Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

- Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish.

- 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

- MANTA holders should brace for potential price drops due to increased supply.

Manta Network (MANTA) price was not spared from the broader market crash instigated by a weakness in the Bitcoin (BTC) market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Also Read: ARB, STRK, AXS: Three token unlocks worth over $350 million to watch out for ahead of Bitcoin halving week

MANTA token unlocks

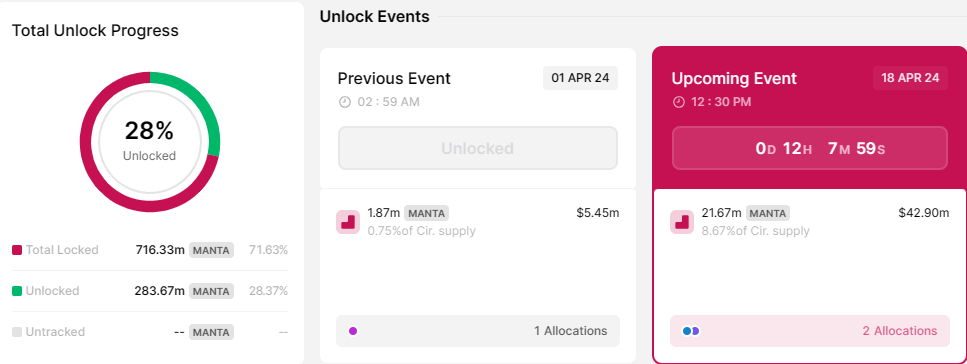

Data according to token unlocks app indicates that the Manta Network has a massive token unlocks event lined up for Thursday, April 18, where up to 21.67 million MANTA tokens will be unleashed to the market.

Comprising 8.67% of the network’s circulating supply, these tokens are worth nearly $44 million. The tokens will be unlocked for distribution through an airdrop (new paradigm or Airdrop 2) and, second, for public sale. This could cause volatility in price.

MANTA token unlocks

During a public sale, tokens are usually sold at a set price; this could stir up demand, but profit booking could follow shortly after as recipients look to cash in their holdings. MANTA holders should therefore brace for impact lest they are trapped in exit liquidity.

When a token is unlocked for an airdrop, it means that the tokens are made available for distribution to eligible users. Participants may receive these tokens for free or as a reward for completing specific tasks, such as joining a community, following social media accounts, or referring others to the project.

Also note that this will be a cliff token unlocks event, where the tokens have been set to unlock on a schedule that is more periodic than daily, and not the traditional weekly, monthly, or yearly periodicals.

Manta Network price outlook ahead of landmark unlocks

Manta Network price is defending against further downside amid broader market corrections. The price is thinly holding above the $1.80 support with prospects for more losses. This is seen with the Relative Strength Index (RSI), which is below the 50 mean level, and the position of both the Moving Average Convergence Divergence (MACD) and Awesome Oscillator (AO) in negative territory.

Enhanced seller momentum could see Manta Network price drop below $1.80, potentially extending the fall to the $1.50 threshold before a recovery.

MANTA/USDT 1-day chart

Conversely, a sweep of the April 13 liquidity with the $1.80 support holding effectively could encourage more buying, sending Manta Network price north. A break and close above the 50-day Simple Moving Average (SMA) at $2.93 would encourage late bulls, enhancing the upside potential for MANTA price. To invalidate the bearish thesis, however, the price must record a candlestick close above the range high of $3.00.