Ripple Forecast: XRP nears $3.00 as VivoPower raises $19 million to scale digital asset treasury

- XRP approaches $3.00, increasing alongside the broader crypto market.

- VivoPower has raised $19 million in equity, offered at $6.05 per share, to advance its digital assets treasury strategy.

- VivoPower has operated a dedicated XRP treasury since May.

Ripple (XRP) rises in tandem with the larger cryptocurrency market on Thursday, as investors position themselves in anticipation of a 25-basis-point interest rate cut by the United States (US) Federal Reserve (Fed) in October.

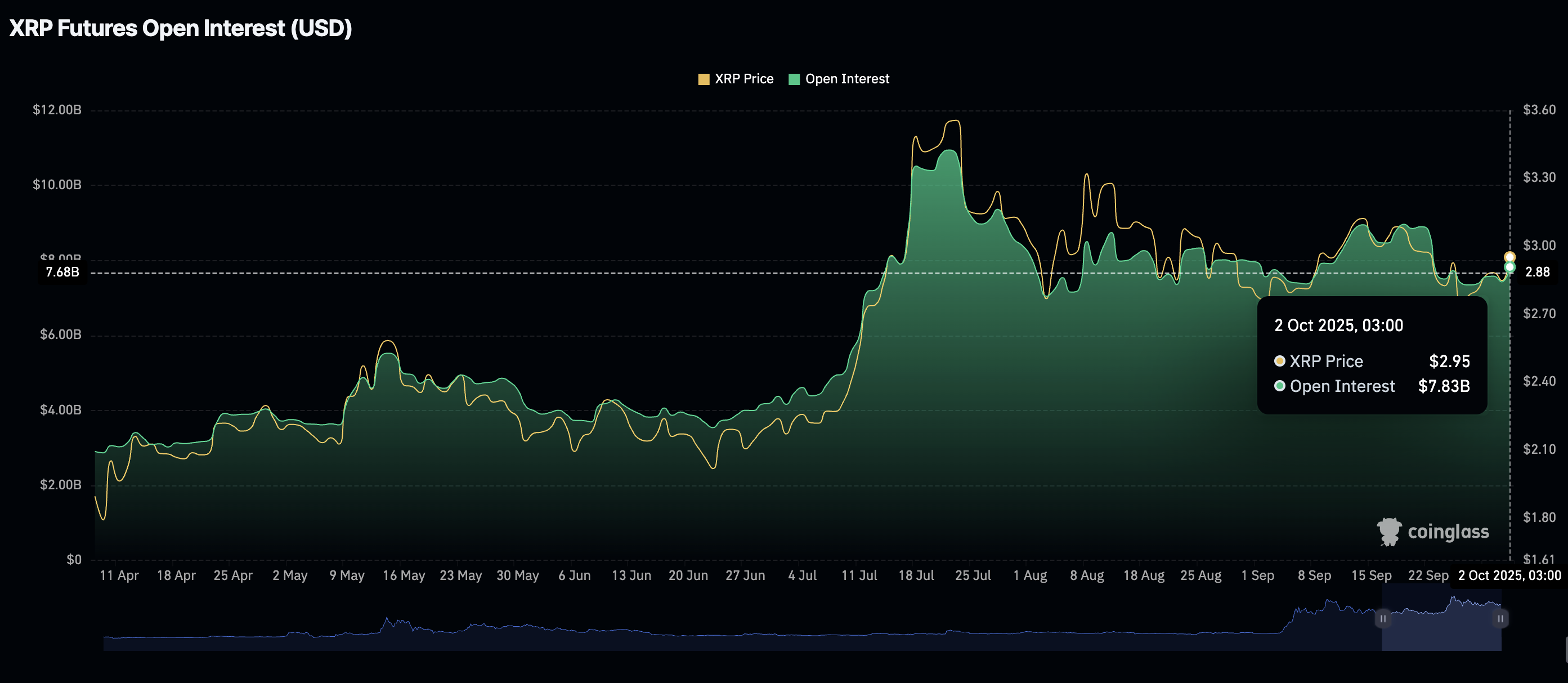

Meanwhile, retail demand for XRP derivatives is also on the rise, with the futures Open Interest (OI) averaging at $7.83 billion, from a monthly low of $7.35 billion on Saturday, according to CoinGlass.

OI represents the notional value of outstanding futures contracts; hence, a persistent increase means demand for futures is gaining traction as traders pile into long positions. Higher OI also implies increased engagement and conviction in XRP’s ability to sustain the uptrend in the short term.

XRP Futures Open Interest | Source: CoinGlass

VivoPower announces $19 million equity raise for digital reserve strategy

VivoPower, the company that debuted its first digital asset treasury strategy in May, valued at $121 million, has announced the completion of an additional $19 million equity raise.

According to the press release on Thursday, the equity raise valued shares at $6.05. The proceeds of the equity raised will be channelled into advancing ViVoPower’s XRP reserve strategy, as well as retiring its debt.

In addition to the digital treasury, ViVoPower emphasized its commitment to contributing to the utility and growth of the XRP Ledger (XRPL) through Decentralized Finance (DeFi) initiatives and blockchain-as-a-service applications (BaaS).

“The Company’s new direction centers on the acquisition, management, and long-term holding of XRP digital assets as part of a diversified digital treasury strategy,” VivoPower stated in the release.

Technical outlook: XRP bulls eye breakout above $3.00

XRP holds above the 50-day Exponential Moving Average (EMA), currently at $2.92. This upside represents marginal intraday gains of slightly more than 1% on Thursday.

Technical indicators, including the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator, support XRP’s bullish outlook, which could drive the price above $3.00 if risk-on sentiment persists.

The RSI highlights a notable increase to 54, indicating that selling pressure is easing, while the MACD indicator maintains a buy signal triggered on Wednesday, encouraging investors to seek exposure.

XRP/USDT daily chart

Since XRP has been in a general downtrend since mid-July, when it reached an all-time high of $3.66, a break above the descending trendline on the daily chart could mark a bullish turning point.

Still, traders should remain optimistically bullish, as the uptrend could stall due to the previous supply around $3.18. If investors book early profits, contributing to selling pressure, attention could shift to the 50-day EMA at $2.98 and the 100-day EMA at $2.84.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.