Ki Young Ju and Peter Brandt Just Released Medium- and Long-Term Bitcoin Predictions

Despite strong accumulation by Bitcoin ETFs and DATs this year, Bitcoin’s price has failed to attract the strong retail participation seen in previous cycles.

Well-known market analysts such as Ki Young Ju, CEO of CryptoQuant, and veteran trader Peter Brandt have released their latest Bitcoin outlooks. Their views shed light on Bitcoin’s short-, medium-, and long-term prospects.

Short-Term Outlook

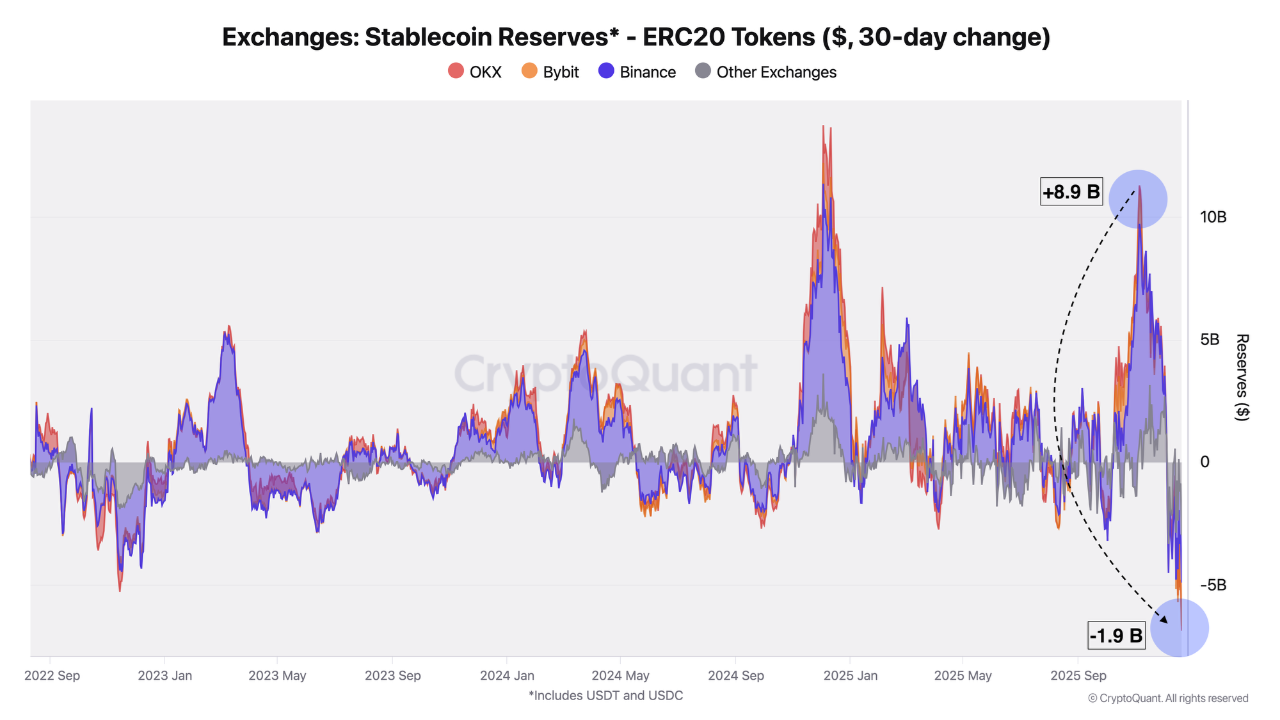

In the short term, Bitcoin may continue facing difficulties in staging a recovery. This weakness appears in declining stablecoin reserves.

CryptoQuant data shows that stablecoin reserves on major exchanges dropped sharply. Capital outflows reached nearly $1.9 billion within just 30 days.

Stablecoin Reserves (ERC20-Token) on Exchanges. Source: CryptoQuant.

Stablecoin Reserves (ERC20-Token) on Exchanges. Source: CryptoQuant.

Binance, the market’s leading liquidity venue, often reflects investor readiness to buy through stablecoin balances. However, data indicate that ERC-20 stablecoin reserves fell significantly on Binance and other centralized exchanges. This trend suggests that retail investors are exiting the market.

“This movement suggests a clear lack of investor interest in immediate market exposure. Rather than keeping their stablecoins on exchanges while waiting for opportunities, some investors have chosen to withdraw them,” analyst Darkfost commented.

As a result, Bitcoin lacks sufficient buying pressure in the short term, which limits its upside potential.

