially held the largest ETH treasury, but that lead was short-lived after BitMine and its new chairman Thomas Lee — who also doubles as Fundstrat's CIO — entered the chat.

Launched with an ambitious goal of acquiring 5% of ETH's circulating supply, BitMine grew its ETH treasury to become the largest globally within a few months of going live. The company has accumulated 3.97 million ETH since July and now ranks second-largest crypto treasury behind Strategy.

The buying pressure from BitMine and other DATs has pushed the total holdings of Ethereum treasury companies to 5.87 million ETH as of December 24.

The significant supply shrinkage sparked a fierce rally in ETH, pushing its price up by 72% between June and August. During the same period, Bitcoin's price rose by just 2.4%.

However, the good times came to a halt following the October 10 crypto leverage flush, which triggered a market-wide downturn. ETH plunged about 45% between October and November, but the shares of crypto treasuries saw sharper declines, pushing their market cap-to-net assets value (mNAV) ratios into the shadows.

An mNAV ratio greater than 1 indicates that DAT shares are trading at a premium to their net assets, enabling them to easily raise cash to fund additional crypto purchases. However, a ratio below 1 implies shares are trading at a discount and could push DATs to close the gap by selling their crypto holdings to conduct share buybacks.

This was the case of FG Nexus, which sold nearly 11,000 ETH in November to repurchase shares after they crashed over 90% between August and November. The company initiated another 24,000 ETH sale in December, adding that it's transitioning away from the treasury model to a tokenization business.

As a result, several experts have expressed concern that one of ETH's biggest blessings in 2025 could turn into a curse if DATs significantly underperform their NAVs in the long term.

Ethereum ETFs' parabolic run in 2025

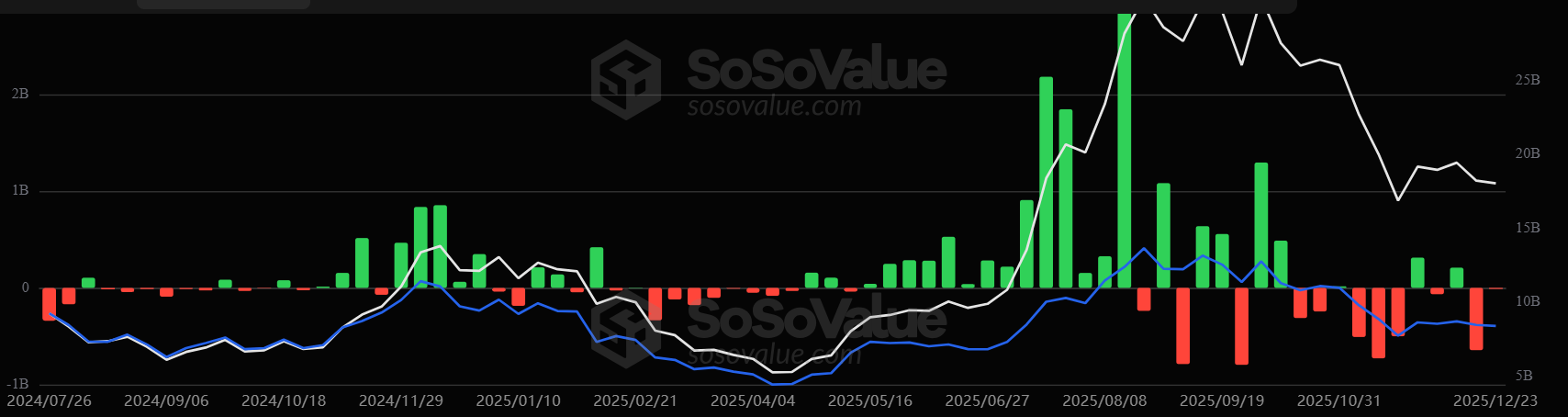

Ethereum ETFs' performance at the tail end of 2024 hinted at an explosive Q1'25. The products posted net inflows of $3.13 billion between November and December 2024.

However, that momentum quickly faded in Q1'25 with the products seeing net outflows of $242 million in the first three months of the year. The weakness followed a market-wide downturn across risk assets sparked by President Trump's tariff plans.

Notably, ETH ETFs went on an eight-week outflow streak between February and April before buyers returned.

