Somnia, The 1 Million Transactions Per Second Chain, Dips 17% From All-Time Highs

Somnia’s native token, SOMI, has seen strong interest since its recent launch, following the mainnet rollout of the Ethereum-compatible blockchain.

The project, capable of processing 1 million transactions per second, quickly attracted attention from investors. However, short-term performance has not reflected early hype, as SOMI is facing sharp price volatility.

Somnia Is Losing Strength

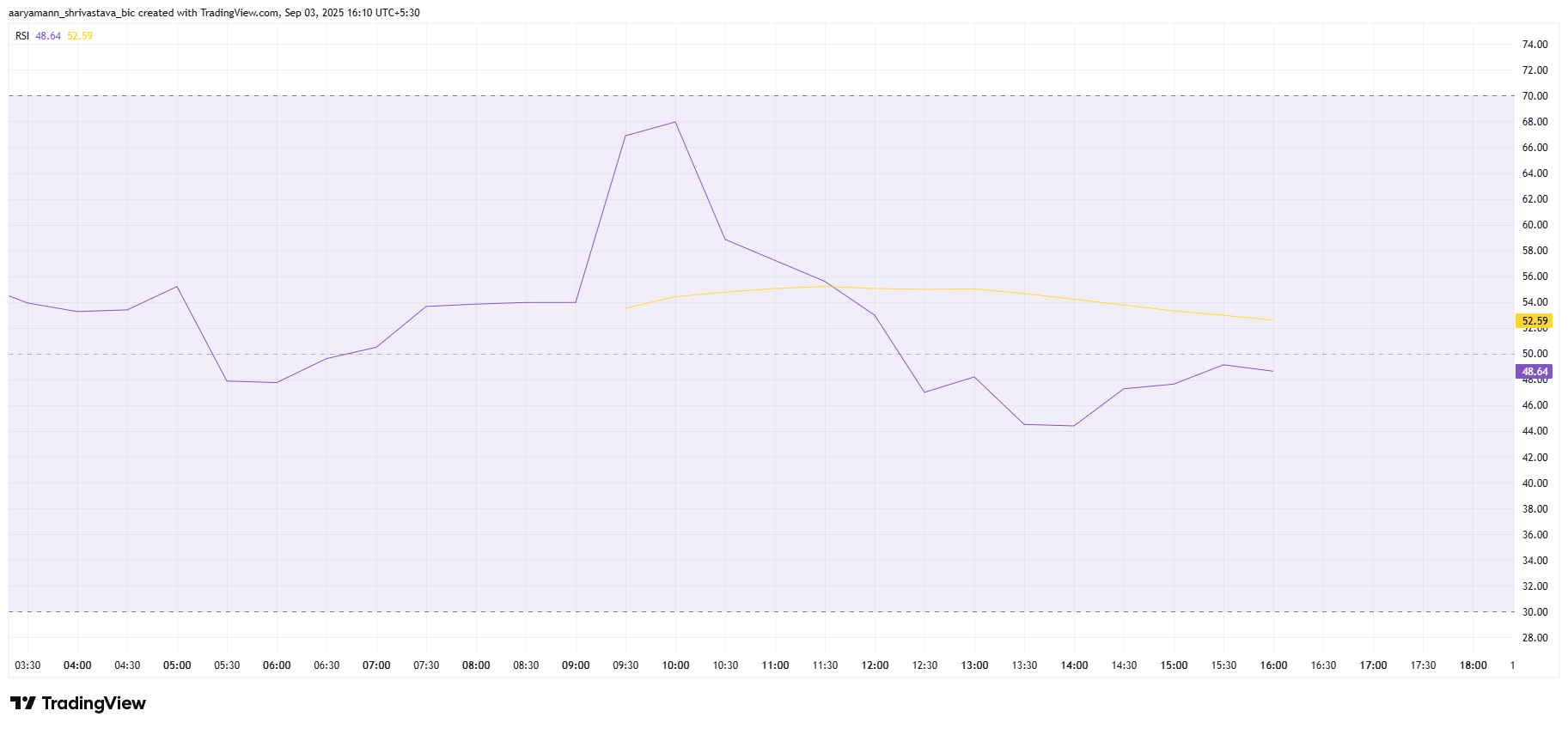

The Relative Strength Index (RSI) paints a cautious picture for Somnia. The indicator is currently positioned below the neutral 50.0 mark, resting in the negative zone. This suggests bearish conditions persist, and SOMI could face difficulty.

