Jan Van Eck appeals for Agora in Hyperliquid's USDH stablecoin race

- Jan Van Eck appeals for Agora in the competitive fight for Hyperliquid’s USDH stablecoin issuance.

- Hyperliquid validators will vote on the issuer of the USDH stablecoin on Sunday.

- The race includes names such as Paxos, Frax, Agora, and Sky.

Hyperliquid (HYPE), a decentralized exchange (DEX), has started a race for its USDH stablecoin issuance among teams from Paxos, Frax, Agora, and Sky.

Jan Van Eck, CEO of global investment management firm Van Eck, is pushing for Agora by praising the Hyperliquid platform and paving the way for potential contributions in the future.

Hyperliquid Foundation announces USDH stablecoin

Hyperliquid is generating high trading volumes underpinned by its speed and transparency. However, the cryptocurrencies available on this DEX are paired with Circle’s USDC for trading, making it the largest stablecoin on the network.

To provide an alternative with reduced user friction, lower taker fees, decreased maker rebates, and increased liquidity, Hyperliquid Foundation has announced the USDH stablecoin, previously reported by FXStreet.

Various teams are pursuing a "Hyperliquid-first," "Hyperliquid-aligned," and USD-compliant stablecoin. The proposal deadline is on Wednesday at 10:00 GMT, and the validators selected before Thursday will vote on the issuers on Sunday.