In May, the products picked up pace with an impressive 14-week inflow run that spanned to August. Coinciding with DATs' buying pressure, the run sparked a 70% price growth for the top altcoin, nearly tripling the net assets of ETH ETFs during the period.

Inflows weakened from September into Q4, eventually flipping to negative in November, with investors pulling out $1.42 billion, the largest monthly outflow on record.

On the regulatory side, the new SEC administration approved staking within Ethereum ETFs, a feature the agency had not favored under former Chair Gary Gensler. Grayscale has already added staking to its two Ethereum ETFs, while other issuers await the SEC's decision on their application to integrate the feature within their products.

BlackRock, on the other hand, filed for a separate Ethereum staking ETF to provide investors with options. The firm's iShares Ethereum Trust (ETHA) maintained its lead as the largest ETH ETF with net assets of $10.69 billion as of December 15.

ETHA was the second-fastest ETF in history to reach $10 billion in assets, only topped by BlackRock's iShares Bitcoin ETF (IBIT).

Developing crypto regulations boosts institutional interest in Ethereum

The Trump administration's pro-crypto regulatory stance has positioned Ethereum as a primary beneficiary heading into 2026. The GENIUS Act established a stablecoin regulatory framework, while the anticipated CLARITY Act promises clear guidance on crypto market structure — both critical for institutional blockchain adoption.

Leadership changes at the SEC and CFTC have accelerated this shift. SEC Chair Paul Atkins and CFTC Chair Selig have demonstrated crypto-friendly approaches, exemplified by granting the Depository Trust & Clearing Corporation (DTC) no-action relief to tokenize securities, such as Russell 1000 stocks and Treasuries, on blockchains.

Major financial institutions are now building directly on Ethereum. Robinhood is developing an Ethereum Layer 2, JP Morgan launched its MONY tokenized money market fund on the network, and BlackRock already operates tokenized products on the blockchain.

The Ethereum Foundation's L2-centric roadmap aligns with the demands that such rising institutional scale will bring in the long run.

The numbers reflect this momentum. Stablecoin value on Ethereum surged $53.31 billion in 2025 to reach $165.13 billion, giving Ethereum 53.3% dominance of the stablecoin market. Tether's USDT accounts for 52.5% of this total.

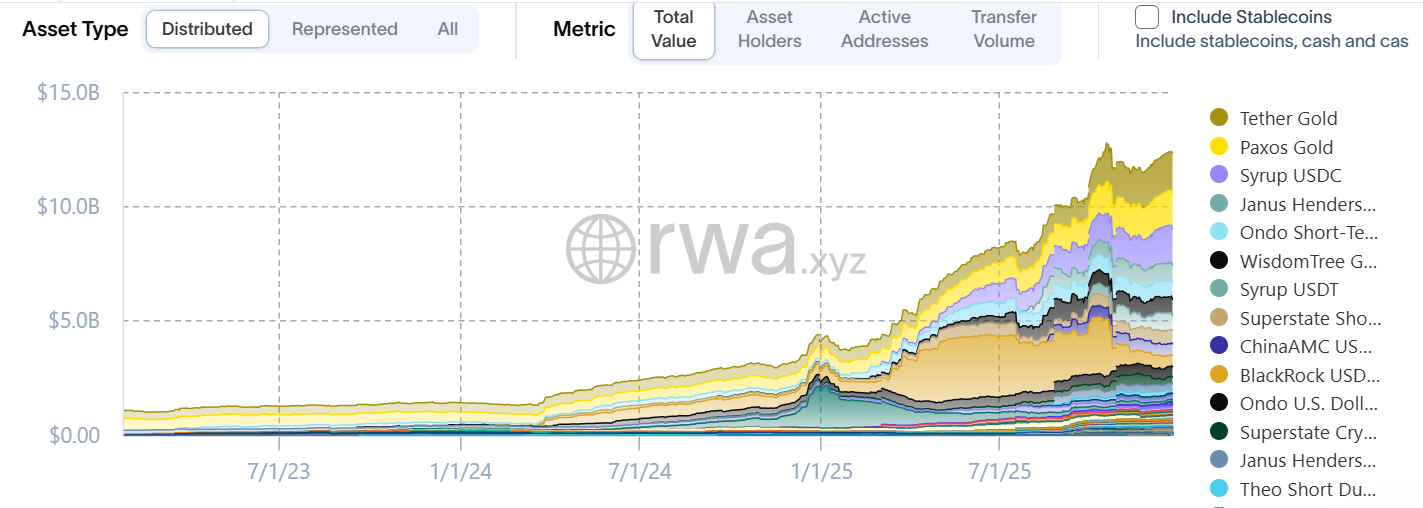

Meanwhile, tokenized real-world assets on Ethereum grew from $4.12 billion to $12.18 billion, capturing 65% market dominance.