A subdued RSI highlights the absence of strong buying pressure from traders. Without a reversal in momentum, the altcoin may remain vulnerable to price drops.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

SOMI RSI. Source: TradingView

SOMI RSI. Source: TradingView

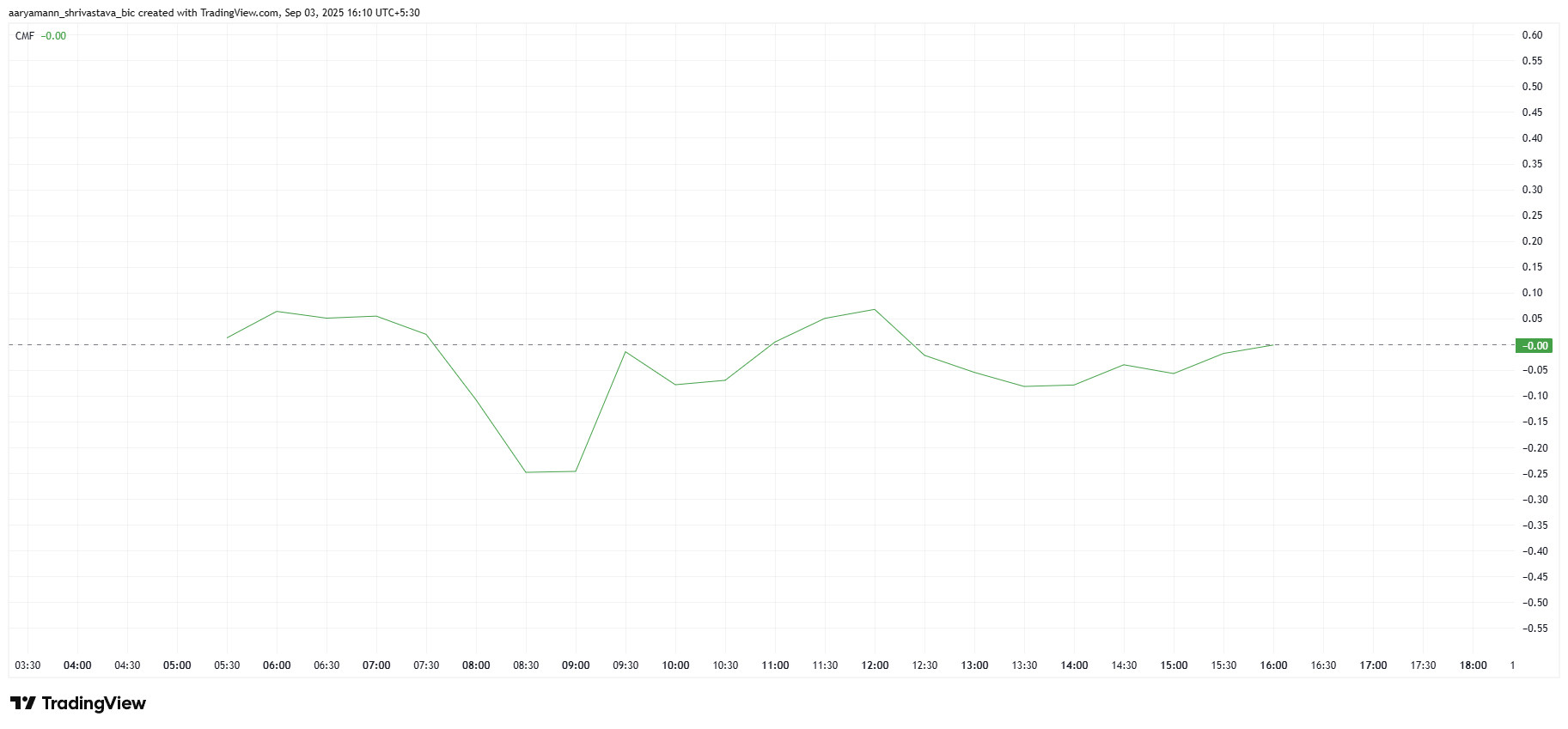

The Chaikin Money Flow (CMF) is hovering near the zero line, indicating weak inflows for SOMI. This suggests investor participation has not been strong enough to sustain recent price levels. Without significant capital injection, the altcoin risks struggling to maintain its valuation and could continue trending downward.

Somnia’s success depends on strong market confidence, but the muted inflows highlight investor hesitation. Unless buyers step in with greater conviction, SOMI could face a challenging period in maintaining growth.

