BNB’s Breakout Beats Profit-Taking Risks as Price Eyes Four Digits

BNB is now within striking distance of four digits, trading near $958 after a 14% gain over the past month. Unlike other major coins weighed down by profit-taking, BNB has shown resilience. Long-term holders are adding to their stacks, exchange balances are falling, and the BNB price has broken out of a bullish pattern.

Together, these signals show conviction, even as profit-taking risks remain high.

Profit-Taking Risk Is High, but Exchange Supply Is Falling

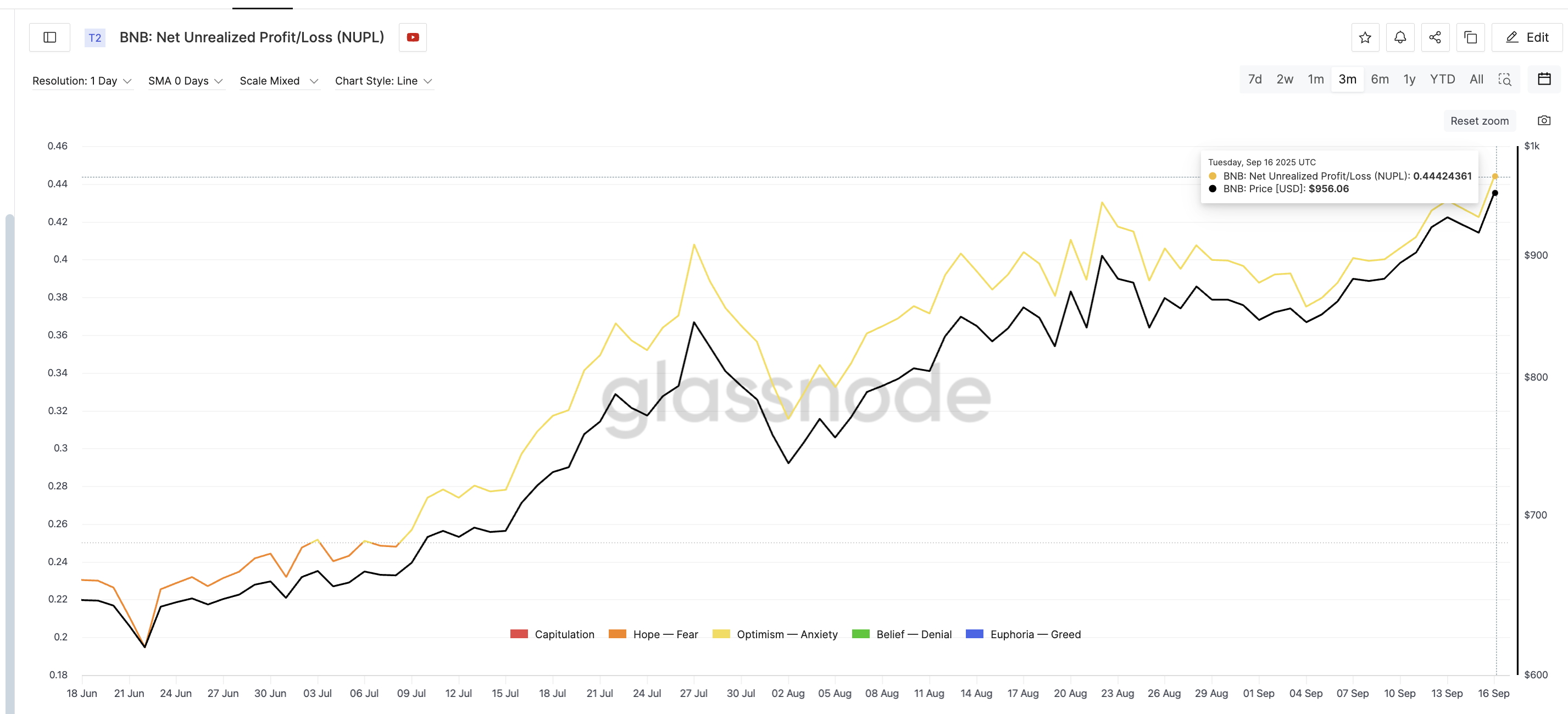

One way to measure selling risk is Net Unrealized Profit/Loss (NUPL), which tracks the percentage of the supply that is in profit. A higher score indicates that investors are sitting on larger gains and may be tempted to sell.

For BNB, NUPL now reads 0.44, its highest level in three months. With BNB up 75% over the past year and nearly 50% in the past three months, profit-taking pressure is a real concern.

BNB NUPL At A 3-Month High: Glassnode

BNB NUPL At A 3-Month High: Glassnode

Yet supply on exchanges tells a different story. Exchange net position change — which shows how much BNB sits on trading platforms — has fallen by almost 50% in just four days, from 4.35 million BNB on September 12 to 2.79 million on September 16.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BNB Buyers Are Slowly Coming Back: Glassnode

BNB Buyers Are Slowly Coming Back: Glassnode

Typically, rising profits are accompanied by increased deposits on exchanges. Here, balances are shrinking, showing conviction even in profit-heavy conditions.