Standard Chartered projects stablecoins and tokenized assets on Ethereum could each reach $2 trillion by 2028, though JP Morgan maintains a more conservative outlook. Such growth would require increasing ETH purchases for onchain settlement, potentially driving significant price appreciation as institutional demand scales.

Ethereum Fundamental/Onchain Outlook 2026

Ethereum’s onchain and fundamental outlook in 2025 was a mixed one with some metrics posting tremendous growth while others stayed flat. Heading into 2026, some of these metrics could begin to show a positive trend and charge ETH upward as traditional institutions continue their march into the onchain economy.

MVRV

Ethereum's Market Value to Realized Value (MVRV) Ratio tracks the average profit or loss of all investors.

The 365-day MVRV shows all wallets that bought ETH in 2025 are sitting on a 11% loss. Meanwhile, the all-inclusive MVRV Ratio reveals that all investors are holding a 22% gain.

MVRV [15-1766588311202-1766588311203.57.52, 24 Dec, 2025].png)

At the end of 2024, both metrics showed huge gains, potentially leading to the quick distribution in Q1'25, following signs of bearish sentiment.

With both metrics sitting at low levels as 2025 comes to a close, ETH could hold steady in 2026 if bearish pressure persists. In the same vein, the top altcoin could see a sustained rise without immediate fears of distribution if bullish momentum returns.

However, distribution could occur quickly if investors' gains rise.

Exchange supply and supply distribution

The supply of ETH held on exchanges plunged to 16.24 million ETH in December, a 21% decrease from the 20.75 million coins at the beginning of the year.

-1766588413927-1766588413928.png)

Meanwhile, wallets holding 100-1K ETH and 1K-10K ETH in 2025 distributed 2.58 million ETH and 1.01 million ETH, respectively. This indicates retail selling activity in 2025.

A large percentage of the distributed supply from exchanges and retailers flowed toward wallets holding 10K-100K ETH and >100K ETH. The holdings of these wallets or whales increased by 7.97 million ETH and 1.02 million ETH in 2025.

-1766588580791-1766588580793.png)

The declining supply within retail cohorts and exchanges, combined with sustained whale accumulation that spans into 2026, could spur accelerated price growth if bullish momentum returns.

On the flip side, large whale holdings could spark a sustained downtrend if prices rise well above their cost basis and they begin profit-taking.

