Fetch.ai Price Prediction: FET must hold above $1.70 for strength

- Fetch.ai price has dropped nearly 45% since late March as broader markets started bleeding.

- FET bulls must defend $1.70 if they want to keep the upward thrust alive, signaling strength on the AI coin.

- A break and close below $1.59 would mean a lower low, invalidating the bullish reversal thesis.

Fetch.ai (FET) is trading with a bearish bias. It comes as chatter about the proposed integration with the Ocean Protocol (OCEAN) and the SIngularityNET (AGIX) ecosystem remains fresh.

Also Read: Fetch.ai, Ocean, and SingularityNET merger a step closer after proposal approval

Fetch.ai price could breakout but there is a catch

Fetch.ai price is on a steady downtrend, which could be setting the tone for a breakout depending on how the bulls play their hand. For a breakout north, the bulls must defend the $1.70 support for inflection to facilitate an upward move.

A bounce above $1.70 could set the tone for the Fetch.ai price to break above the downtrend line, effectively flipping the 50% retracement into support above $1.98. In a highly bullish case, FET price could extend the gains to the $2.87 threshold, in a move that would constitute a climb of above 40% above current levels.

In a highly bullish case, the Fetch.ai price could extend a neck higher to the peak if the market range at $3.48, levels last seen on March 28.

FET/USDT 1-day chart

On-chain metrics to support bullish outlook for Fetch.ai price

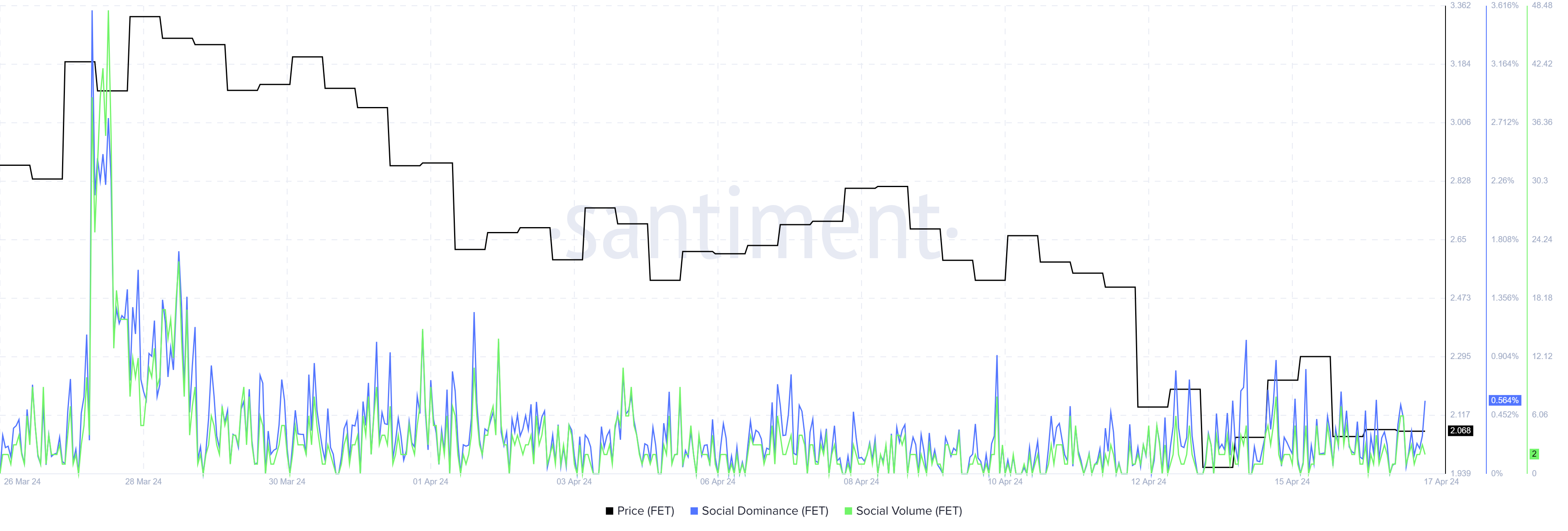

To support the bullish reversal thesis, Santiment data notes a spike in social volume and social dominance. Social volume refers to the level of online chatter surrounding a particular coin or token across various social media platforms, forums, and news outlets. An increase in social volume indicates a higher level of interest, discussion, and attention on the asset.