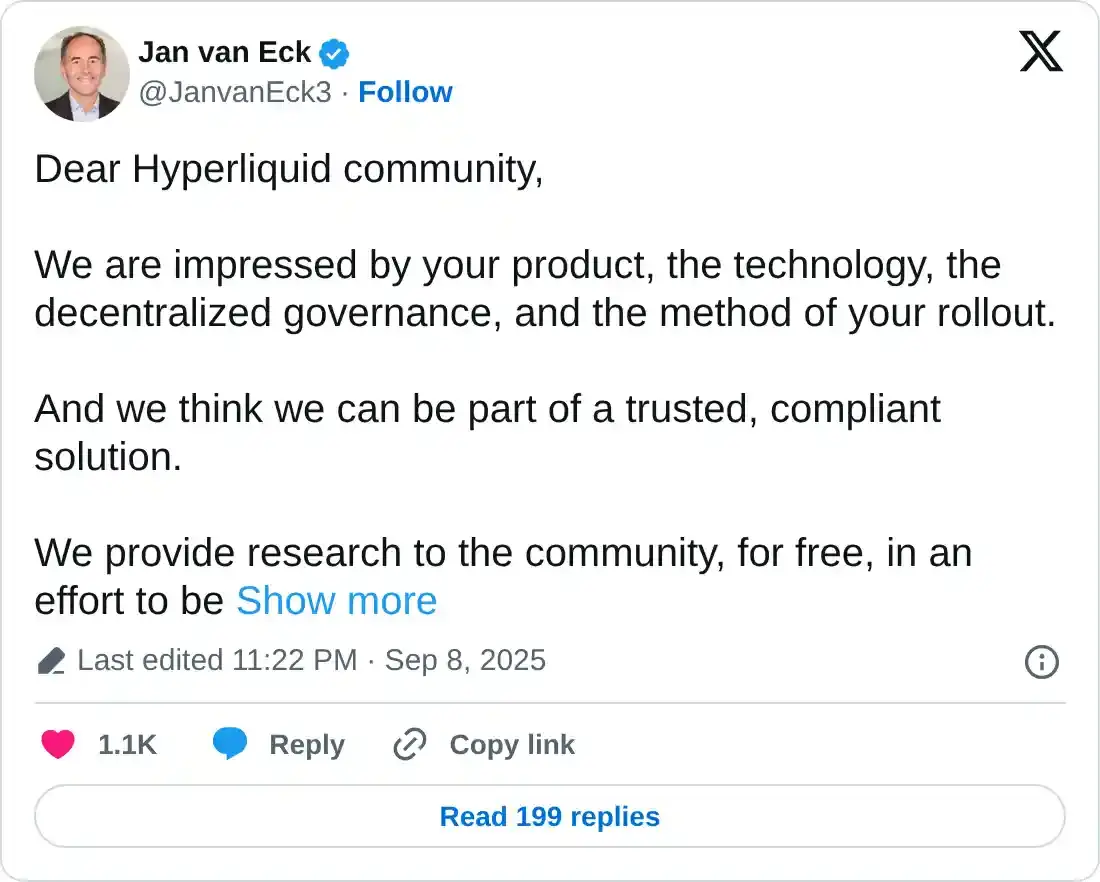

Van Eck attempts to woo the Hyperliquid community

Jan Van Eck appealed to the Hyperliquid community in an X post on Tuesday, praising the platform, technology, decentralized governance model, and rollout method as an attempt to secure the issuance of the USDH stablecoin with the Agora proposal. Van Eck positions itself as a "trusted, compliant solution" by highlighting the free research provided to the community.

Apart from the pros and cons of the deal, the CEO also shared that he’s in contact with HyperEVM builders and will continue to look for future opportunities.

Ending the post on a strong note, Jan Van Eck said:

"We don’t like being gang-tackled. And you wouldn’t want us as a partner if we were pushed around easily."

Agora has proposed that the issuance of USDH will follow US regulations, with an initial $10 million liquidity. 100% of net revenue from the USDH reserve, which is the revenue left after the custodian fees (estimated at three basis points), will go towards HYPE buyback and community funds.

Additionally, coalitions with Rain for global cards and LayerZero for cross-chain interoperability will help USDH expand its reach.

