Stacks plans for Nakamoto Upgrade, total smart contracts deployed surge

- Stacks Nakamoto Upgrade is likely to be deployed on April 16, close to the Bitcoin halving.

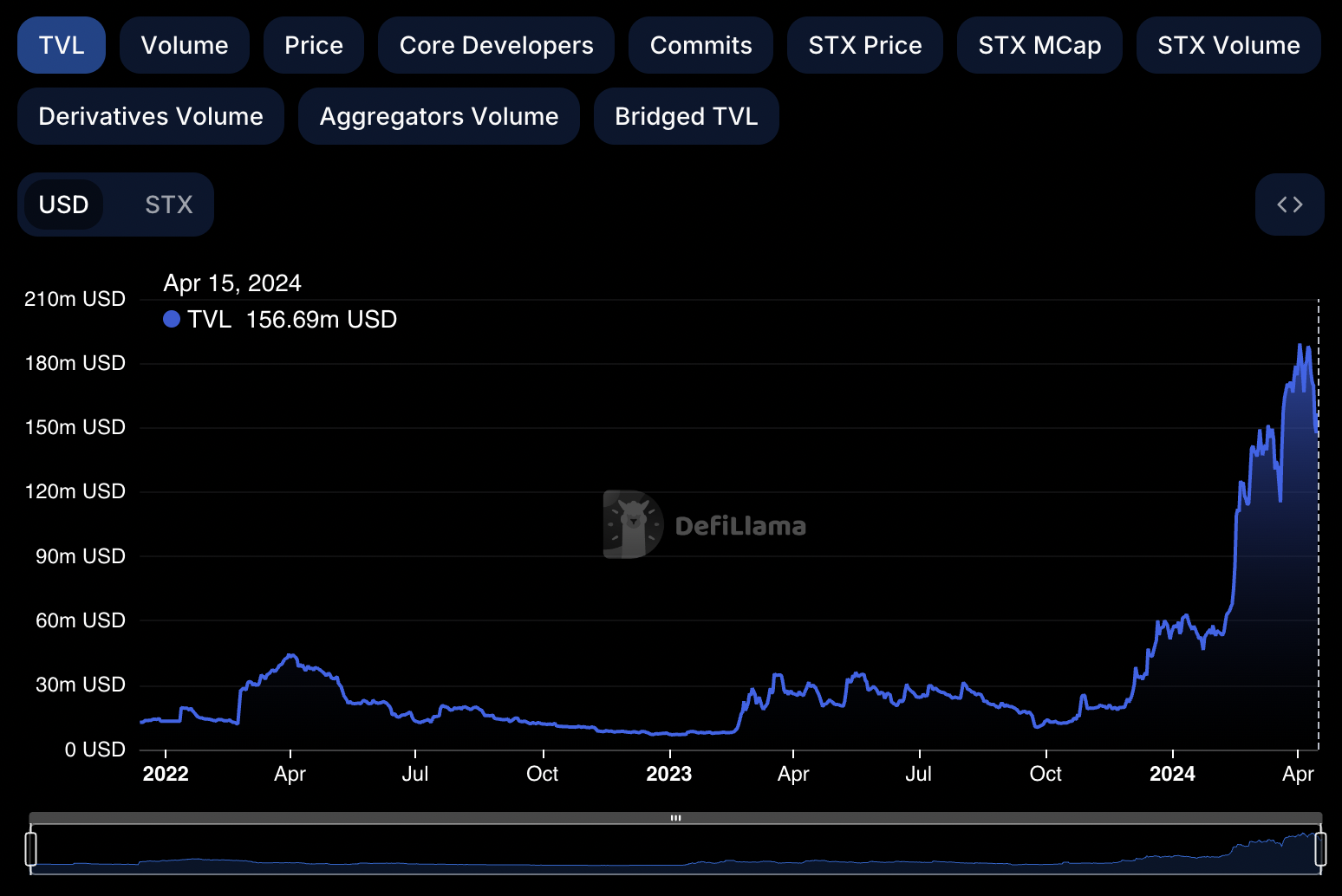

- The total value of assets locked on the Stacks blockchain has crossed $150 million as of April 15.

- STX price has climbed nearly 35% from Saturday’s low of $2.07.

Stacks (STX) operates as a Layer 1 blockchain network and is set to deploy its Nakamoto Upgrade tentatively on April 16, close to the Bitcoin halving estimate of April 20. With the upgrade, the protocol aims to transform itself into a Bitcoin Layer 2 chain.

STX has amassed a large volume in total value of crypto assets locked and the token’s price has rallied nearly 35% over the weekend.

Stacks prepares for Nakamoto Upgrade

Stacks is a Layer 1 blockchain that works with the Bitcoin blockchain and works on the Proof-of-Transfer (PoX) consensus mechanism. Stacks is awaiting its next key upgrade, the Nakamoto Upgrade, focused on making the blockchain faster and more secure. 99.98% of voters favored the upgrade to the Stacks blockchain.

In its official blog, Stacks explains that the upgrade will mean that the chain not only settles existing block transactions on Bitcoin but upgrades to 100% BTC reorg resistance. This will mean the STX blockchain becomes faster and has rapid block times. Currently, the block time is between 10 and 30 minutes.

The Stacks Foundation estimates that the Nakamoto Upgrade will go live on April 16. Faster transaction times and Bitcoin finality are likely to draw market participants to Stacks.

STX total value locked (TVL) has climbed to $156.69 million, according to data from DefiLlama. An increase in TVL signals the project’s increasing relevance among traders.

STX TVL as seen on DeFiLlama

STX price is up nearly 35% from Saturday’s low of $2.07. At the time of writing, STX price is $2.73.