Top Crypto Gainers: Pi Network, Aerodrome Finance, Official Trump rally toward breakout levels

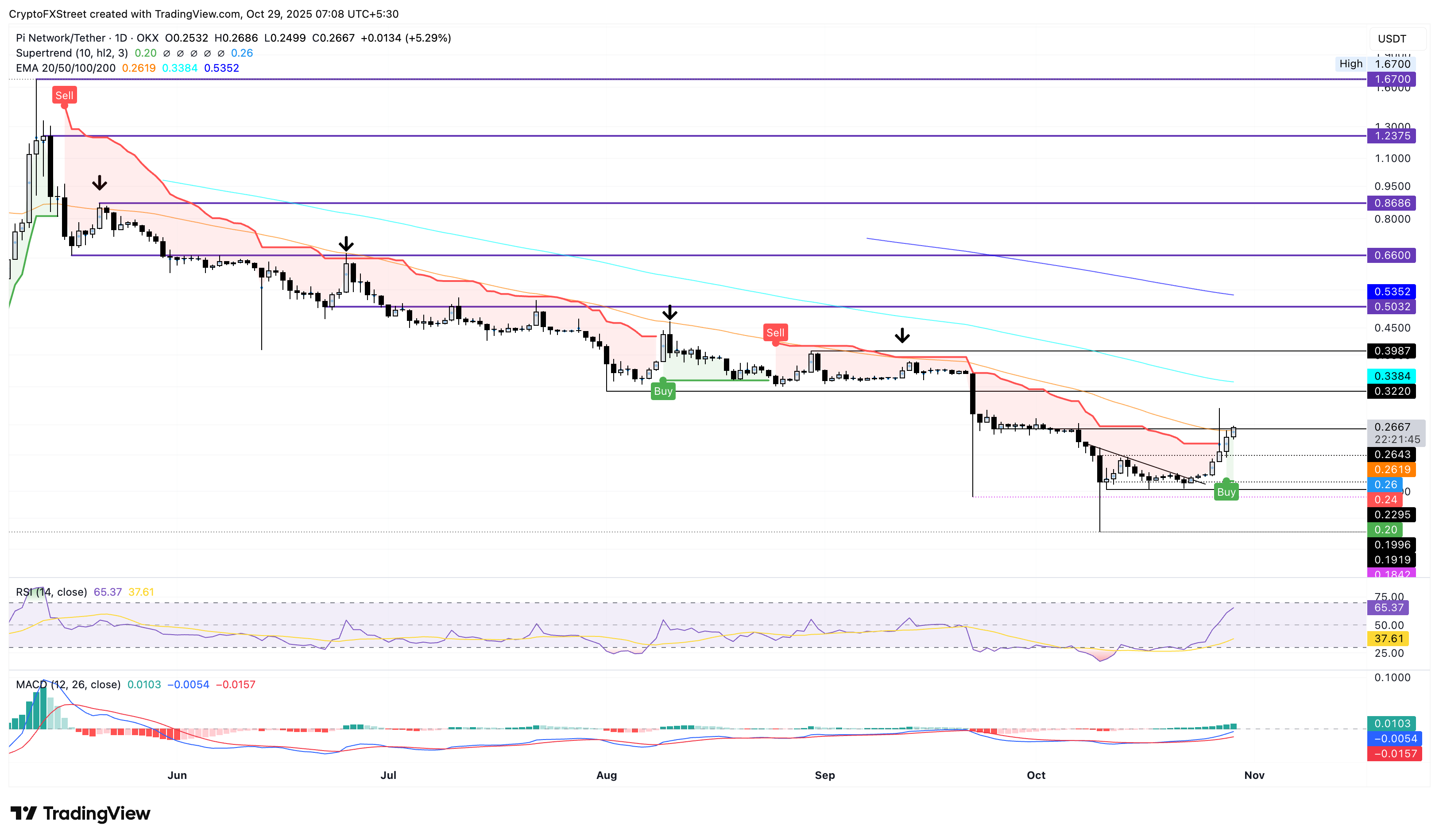

- Pi Network reclaims the $0.2500 level, with bulls aiming to surpass the 50-day EMA.