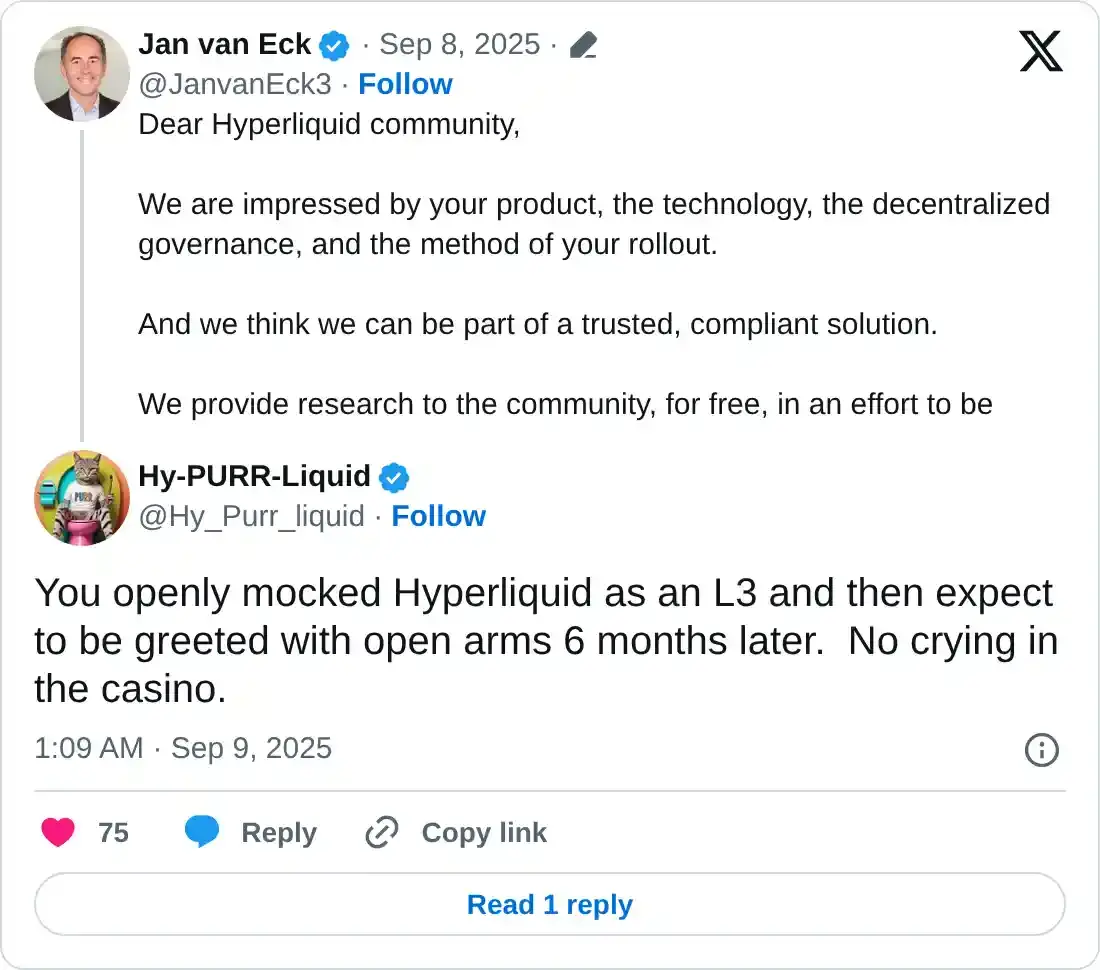

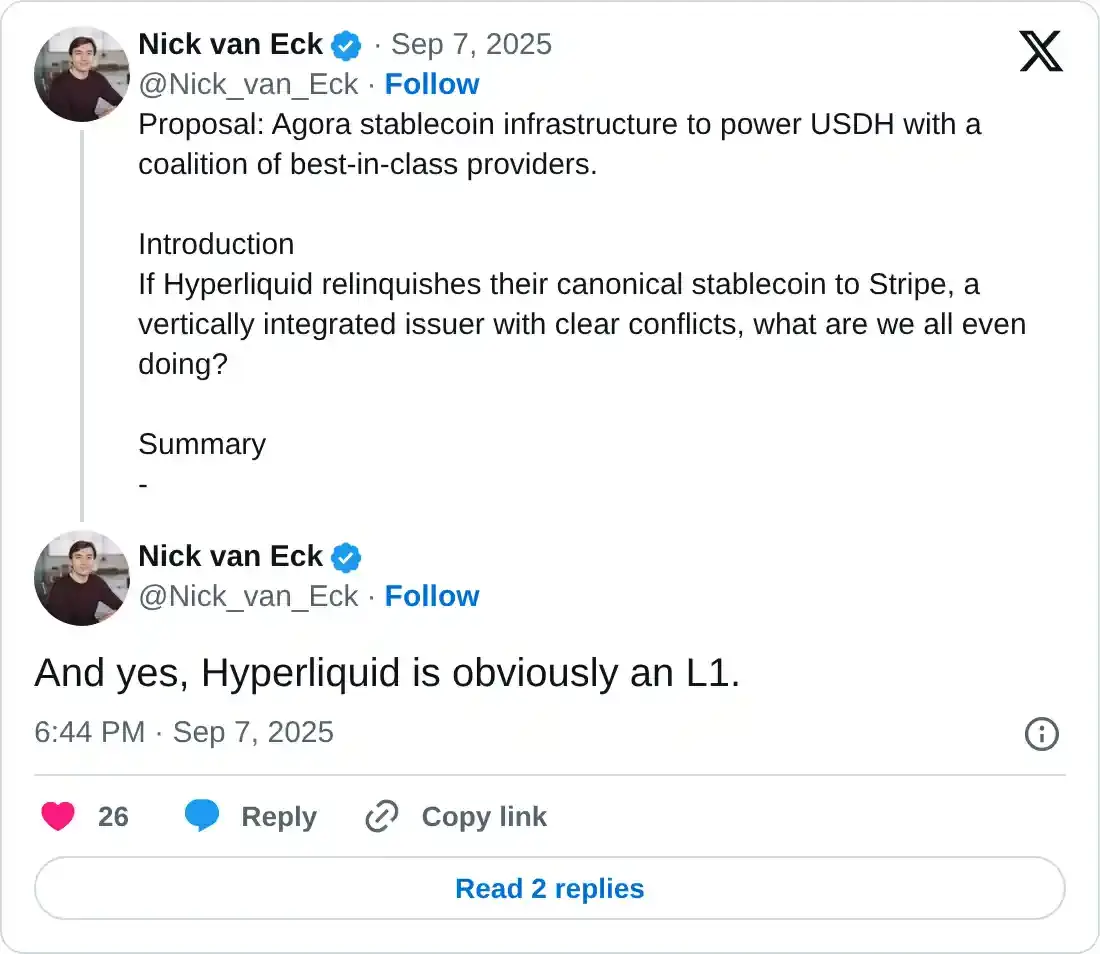

However, the community is yet to warm up to Van Eck as a member, named "Hy_Purr_liquid," highlighted the tag of layer3 applied to Hyperliquid in VanEck's crypto market report of December.