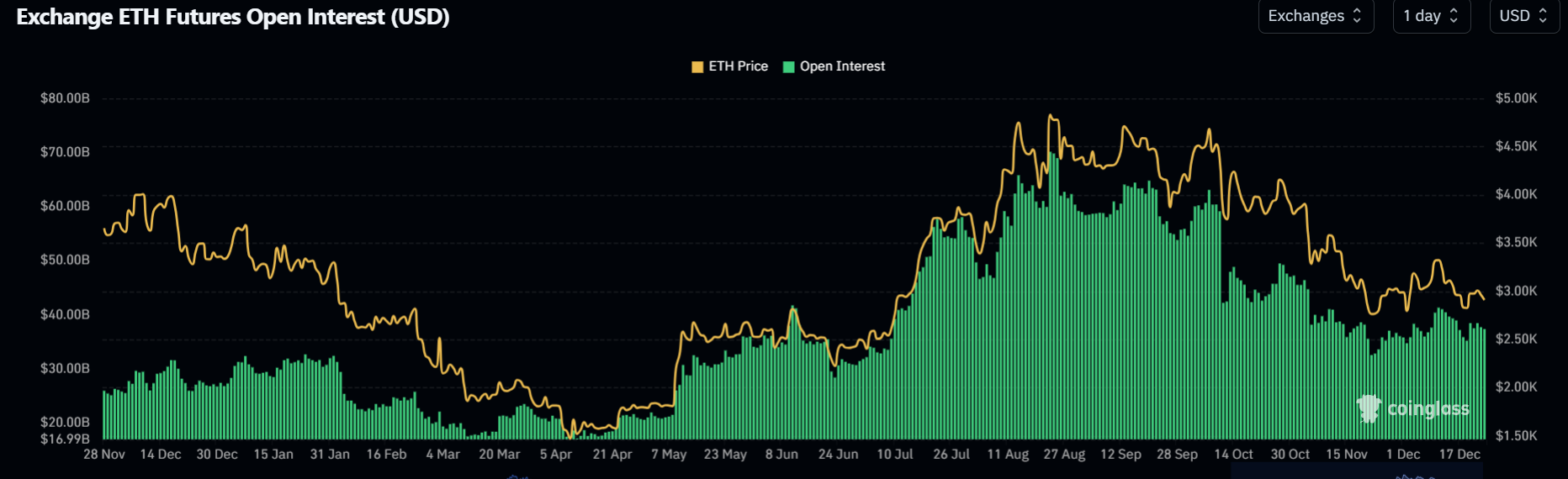

Open interest

Open interest is the total worth of unsettled contracts in a derivatives market.

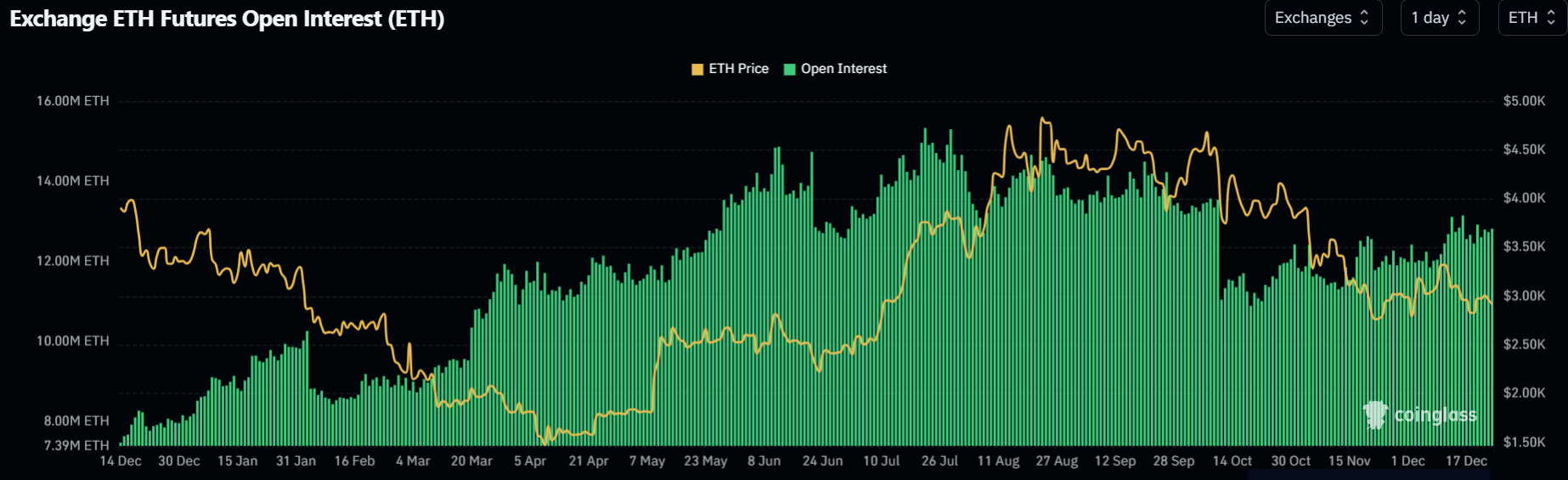

Ethereum's futures market saw significant growth in 2025, with open interest rising from 8.03 million ETH on January 1 to a record 15.33 million ETH in July. The subsequent price decline in Q4 flushed a portion of that leverage as OI dropped to 11.30 million ETH in November.

However, OI is growing again, hovering around 12.5-13 million ETH in December.

The value becomes more pronounced when measured in USD terms.

From $26.83 billion in January, Ethereum's OI surged more than 160% to $70.13 billion in August. However, it crashed by more than 53% to a low of $32.57 billion in November after the October 10 leverage flush. The figure has increased slightly to $37.37 billion in December.

The absence of significant leverage puts the market in a healthy position for a potential recovery when bullish sentiment returns.

