YouTube Enables PYUSD Stablecoin Payments for US Creators as Market Cap Hits $3.9 Billion

YouTube now allows US content creators to receive payments in PayPal’s PYUSD stablecoin. This marks a major step forward for crypto adoption on a leading video platform.

This partnership between the Google-owned platform and PayPal highlights growing institutional faith in stablecoin technology for routine transactions.

YouTube Adds PYUSD to Creator Payment Options

Creators in the United States can now select PYUSD, PayPal’s dollar-backed stablecoin, to receive YouTube earnings. May Zabaneh, PayPal’s head of crypto business, confirmed that the option is live for American users, according to Fortune. A Google spokesperson also verified the move.

This feature builds on PayPal’s third-quarter 2025 platform upgrade, which enabled recipients to accept PYUSD payments. YouTube has subsequently adopted the option.

The news has been welcomed by the community, which views it as a positive development. They stressed that this makes transactions easier and faster.

“Stablecoin payouts on youtube is wild. makes the creator economy feel a lot more global and frictionless, especially for those outside traditional banking. huge,” an user commented.

YouTube’s integration comes amid growing institutional adoption of PYUSD. Yesterday, State Street Investment Management and Galaxy Asset Management announced plans to launch the State Street Galaxy Onchain Liquidity Sweep Fund (SWEEP) in early 2026.

The fund will use PYUSD as the settlement currency for continuous subscriptions and redemptions, signaling a notable step in the use of stablecoins within regulated financial products.

PYUSD Market Cap Hits New High As Stablecoin Adoption Surges

The broader stablecoin market has experienced strong growth over the past few years. According to the IMF, cross-border flows involving USDT and USDC reached approximately $170 billion in 2025.

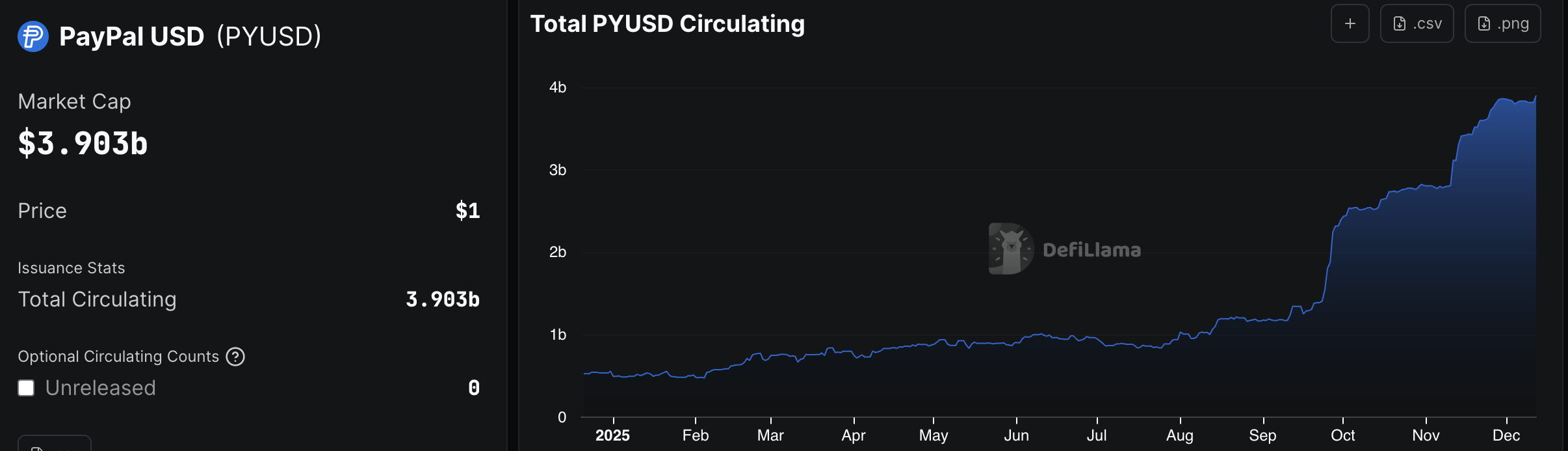

Against this backdrop, PYUSD has also seen significant expansion. Its market capitalization has grown from roughly $500 million in early January to a record high of about $3.9 billion in December.

PYUSD Total Value Locked. Source: DeFiLlama

PYUSD Total Value Locked. Source: DeFiLlama

Furthermore, data from DeFiLlama indicates that Ethereum currently hosts the largest share of PYUSD, with $2.79 billion in circulation, representing a 36.6% increase over the past month.

Solana follows with $1.046 billion, up 4.3% over the same period. Smaller amounts are distributed across Flow, Berachain, Plume, and Cardano, reflecting PayPal’s multi-chain strategy for the stablecoin.

The combined impact of YouTube’s PYUSD integration, rising market cap, and institutional adoption launches demonstrates how PYUSD is strengthening its position in the digital finance space. These trends suggest stablecoins are moving from niche crypto interest to essential financial tools supported by major brands and trusted institutions.