Week Ahead: Crypto market volatility likely to come back as BTC halving looms

- Bitcoin's recent tumble seems to have spiked volatility as BTC remains rangebound.

- Ahead of Bitcoin's fourth halving, some altcoins are likely to yield unusually high returns.

- Major altcoins have like AXS & IMX have multi-million dollar token unlocks this week.

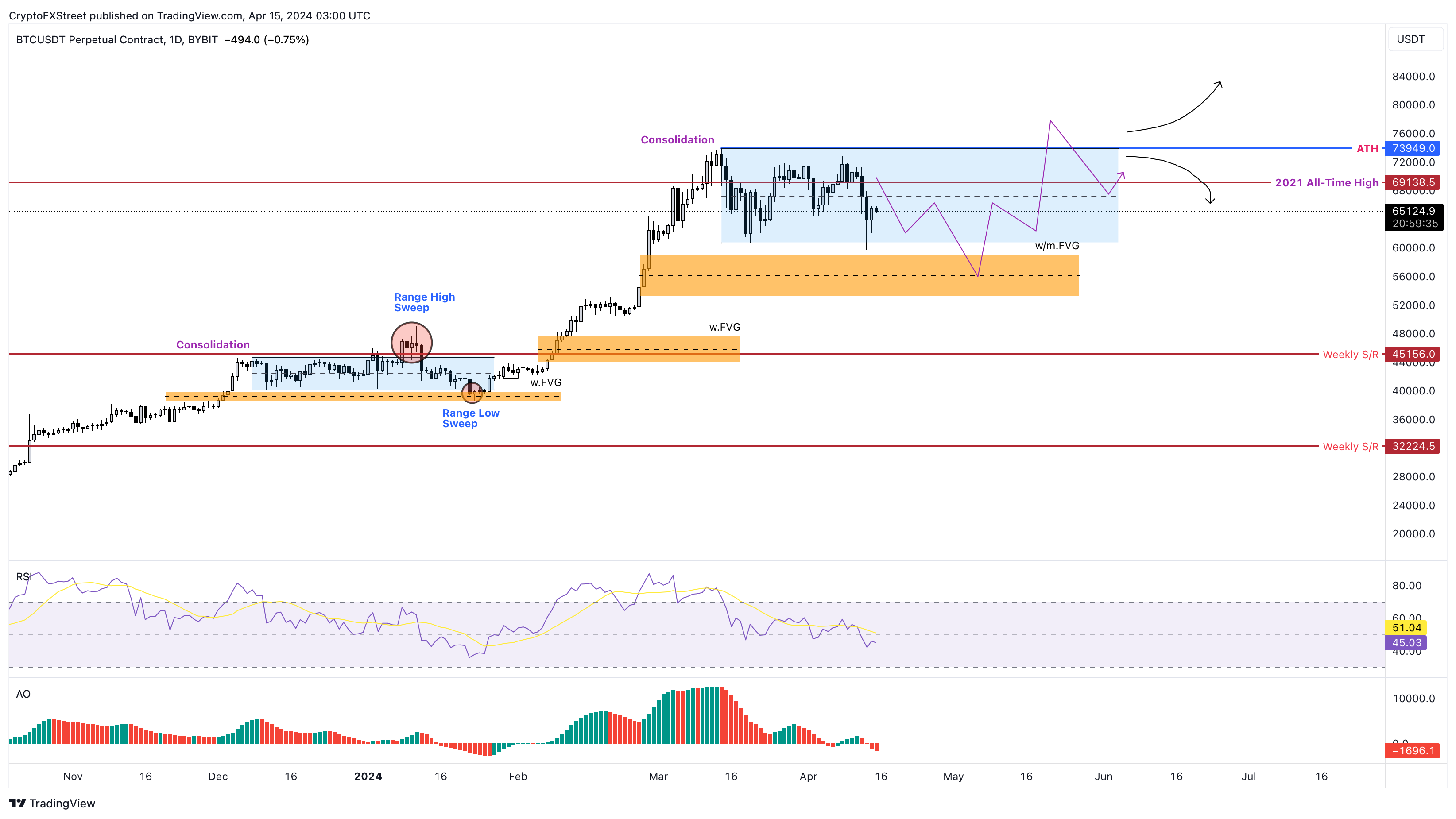

This week’s outlook is interesting since Bitcoin (BTC) has swept the range low on the daily time frame. This development, coupled with the upcoming halving event, suggests that a short-term correction play is in the works.

Going forward, investors need to monitor buy-the-dip opportunities closely since BTC tends to continue its bull run after halving.

Read more: Bitcoin halving: Altcoin rally looks likely, historical data shows

Bitcoin’s breakdown

Bitcoin (BTC) has breached the $70,000 level and crashed nearly 15% over the weekend. This move has swept the range low, as discussed in a previous article. But the down move failed to dip into the weekly imbalance, extending from $53,120 to $59,111.

With no major macroeconomic event to influence the directional bias, the sideways movement is likely to continue.

BTC/USDT 1-day chart

Also read: Bitcoin Weekly Forecast: BTC’s rangebound movement leaves traders confused

This week’s crypto events

Monday, April 15:

- Stacks (STX) – Nakamoto Upgrade

Tuesday, April 16:

- Arbitrum (ARB) – $107 million unlock

- Axie Infinity (AXS) – $78 million unlock

- Fetch.AI (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN) merger voting ends.

Thursday, April 18:

- Manta (MANTA) – $44 million unlock

Friday, April 19:

- ImmutableX (IMX) – $73 million unlock

- Coinbase vs. SEC lawsuit – Submit case management plan deadline

Saturday, April 20:

- Dogecoin (DOGE) day

- Bitcoin Halving (Approximate ETA)

Altcoins to watch

- Bitcoin halving: This event could benefit BTC-related altcoins like Bitcoin Cash (BCH), Bitcoin SV (BSV) and Stacks (STX).

- Ordinal Tokens: Originals or similar tokens launched on the Bitcoin blockchain will likely see a similar boom. Some of these lesser-known, highly risky and volatile tokens include Pups (PUPS), SatoshiVM (SAVM) and Orange (ORNG).

Top 3 Reads

- Bitcoin price tanks to $62K ascribed to geopolitical tension a week to BTC halving

- Ethereum price stagnates as EIP-3074 brings smart contract functionalities to wallets

- XRP price tests $0.60 support as AMM makes comeback on XRPLedger