Solana congestion troubles could end soon, testnet v1.18.11 release arrives

- Solana blockchain’s troubles could end soon with a release that brings congestion fixes to the chain.

- Solana focused devshop Anza came up with a fix for the Web3 infrastructure platform’s failed transactions.

- SOL price remains range bound below resistance at $192.

Solana network is plagued by failed transactions caused by congestion issues on the blockchain. The recent rise in popularity of Solana-based meme coins has resulted in a massive increase in user activity on the SOL blockchain, which has exacerbated the issue.

Solana congestion troubles could end with a technical release

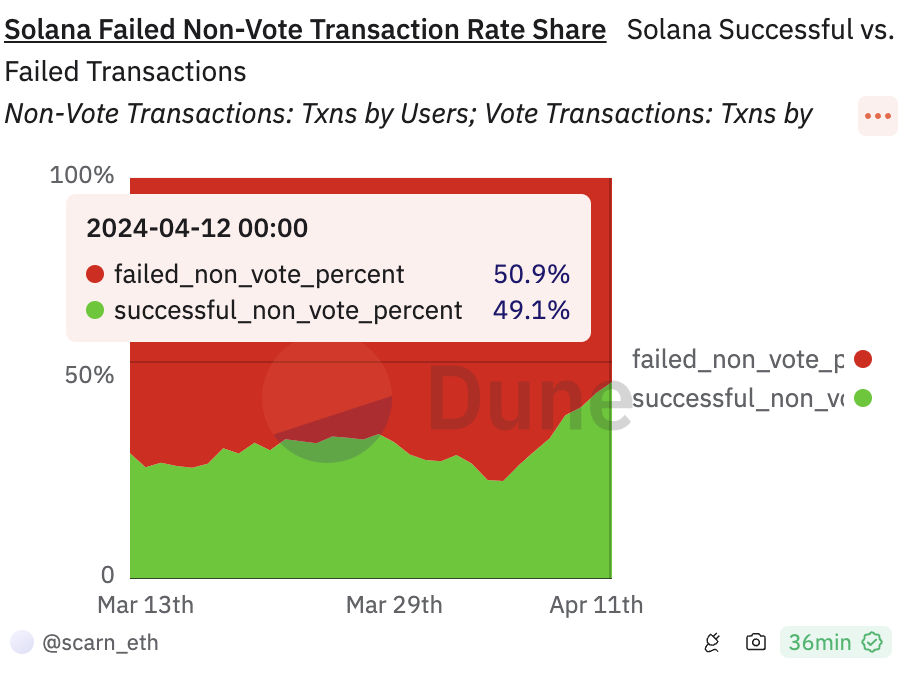

Over 50% of transactions on the Solana blockchain fail due to congestion issues on the chain. This is based on data from Dune Analytics. The failed transactions have invited criticism from market participants on social media platforms like X.

Solana failed transactions on Dune Analytics platform

Solana’s co-founders have previously assured SOL holders that technical teams and engineers are working on a fix to the issue. Anza, a Solana focused devshop, announced the release of a fix for the devnet and recommended it to the testnet as well. The solution addresses the congestion issues faced by the chain and is likely to tackle the problem, once deployed on the mainnet.

.@Solana testnet validators, the v1.18.11 release is now deployed to devnet, recommended for use on testnet. Please upgrade ASAP to help us start analyzing the effects of the proposed congestion fixes. https://t.co/8tcmtZ5tuQ

— Anza (@anza_xyz) April 12, 2024

SOL price remains range bound

SOL price has traded within a tight range between $162 and $192 since April 2. The range bound price action has seen SOL price move towards the lower boundary, closer to $162. SOL price is $168.32 on Friday, at the time of writing.

In the past week, SOL price wiped out over 6% of its value.