Medium-Term Outlook

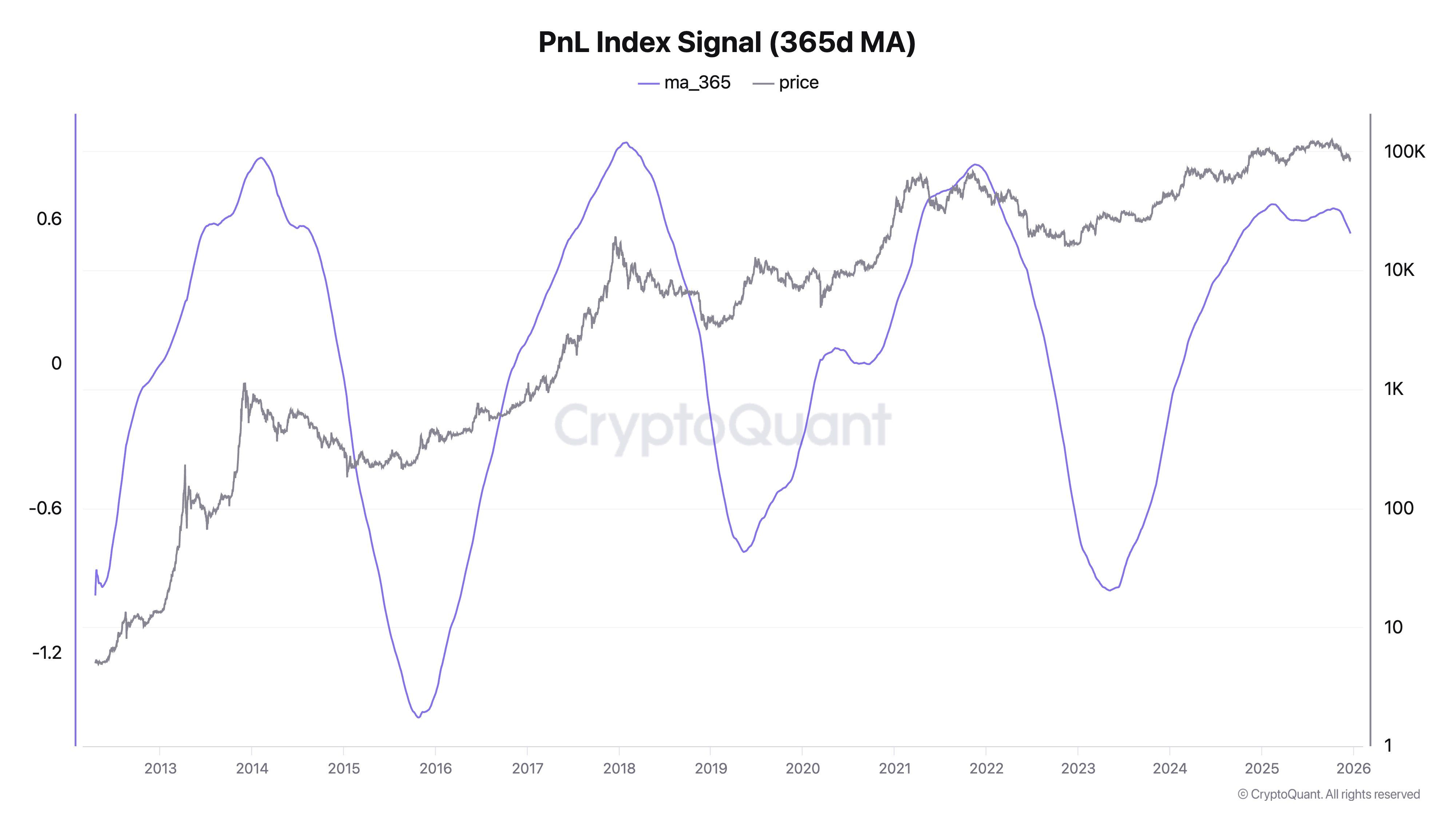

In the medium term, Ki Young Ju, founder of CryptoQuant, noted that on-chain capital inflows into Bitcoin are gradually weakening.

He explained that after approximately 2.5 years of continuous growth, the realized cap stalled over the past month. This metric measures total realized capitalization based on the last purchase price of each Bitcoin.

PnL Index Signal. Source: CryptoQuant.

PnL Index Signal. Source: CryptoQuant.

Data also shows that the PnL Index Signal, which tracks profit and loss based on the cost basis of all wallets, has moved sideways since early 2025. The indicator has begun trending downward toward year-end, signaling increasing losses.

“Sentiment recovery might take a few months,” Ki Young Ju predicted.

Long-Term Outlook

Over the long term, most analysts remain optimistic. Peter Brandt, a renowned trader with experience dating back to 1975, maintains a bullish stance.

In a recent post on X, Brandt stated that Bitcoin has experienced five logarithmic parabolic advances over the past 15 years. Declines of at least 80% followed each other. He argued that the current cycle has not yet ended.

When asked about the timing of a potential bottom, Brandt offered no specific answer. However, he projected that the next bull market peak could occur in September 2029.

His thesis relies on historical performance. Later market cycles tend to last longer, delivering smaller percentage gains compared to earlier ones.

Overall, analysts suggest that Bitcoin may require several months to recover. A new all-time high is unlikely to arrive quickly.