It is worth noting that exchange flows are still positive (lingering sell pressure), but the downward curve while the price peaks does invoke confidence in the BNB price structure. More so when, in the next section, we discover which groups are accumulating.

Profitable Cohorts Are Accumulating, Not Selling

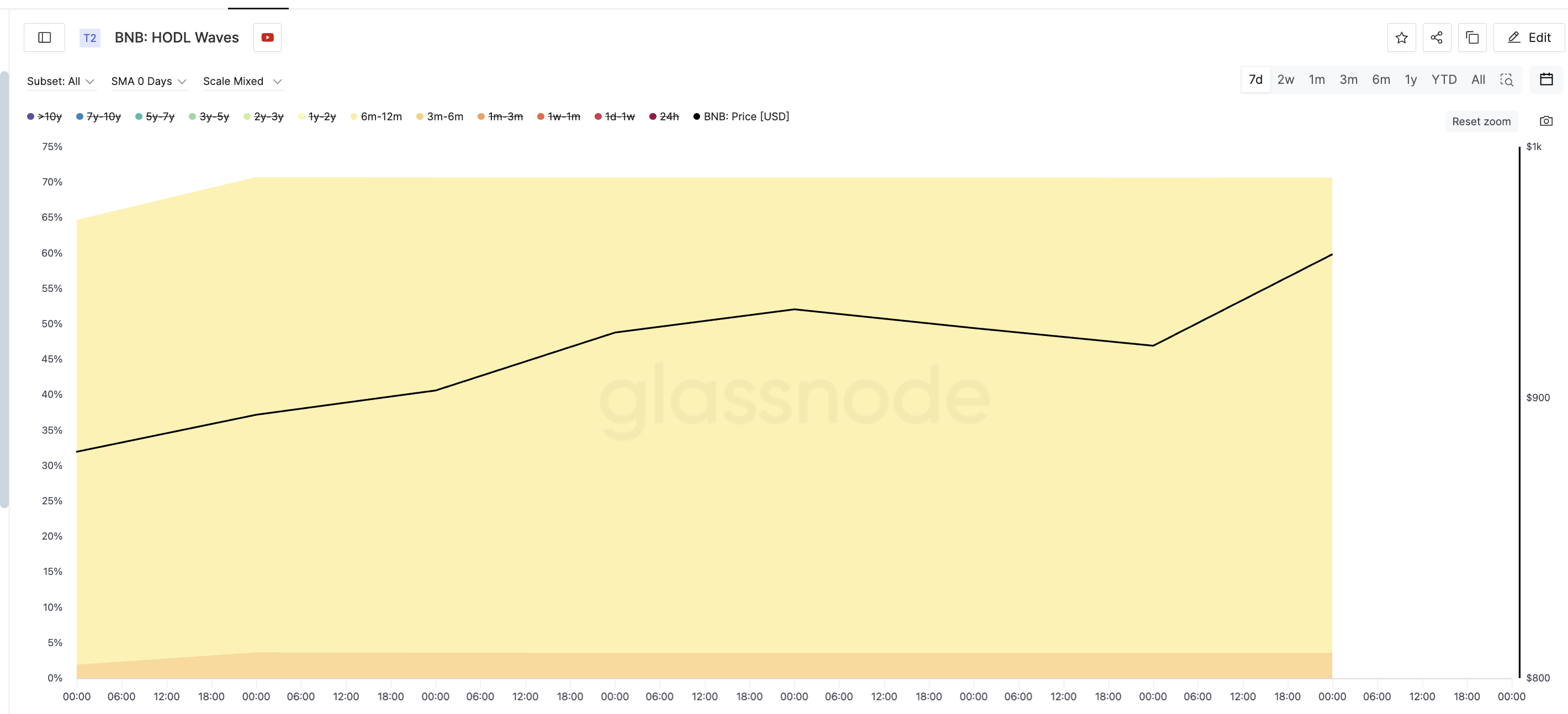

HODL waves track how long coins have been held, helping us see which groups are moving supply. The standout cohorts are 6–12 month holders and 3–6 month holders. Both groups are typically most likely to sell since they are sitting on strong recent gains. Instead, they are accumulating.

BNB HODLers In Action: Glassnode

BNB HODLers In Action: Glassnode

From September 9 to September 16, the 6–12-month group grew from 62.8% of supply to 67.1%. The 3–6 month group nearly doubled from 1.9% to 3.6%. These cohorts alone account for the bulk of new holding growth.

This means traders who bought when BNB was much cheaper are not cashing out. Instead, they are tightening supply as the BNB price rises.

