Bitcoin's historic leverage flush could set the tone for structural recovery

- Bitwise CIO Matt Hougan states that Bitcoin's historic liquidation event last week did not affect its current bullish structure.

- The heavy liquidations could set the stage for a more stable market structure as prices look to recover.

- Bitcoin risks a deeper pullback if prices fail to push above $117,100.

Bitcoin (BTC) trades around $110,500 on Wednesday, down 2%, amid insights that recent record liquidations signal a market reset without affecting fundamentals. Hence, paving the way for a potential structural recovery ahead.

Bitcoin could be on road to recovery from weekend pullback and historic liquidation

Bitcoin's historic liquidation over the weekend does not affect its bullish outlook, Bitwise Chief Investment Officer (CIO) Matt Hougan stated in a note on Tuesday.

The decline, which saw the top crypto dive from all-time high territory before stabilizing near $110,000, may not hold "any lasting consequences," Hougan noted, citing that there was no change to BTC's fundamental outlook.

"I expect the market will catch its breath and renew its attention on crypto's fundamentals. When that happens, I think the bull market will continue apace," Hougan wrote.

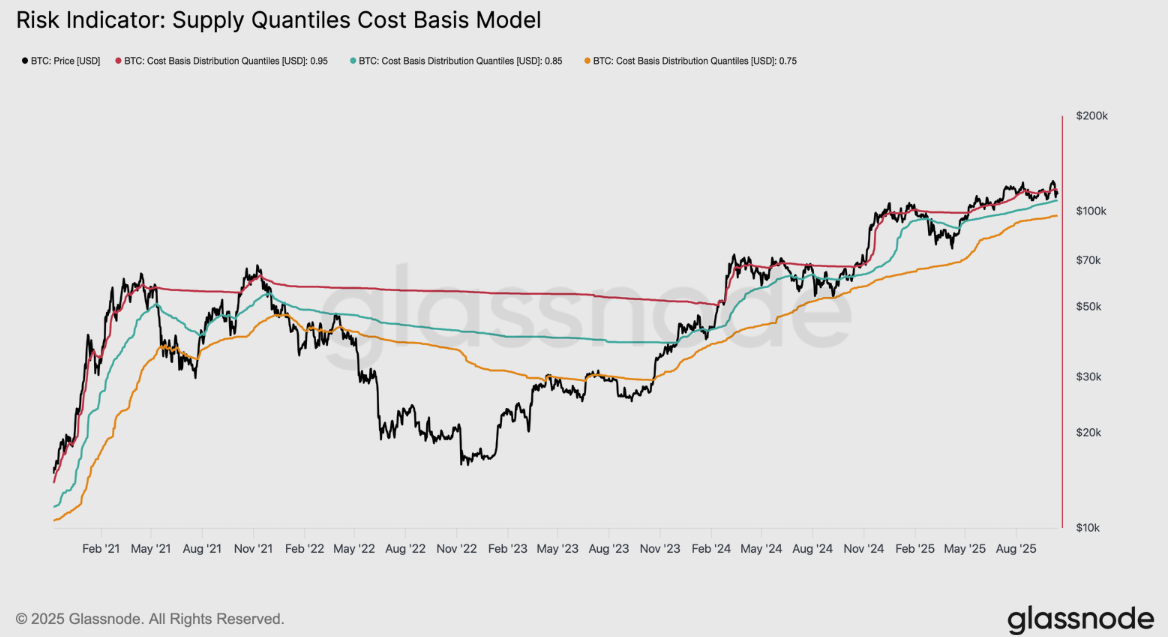

Hougan's prediction comes as Bitcoin's price remains within the 0.85-0.95 ($108,400 to $117,100) cost basis quantile range. The top crypto risks a deeper pullback if prices fail to break back above $117,100, according to Glassnode analysts in a Wednesday report.

"Historically, when price fails to hold this zone, it has often preceded prolonged mid- to long-term corrections, making a sustained drop below $108K a critical warning signal of structural weakness," the analysts wrote.

