Stellar Price Forecast: Whisk upgrade faces muted interest amid XLM mixed technical outlook

- Validators will vote on Stellar's Protocol 23 upgrade, named Whisk, on Wednesday at 17:00 GMT.

- The derivatives data reflect that interest in Stellar remains at lower levels.

- The technical outlook shares mixed signals as the short-term recovery undergoes a retest phase.

Stellar (XLM) edges lower by over 1% at press time on Wednesday, reversing after the 3% jump from the previous day. The soft stance in XLM aligns with the mixed technical and derivatives sentiment ahead of Stellar’s Protocol 23 launch, named Whisk.

Validators ready to vote on Stellar’s Whisk upgrade

The Stellar Protocol 23, named Whishk, aims to boost smart contract development on the network. Whisk will introduce features such as unified events to eliminate the fragmentation between classic operations and smart contracts, alongside parallel transactions for faster transactions at lower costs.

The upgrade is scheduled for a mainnet vote on Wednesday at 17:00 GMT. If validators accept the protocol, Whisk will go live on the network.

Lowered interest risks muted Whisk's performance

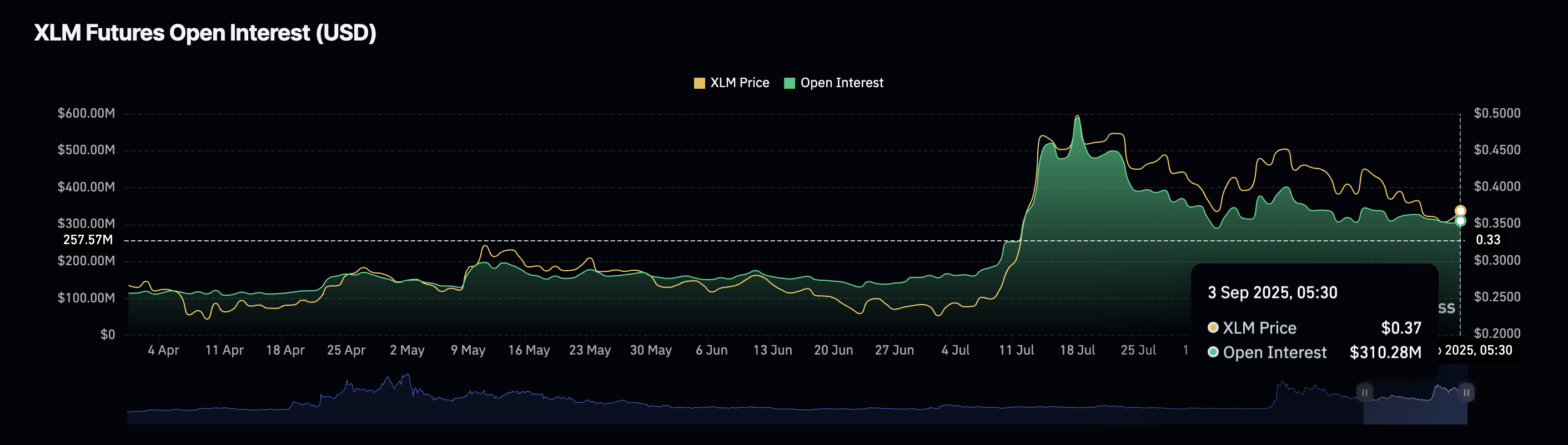

CoinGlass data indicates a 2% rise in the XLM Open Interest (OI) over the last 24 hours, reaching $310 million. Still, the relatively flat movement in OI above $300 million poses the risk of stagnancy, reflecting lowered interest among derivatives traders.

XLM Open Interest. Source: CoinGlass

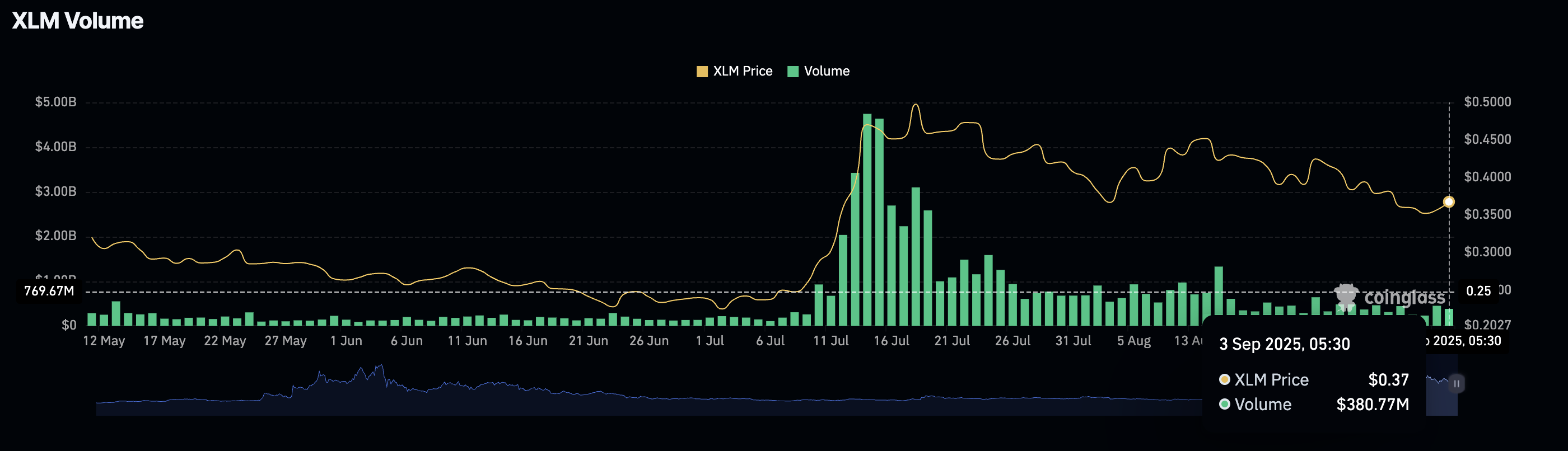

Adding to the lowered interest risk, the XLM trading volume maintains a declining trend after reaching a peak of $4.74 billion on July 14. If these metrics remain muted, XLM could underperform at the launch of the Whisk upgrade.

XLM Volume. Source: CoinGlass

XLM is at a crucial crossroads ahead of the technical overhaul

XLM corrects lower to $0.3630 on Wednesday, holding above the $0.3613 support level marked by a pivot low on August 3. The recent rebound from the $0.3442 low on Monday marks a fresh recovery after three consecutive weeks of losses.

If XLM upholds a daily close above the $0.3613 support, it could extend the rally to $0.4009, marked by a pivot low on July 24.

The technical indicators highlight a recovery in trend momentum on the 4-hour chart as the Moving Average Convergence Divergence (MACD) and its signal line maintain an upward trend towards the zero line, aiming to cross into the bullish field.

Additionally, the Relative Strength Index (RSI) at 50 has recovered to neutral levels from near oversold conditions on Sunday. This indicates that the bullish momentum is gaining traction.

XLM/USDT daily price chart.

Looking down, a drop below the $0.3613 level poses the risk of potentially retesting Monday's low at $0.3442.