To clarify on this comment, Nick Van Eck, CEO of Agora, added "And yes, Hyperliquid is obviously an L1" to the proposal.

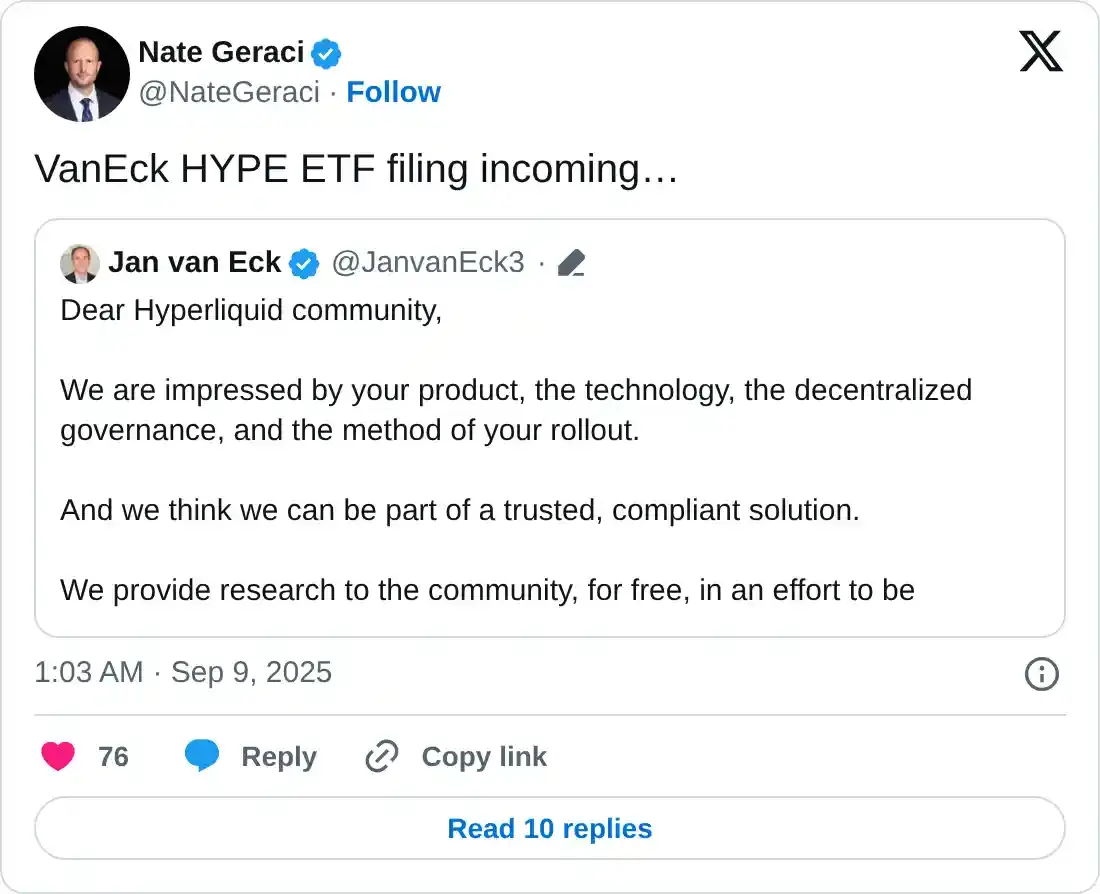

Amid the proposal, Nate Geraci, Co-founder of the ETF Institute, anticipates a potential HYPE Exchange Traded Fund (ETF) from VanEck.

More players to the race

Paxos, Frax, and Sky (formerly MakerDAO) are other notable players making waves in the race to issue the USDH stablecoin. Paxos has offered that 95% of USDH reserve earnings will be used to buy back HYPE and a zero-fee USDC migration.

