Is Bitcoin sucking liquidity from altcoins, or will alt season begin again?

- Bitcoin price continues its sideways movement around the $70,000 psychological level.

- Bitcoin dominance is increasing ahead of the fourth BTC halving.

- Capital rotation due to the interest rates being higher for longer could push capital to rotate back to BTC.

Bitcoin (BTC) price has remained rangebound since setting an all-time high of $73,949 on March 14. Not all altcoins are showing the same strength, which can be attributed to BTC’s lackluster performance, but this consolidation could lead to a massive volatile move soon that could be harmful for altcoins.

Also read: US Dollar strength could be one of the reasons why Bitcoin could crash more

Crypto’s connection with macroeconomic events

Bitcoin was highly sensitive to macroeconomic events in 2021 and 2022, but this connection waned at the start of 2023. The recent jobs data showed a surprise upside after the Fed decided to keep the interest rate unchanged in the previous month. The US Consumer Price Index (CPI) data for March showed that headline inflation came in at 3.5% year-over-year, which was higher than what economists expected. All these data points indicate that inflation is still high, albeit not as much as in 2023.

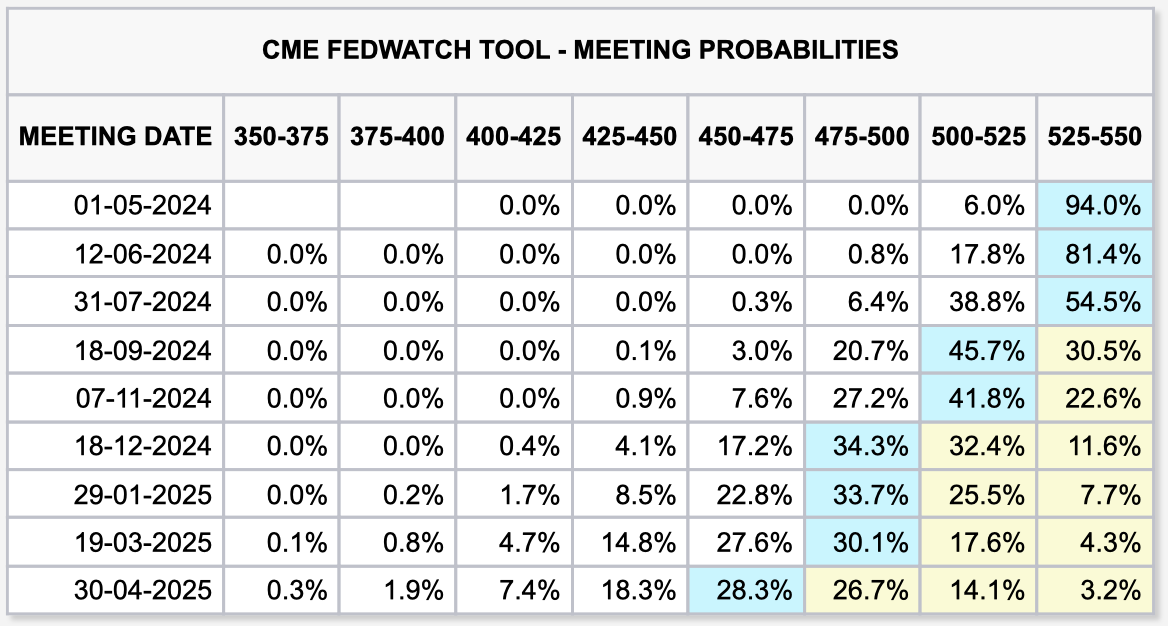

The CME FedWatch Tool shows that these events have affected the expected timing for rate cuts, which has moved from June to September. The probability of a 25 basis point rate cut in September currently stands at 45.7%.

CME FedWatch Tool

High interest rates likely to stop altcoin rally

In the past, interest rates remaining higher for longer has inadvertently caused capital to move from risky bets to non-risky, stable bets. In the case of the stock market, capital moves from small caps to high caps or blue chip stocks. This is because higher interest rates eventually cause overly exposed companies to go bankrupt.

If this analogy is applied to the crypto landscape, then capital should ideally move from risky altcoin bets to relatively stable cryptos like Bitcoin and Ethereum.

Additionally, there are two more considerations that need to be factored in – rising Bitcoin dominance and the fourth BTC halving.

The rising Bitcoin dominance confirms the interest rate assumption made above. Altcoins, in general, have been showing weakness in the past month either correcting double digits or moving sideways. Only a select few cryptocurrencies are performing exceptionally well. Currently, BTC dominance sits at 54.47%, producing equal highs and higher lows. In the coming days, investors can expect the dominance to rise to 56.62%.

BTC Dominance

Furthermore, as Bitcoin’s halving event nears, altcoins usually tend to lose strength and correct. So, to conclude, capital rotation is likely going to drain the liquidity from altcoins and send it to Bitcoin.

Read more: Bitcoin halving is a few days away. Here's what key crypto community members are saying