SEC vs. Ripple lawsuit likely enters final pretrial conference, XRP holders await settlement news

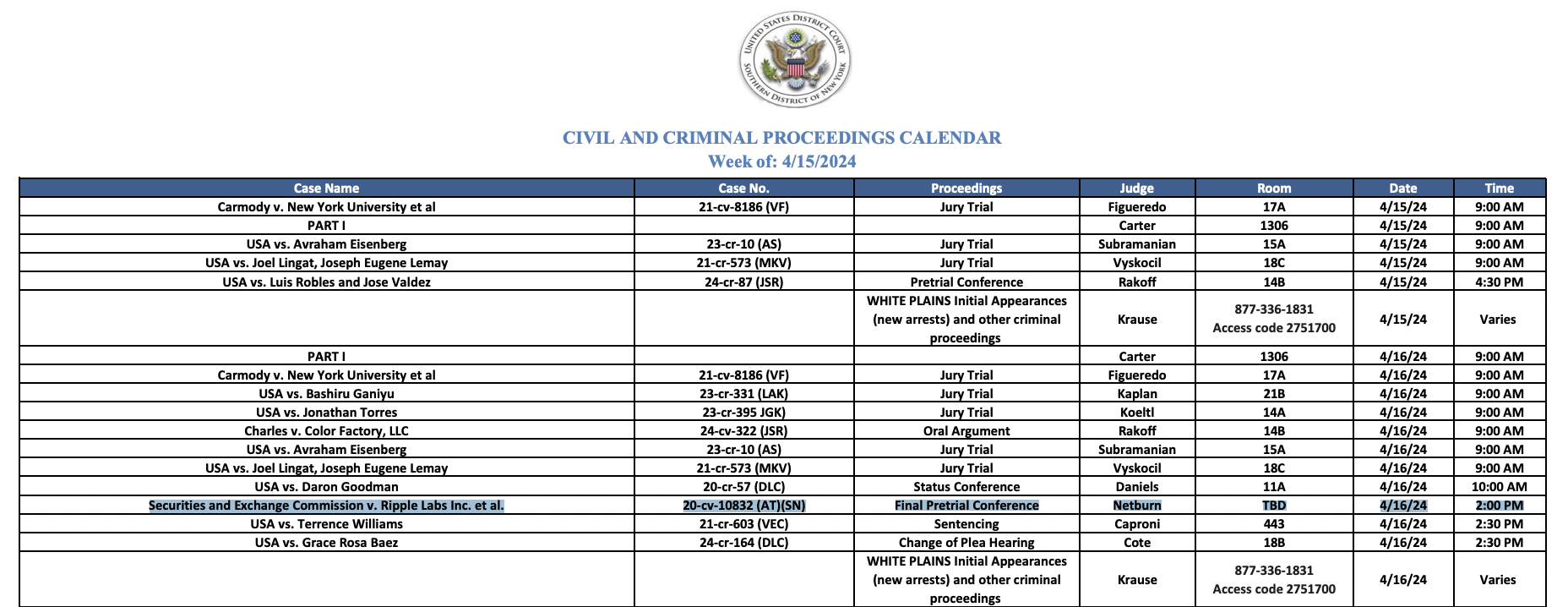

- SEC vs. Ripple lawsuit is likely to enter its Final Pretrial Conference on April 16, under Judge Sarah Netburn.

- XRP holders and proponents anticipate settlement talks between the two parties.

- XRP price is struggling to overcome resistance at $0.50, down to $0.48 on Tuesday.

Ripple (XRP) and Securities and Exchange Commission (SEC) are gearing up for the Final Pretrial Conference on April 16, at a New York court. The legal calendar shows the date and time, therefore the conference is planned and may proceed as scheduled.

XRP is struggling with resistance at $0.50 and the altcoin’s price is down to $0.48 on April 16.

Daily digest market movers: SEC vs. Ripple Final Pretrial Conference could influence XRP price

- SEC vs. Ripple lawsuit proceedings have acted as a catalyst for XRP price since 2020.

- The latest development is the Final Pretrial Conference, mentioned in the legal calendar of a New York court, at 2:00 PM on April 16.

- While XRP holders expect a settlement between the two parties, it is unlikely if the regulator decides to appeal the XRP Programmatic Sales ruling of Judge Analisa Torres.

Civil and criminal proceedings calendar

- On July 13, Judge Analisa Torres ruled that XRP is a non-security in its secondary market sales on exchanges. This programmatic sales ruling is likely to be appeal by the SEC.

- Ashley Prosper, XRP proponent and crypto influencer shared his insights on why a settlement between the two parties is likely, in a recent tweet on X.

#XRP #XRPCommunity

— Ashley PROSPER (@AshleyPROSPER1) April 12, 2024

Is the Ripple case over? Let me count the ways...

➡️2nd Circuit says no SEC disgorgement where no financial loss was suffered.

➡️SEC submits terrible remedies and judgment brief, failing to identify a single investor who suffered financial loss at the hands of… https://t.co/uP5MpCgsUk

- It is important to note that the Final Pretrial Conference may or may not lead to a settlement in the lawsuit.

Technical analysis: XRP struggles to recoup from drop below $0.50

XRP sustained above the $0.50 level for nearly six months. The altcoin flipped $0.50 support to resistance on Saturday, April 13. XRP could sweep liquidity below $0.4717, the 23.6% Fibonacci retracement level of the altcoin’s drop from April 9 top of $0.6431.

The Moving Average Convergence Divergence (MACD) indicator supports a thesis of further correction in the altcoin, since the momentum is negative.

XRP price could find support at the April 13 low of $0.4188 and weekly support level at $0.4117, if the altcoin continues to bleed.

XRP/USDT 1-day chart

A daily candlestick close above $0.50, a resistance level that is significant to XRP, could invalidate the bearish thesis. XRP price could surge to $0.5310, the 50% Fibonacci retracement level of the decline from April 9 local top at $0.6431.

The altcoin faces resistance at the psychologically important $0.60 level, in its path to the $0.6431 target.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.