The Fed’s Liquidity Cushion Is Vanishing — What Happens When the Tank Runs Dry?

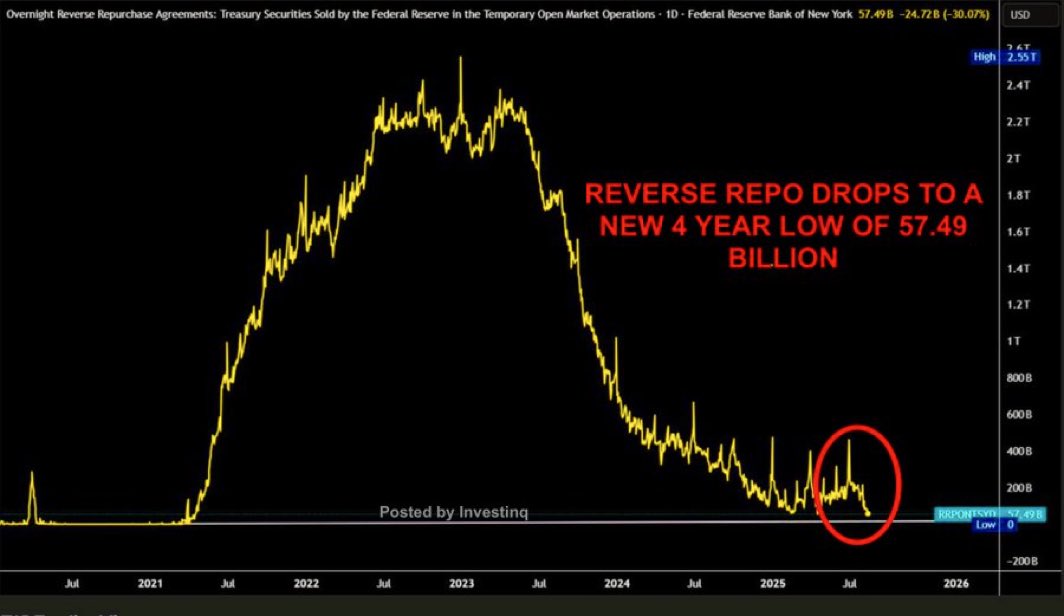

The Federal Reserve’s Reverse Repo Facility (RRP) dropped to its lowest level in 1,596 days, suggesting a crack in the liquidity backbone of global markets.

This turnout, which points to tightening financial conditions, raises alarm bells across Wall Street and crypto circles.

Experts Warn as Federal Reserve Reverse Repo Drops to a 5-Year Low

Malone Wealth founder Kevin Malone noted the decline, warning that the “excess cushion” in financial markets is vanishing.

He explained that once the RRP is empty, every new Treasury issuance must be absorbed directly by private buyers rather than being offset by cash parked at the Fed.

That shift, he said, will likely push bond yields higher while forcing banks, hedge funds, and money market funds to compete harder for funding.

“The bottom line is that liquidity flowing from RRP into markets has been supportive until now. But when it reaches near zero, there’s no cushion left. That’s when financial conditions tighten significantly,” wrote Malone.

Others hold that the Fed’s failure to intervene will lead to problems in markets, banks, and possibly even government funding.

Bruce, Co-Founder of Schwarzberg, tied the RRP decline to broader risks for stocks, bonds, and Bitcoin. He explained that the $2 trillion in excess liquidity built up during the pandemic had acted like momentum, sustaining markets even as interest rates rose.

However, with that liquidity nearly exhausted, the underlying fragility is exposed.

“This is bad in the short term for stocks, bonds, and Bitcoin…The US bond market is the most important market in the world. If the RRP now drops out as a buyer, bond yields will continue to rise. The Fed will likely have to step in and save the bond market by providing new liquidity,” Bruce warned.

Meanwhile, Joseph Brown of Heresy Financial highlights how the Treasury continues to ramp up short-term borrowing despite the RRP running dry.

He estimated that an additional $1.5 trillion in bills could hit the market by year’s end.

“Treasury is betting that rate cuts will come soon and provide a band-aid,” Brown said.

Meanwhile, some see the liquidity crunch as a prelude to the next phase of monetary easing. Crypto analyst Quinten argued that quantitative easing(QE) and fresh money printing will become unavoidable once the RRP balance hits zero.

“Federal Reserve’s Reverse Repo Facility is plummeting. QE & money printing will start aggressively when this drains to 0. Bitcoin will explode,” he predicted.

Fed’s Reverse Repo Drops. Source: Quinten on X

Fed’s Reverse Repo Drops. Source: Quinten on X

the liquidity engine that quietly propped up markets for years sputters, the Fed faces a narrowing path between rising funding costs, surging Treasury supply, and market stability.

The next act may involve bond market turmoil, emergency easing, or a Bitcoin rally, all of which hinge on how quickly the last drops of the RRP dry up.