SOMI CMF. Source: TradingView

SOMI CMF. Source: TradingView

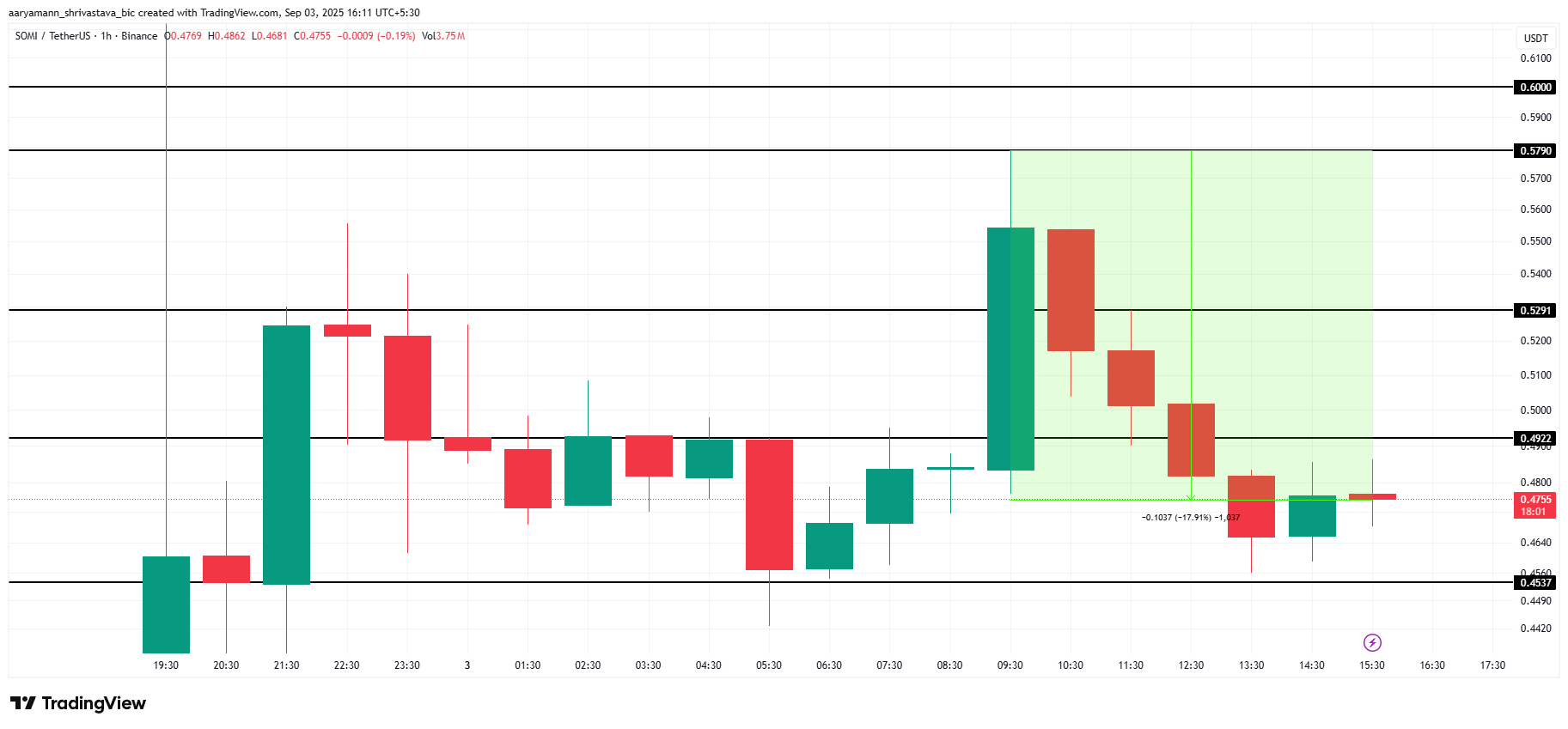

SOMI Price Faces A Drop

SOMI’s price has dropped nearly 18% in the past six hours. After marking an all-time high near $0.579, the token is now trading at $0.475. This sharp decline highlights growing uncertainty and the pressure Somnia faces as it attempts to stabilize after its launch.

Given current indicators, SOMI appears susceptible to further decline. If bearish pressure persists, the token could slip below $0.453, leaving it vulnerable to additional correction. Such a move would signal weakening demand.

SOMI Price Analysis. Source: TradingView

SOMI Price Analysis. Source: TradingView

If SOMI manages to reclaim support at $0.492, conditions could improve. Regaining this level may provide momentum for a rebound toward $0.529, which would help invalidate the bearish thesis. A recovery of this nature could signal short-term resilience for the new token.