- Aerodrome Finance approaches the $1 psychological level as Animoca Brands acquired and staked AERO for veAERO tokens.

- The Official Trump token extends its uptrend above $7, aiming to break out of a falling channel.

Pi Network (PI), Aerodrome Finance (AERO), and Official Trump (TRUMP) extend their recovery run, outpacing the broader market in the last 24 hours. Pi Network aims to surpass its 50-day Exponential Moving Average (EMA), while Aerodrome Finance and the Official Trump token are close to outgrowing their falling channel patterns.

Technically, the altcoins are close to potential breakout rallies, which could further boost their gains.

Pi Network recovery gains traction

Pi Network edges higher by 5% at press time on Wednesday, extending the uptrend for the seventh consecutive day. The recovery run in the mobile mining cryptocurrency is fueled by the recent mainnet migration and the rumors of potential ISO20022 certification to compete with Ripple and other cross-border payment tokens.

A decisive close above the 50-day EMA at $0.2619, which has previously provided multiple bearish reversal points, would confirm a renewed uptrend. If this happens, a breakout rally could test the $0.3220 level, marked by the August 1 low, followed by the 100-day EMA at $0.3384 and the $0.4000 round figure.

The momentum indicators on the daily chart maintain a bullish bias, with the Relative Strength Index (RSI) at 65, extending an upward trend that signals rising buying pressure.

Corroborating with momentum indicators, the Supertrend indicator flashes a buy signal as PI renews its uptrend by crossing above its red line. Meanwhile, the Moving Average Convergence Divergence (MACD) diverges to the upside from its signal line, with green histograms rising above the zero line, indicating an increase in upward momentum.

PI/USDT daily price chart.

On the downside, the key support levels for PI stand at the $0.2500 round figure, followed by the $0.1919 base marked by the October 11 low.

Aerodrome Finance aims to extend the bull run above $1

Aerodrome Finance, a Decentralized Exchange (DEX) built on Coinbase’s Ethereum Layer 2 Base, secured backing from Animoca Brands on Tuesday. Animoca acquired AERO without disclosing the amount, but staked out all of it for veAERO.

At the time of writing, AERO is up by 1% on Wednesday in the Asian trading hours, extending the 8% gains from the previous day. The recovery run approaches the $1 psychological level and an overhead resistance trendline, which completes a falling channel pattern on the daily chart.

If AERO secures a close above the $1 mark, it would confirm the upside breakout of the falling channel pattern, potentially targeting the R1 Pivot Point at $1.2687.

The MACD and signal line rise towards the zero line after a crossover on Friday, indicating a surge in bullish momentum. Additionally, the RSI at 54 crosses above the midpoint line, reflecting further room for growth before reaching the overbought zone.

AERO/USDT daily price chart.

If AERO flips to the downside from the $1 mark, the S1 and S2 Pivot Points at $0.8587 and $0.7043, respectively, could provide support.

Official Trump token eyes a bullish breakout rally

The Official Trump token price is up by nearly 3% at the time of writing on Wednesday, preparing its seventh consecutive positive candle on the daily chart. The official meme coin of US President Donald Trump inches closer to surpassing a local resistance trendline, formed by connecting the May 22 and September 13 peaks, to confirm a falling channel breakout rally.

If the TRUMP token closes above the trendline at $7.70, the breakout rally could test the R1 Pivot Point at $8.973.

The MACD indicator shows a steady rise in trend momentum, with upward-sloping average lines and successively higher green histogram bars. At the same time, the RSI at 61 keeps a stable uptrend, indicating steady buying pressure.

TRUMP/USDT daily price chart.

If the TRUMP token reverses from the overhead trendline, it could test the S1 Pivot Point at $6.323.