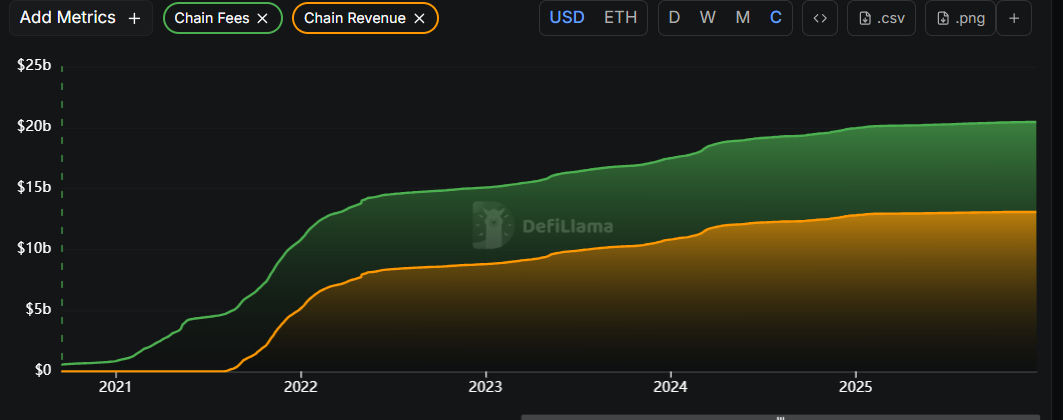

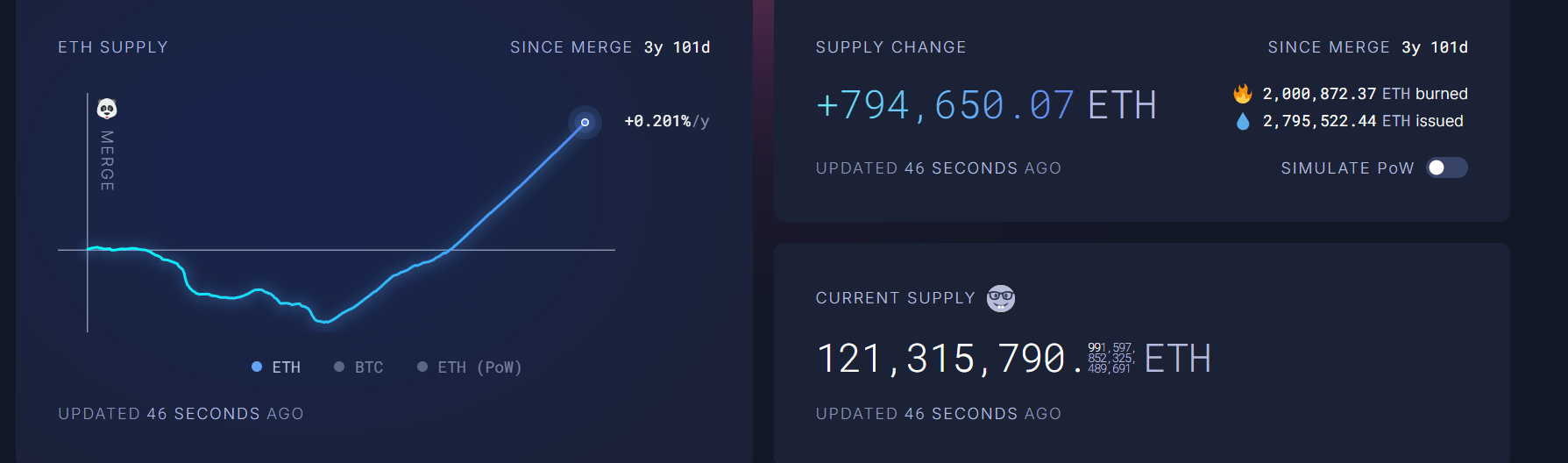

Ethereum chain revenue and Fees

Fees and revenue largely stayed flat on Ethereum in 2025, rising by 2.5% and 2.1%, respectively. The weak growth stems from the expansion of blobs on the Ethereum Layer 1 over the past three network upgrades, further reducing the cost of posting L2 data on the mainnet.

As a result, the amount of ETH burnt on Ethereum continues to decline, pushing the total supply upward.

The Ethereum burn mechanism, introduced in the London hard fork of 2021, permanently destroys a portion of transaction fees, thereby reducing ETH's inflation.

