Bitcoin Price In A Trend Shift? Here’s Why $118K Might Be Vital For A Bullish Return

The price of Bitcoin has struggled to make any real headway since reaching the former all-time high around $123,800 in mid-July. While the premier cryptocurrency set a new record-high price at around $124,120, it never really looked certain to go on a fresh bullish run.

Over the past week, the market leader succumbed to severe bearish pressure, falling briefly beneath the $112,000 level on Thursday, August 21. However, the Bitcoin price—and the rest of the market—reacted positively to the speech of the US Federal Reserve (Fed) Chairman Jerome Powell on Friday, August 22.

A prominent on-chain analyst on the X platform has identified a price level that could be crucial to Bitcoin resuming its bullish trend.

What Does A Return Above $118,000 Mean For BTC?

In an August 23 post on social media platform X, crypto analyst Ali Martinez pinpointed $118,000 as the most important level for Bitcoin’s next course of action. According to the online pundit, the price of BTC needs to quickly reclaim this price level in order to return to its bullish tracks.

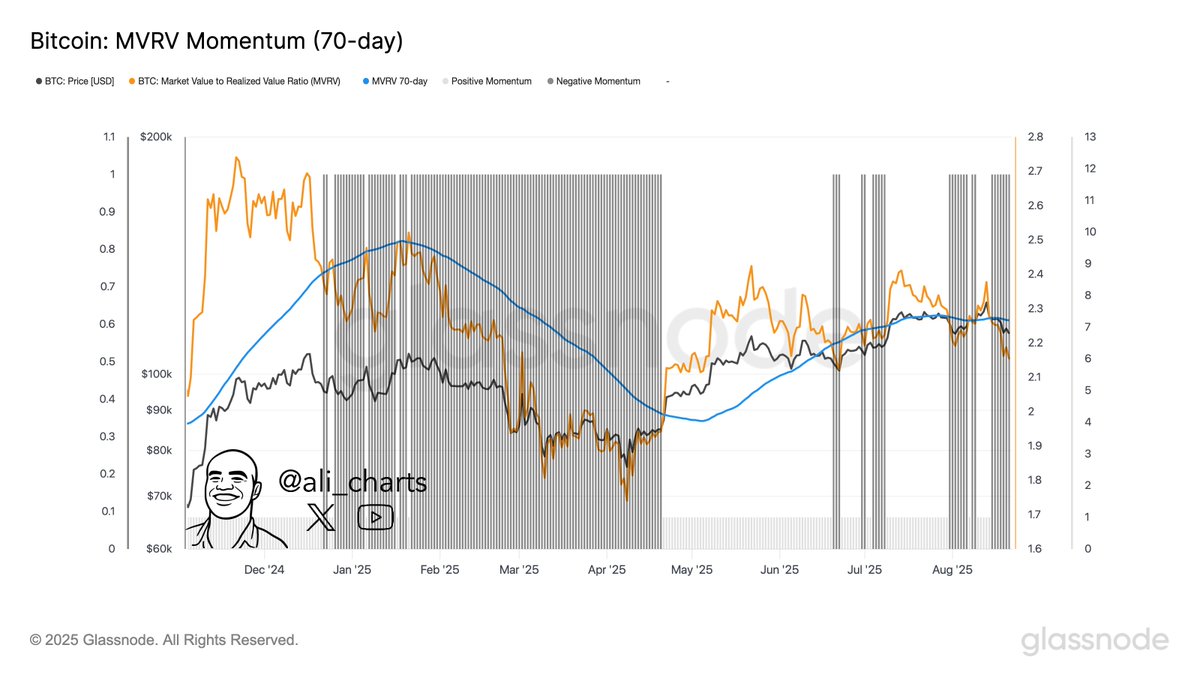

This relevant indicator here is the Glassnode MVRV (Market Value to Realized Value) Momentum indicator, which helps in identifying macro market trends. This metric consists of the MVRV ratio and the 70-day simple moving average (SMA).

When the MVRV ratio breaks above this 70-day SMA, it indicates a transition into the bull market. Meanwhile, a break below the simple moving average signals a shift to the bearish phase.

Typically, strong breaks above the MVRV 70-day moving average imply that large volumes of Bitcoin were purchased below the current price, showing that the holders are now in profit (light area in the highlighted chart). On the other hand, a strong breach below the moving average suggests that large volumes of BTC were acquired above the current price, with the holders in the red (shaded area in the chart below).

As observed in the chart above and highlighted by Martinez, the Bitcoin price is witnessing a trend shift at the moment. The crypto analyst then suggested that the 70-day SMA is currently around the $118,000 region, with the MVRV ratio needing to break above the moving average for Bitcoin to return to bullish momentum.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $116,217, reflecting an over 2% increase in the past 24 hours. However, the flagship cryptocurrency is still down by more than 1% on the weekly timeframe.