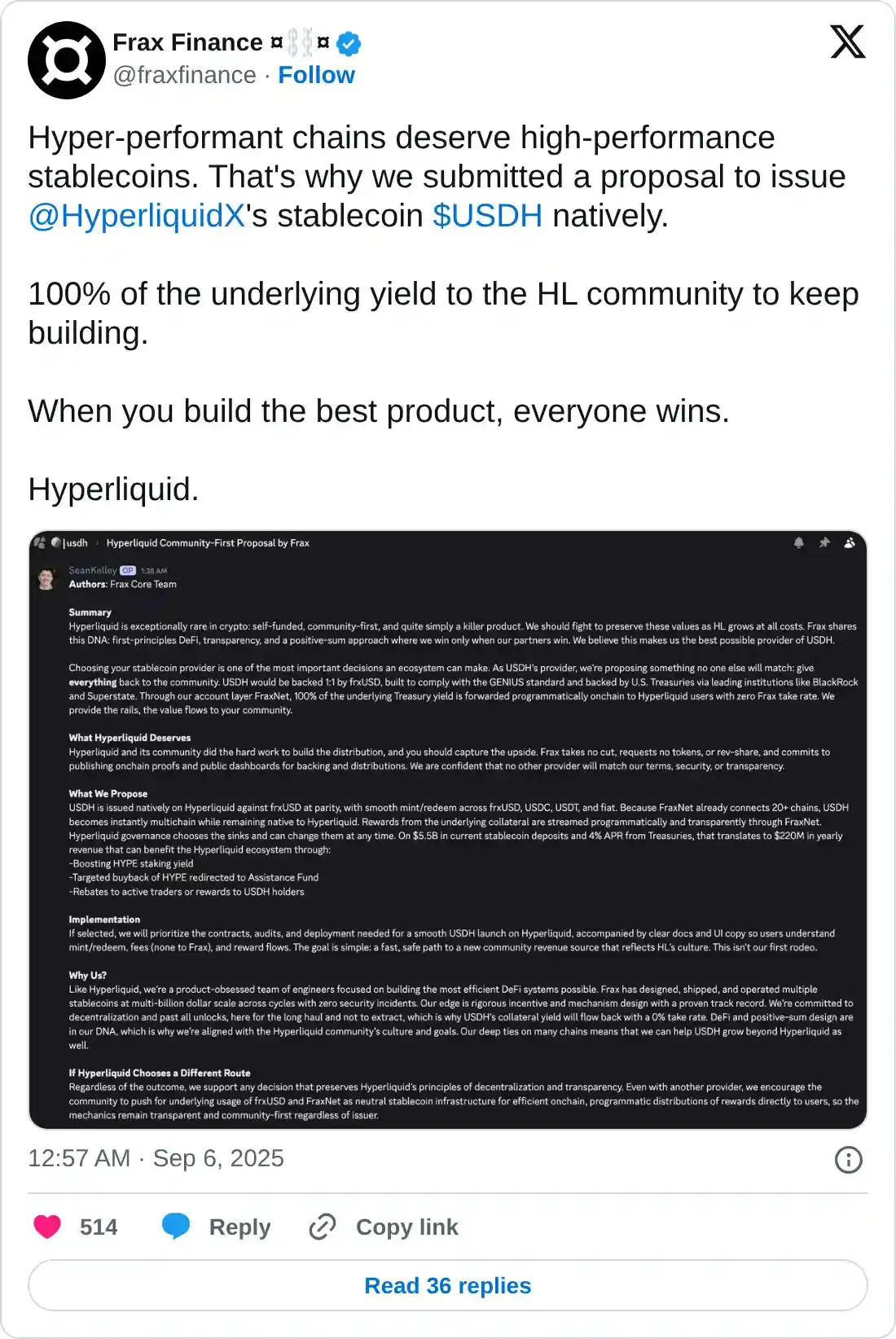

Frax has pledged that 100% of the Treasury yield will flow directly to users, making it a "community-first" model.

On the other hand, Sky (formerly known as MakerDAO) has proposed a 4.85% annual yield for USDH holders, which is greater than the US Treasury bills. Additionally, Sky will provide instant liquidity for USDC redemption of $2.2 billion through Sky’s Peg Stability Module.

For buybacks, Sky has proposed $250 million annually alongside a $25 million to bootstrap DeFi innovation.