However, the introduction of minimum blob fees via EIP-7918 in the Fusaka upgrade could help reverse the trend in 2026.

A strong run of demand in Layer 2 networks could cause a notable growth in fees captured on the L1. In turn, it increases the amount of burnt ETH, reducing supply and potentially pushing prices upward.

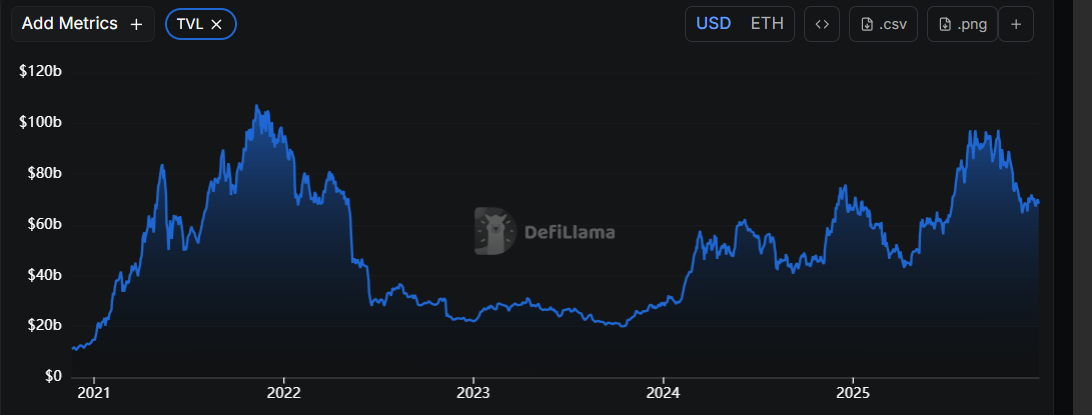

Total value locked

Total value locked (TVL) measures the total worth of assets held in smart contracts on a blockchain network or decentralized application (dApp).

Ethereum's TVL increased from 19.57 million ETH at the beginning of the year to 29.32 million in April, nearly matching its record high in the 2021 bull market. It eventually decreased in subsequent months, reaching 23.18 million ETH on December 16, a year-to-date (YTD) rise of 18%.

In USD terms, TVL surged from $65.31 billion on January 1 to $97.48 billion in October, a few billion dollars off 2021's high of $107.45 billion. The metric dropped to $68.71 billion on December 16, a YTD rise of 5% and 58% dominance over other chains.

Active addresses

The 30-day moving average (MA) of Ethereum active addresses spiked above 450K in August, levels last seen since November 2021, but eventually declined below 370K in December as the market cooled.

-1766589565363-1766589565364.png)

ETH's price occasionally follows the direction of network activity. Hence, active addresses may need to return before the top altcoin could stage any major recovery.