BTC Risk Indicator: Supply Quantiles Cost Basis Model. Source: Glassnode

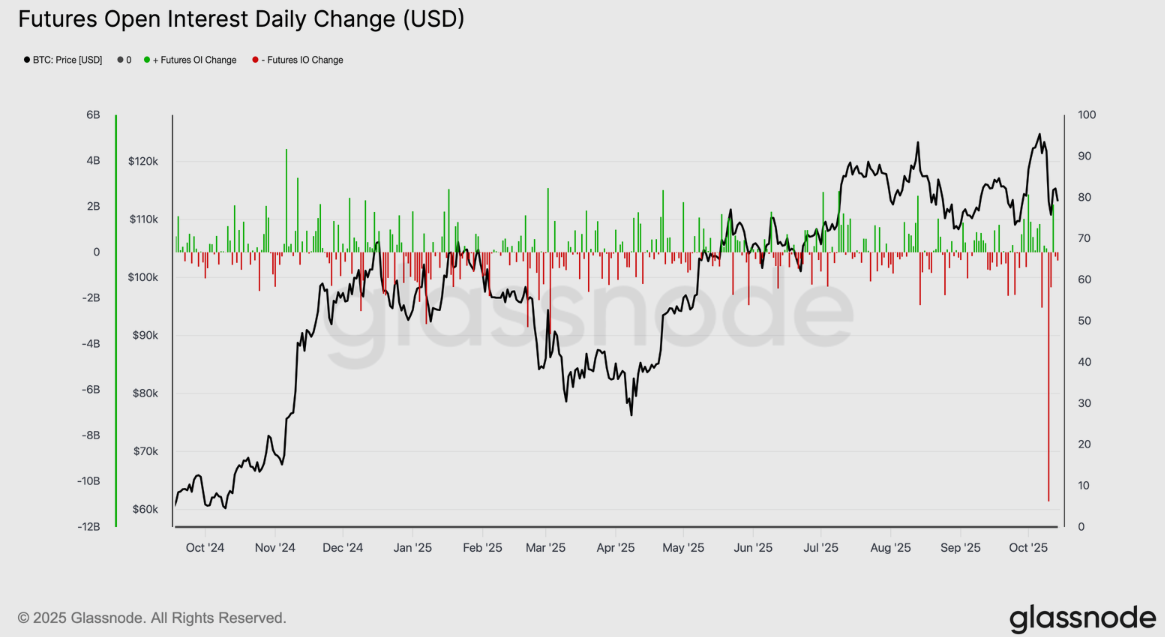

Meanwhile, spot trading activity climbed sharply during the recent shake-up, reaching its highest levels so far in 2025. On the other hand, Bitcoin futures open interest saw one of its largest single-day drops on record, wiping out more than $10 billion in leveraged positions.

Glassnode stated that, although volatility spiked, the latest pullback appeared to stem from targeted position unwinding rather than a broader sell-off. They described the decline as a "derivatives market reset," similar to major unwinds seen in May 2021 and after the FTX collapse in November 2022. Although severe, such episodes often flush out excess risk and "lay the groundwork for a more stable market structure ahead," the analysts noted.

BTC Futures Open Interest Daily Change. Source: Glassnode

Additionally, options data revealed a sharp rise in defensive positioning days before the market's downturn. Glassnode highlighted that the put/call volume ratio, which measures the balance between bearish and bullish option bets, surged above 1.0 and closed around 1.4 as BTC hovered near $121,700.

"While not always predictive of downside, such abrupt spikes often signal structural stress or concentrated hedging, suggesting traders were actively positioning for risk even before the broader liquidation cascade began," wrote Glassnode.

With the market yet to fully recover, the analysts noted that renewed inflows into spot Bitcoin exchange-traded funds (ETFs) and steady on-chain accumulation will be vital to restoring confidence and confirming a sustained recovery.