Social dominance, on the other hand, is a measure of how much attention or discussion a particular cryptocurrency receives compared to others in the market. A rise in social dominance suggests that a cryptocurrency is gaining popularity and capturing more attention relative to its competitors.

FET Social volume, Social dominance

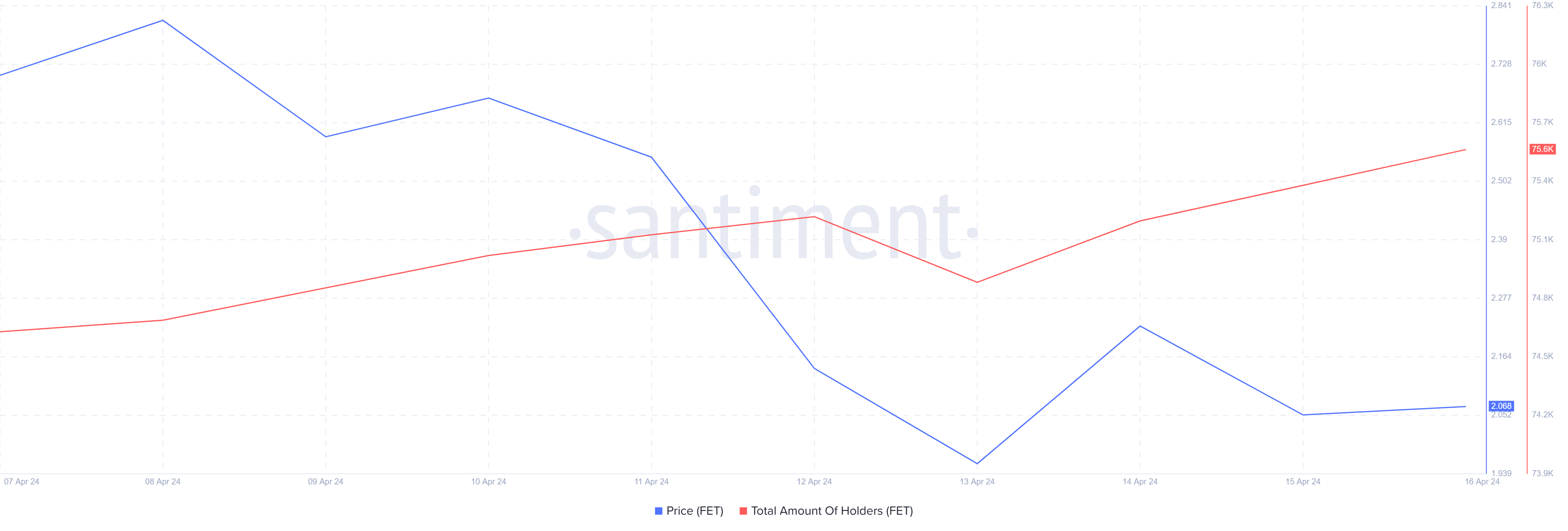

Other than the social metrics, the total amount of FET holders has also been increasing steadily since April 13. This reinforces the growing interest and adoption, likely driven by factors such as positive developments, increased visibility, partnerships, or market conditions.

FET holders

On the flip side, if the $1.70 support level breaks, the Fetch.ai price could extend the fall to $1.50, or lower to retest the $1.00 psychological level before a possible recovery. In a dire case, the AI crypto coin could roll all the way over to the bottom of the market range at $0.49, denoting an approximate fall of about 75% below current levels.