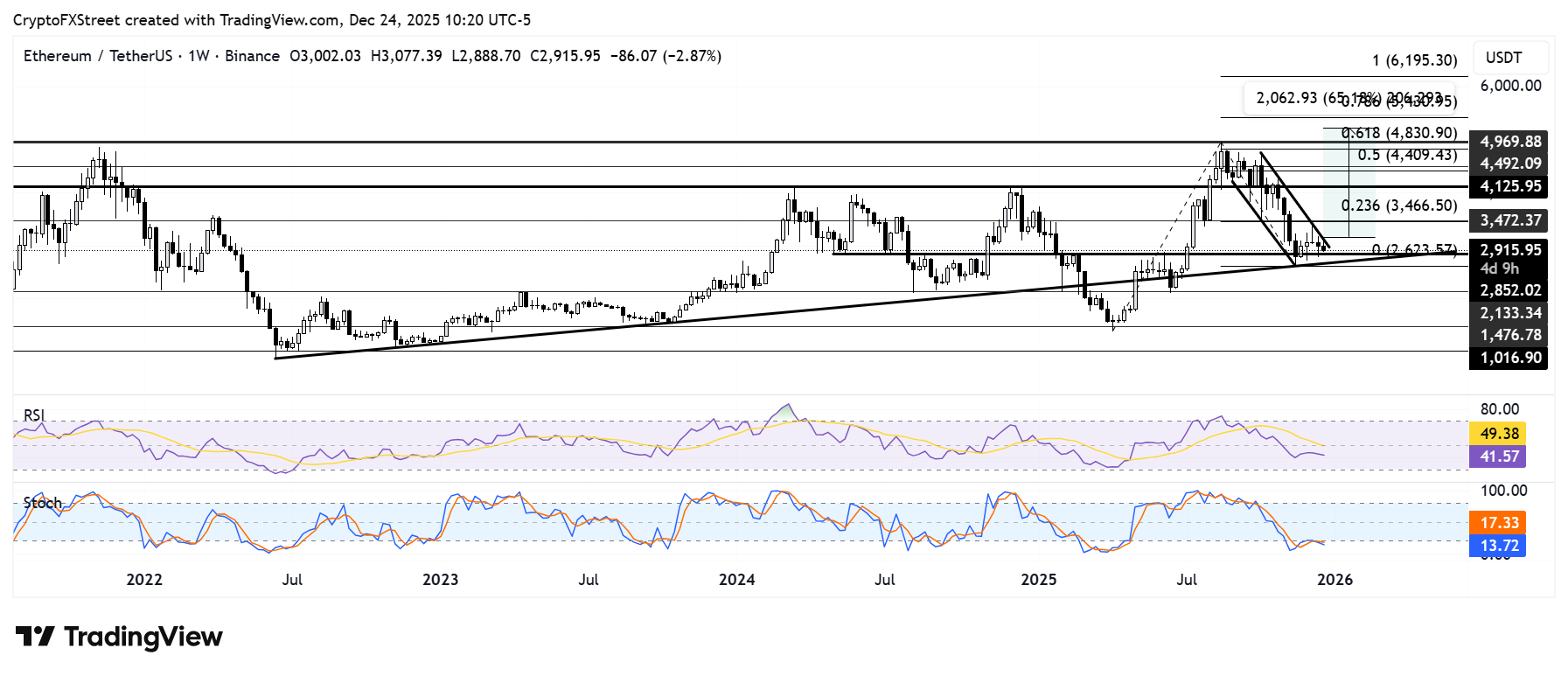

Ethereum 2026 Technical Analysis: ETH has to establish $5,000 as support to break out of 2021 shadows

Ethereum has been trading in a descending channel on the weekly chart, declining below the 20-, 50-, and 100-week Exponential Moving Averages (EMAs) following the October 10 crash.

The top altcoin eventually bounced off an ascending trendline extending from June 2022, strengthened by the 200-week EMA.

On the upside, ETH faces resistance at the upper boundary of the descending channel. The channel's resistance is reinforced by the 50-week EMA, which has proven a key hurdle over the past two weeks.

A breakout from the channel could see ETH set a new all-time high above $5,000. The target is determined by measuring the channel's height and projecting it upward from a potential breakout point.

On the way up, it has to overcome several key resistance levels at $3,470, $4,120, $4,500 and its current all-time high of $4,956.

After overcoming the historical selling pressure around $4,120 in August, the $4,800 to $5,000 range is the next key level ETH must clear and establish as support before it can break out from its 2021 shadows.

Above $5,000, ETH could rise toward key targets at $5,430 and $6,190, aligning with the 78.6% and 100% Fibonacci extensions.

On the downside, ETH could find support at $2,100 if it breaches the ascending trendline near the 200-week EMA. Further down, bulls could hold the support at $1,500, as they did in Q1'25, if a major downtrend occurs.

The Relative Strength Index (RSI) is below its moving average (MA) and neutral level. As the MA trends down toward the neutral level, a firm rise by the RSI above both lines could strengthen bullish momentum. Historically, ETH has seen major price gains whenever the RSI posts such a move.

The Stochastic Oscillator (Stoch) has been in oversold territory since November. ETH has historically pulled off major rallies after extended periods — typically >6 weeks — of oversold conditions in the Stoch.

A major downtrend with a weekly candlestick closing below $1,500 could invalidate the thesis.

Conclusion

Ethereum saw many developments in 2025 within and outside its ecosystem that position its network for expansion in the years to come. However, one thing remained consistent for ETH throughout 2025: prices failed to catch up with these developments as the crypto market's correlation with macro factors weighed heavily on the top altcoin.

If the macro picture improves in 2026, ETH could enjoy a robust rally and leap out of its four-year shadow. Serving as tailwinds to this optimistic viewpoint is ETH’s newfound momentum through DATs and ETFs, alongside the development of crypto policies and institutional adoption.