BNB Price Chart Points to Higher, 4-Digit Targets

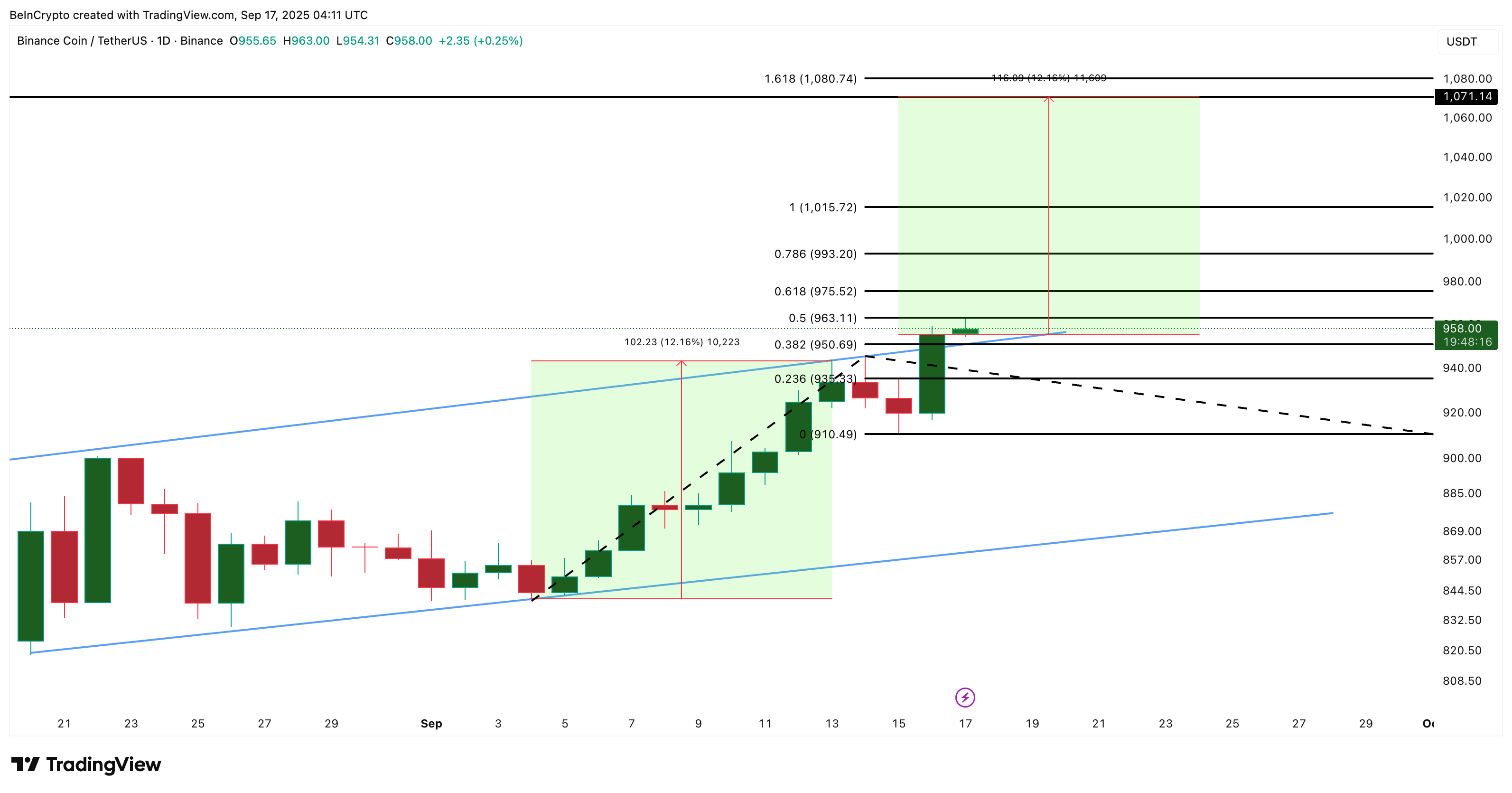

On the daily chart, the BNB price has broken out of an ascending channel, a bullish continuation pattern. Yesterday’s close above the upper trendline confirmed the breakout. Fibonacci extensions highlight resistance at $975 and $1,015, while the next upside target sits around $1,071–$1,080. That zone is the immediate four-digit goal.

BNB Price Analysis: TradingView

BNB Price Analysis: TradingView

The lower end of the target at $1,071 comes from measuring the widest part of the ascending channel — from its lowest swing inside the channel to its highest point — and projecting that distance upward from the breakout. Key support levels, in case the BNB price corrects, sit at $950 and $935.

Still, there’s a clear invalidation. If BNB closes below $910, the breakout structure weakens and deeper pullbacks open. Until then, both on-chain conviction and chart structure support more upside.