LDO Price Rallies 68% Ahead of Lido DAO’s First Tokenholder Update

Lido DAO’s token (LDO) has seen a remarkable 68% price surge in the past week, driven by anticipation surrounding the first-ever Lido DAO Tokenholder Update scheduled for this Thursday.

This optimism has been reflected in LDO’s price, signaling potential further gains for the altcoin in the short term.

Lido DAO Prepares To Provide Major Updates

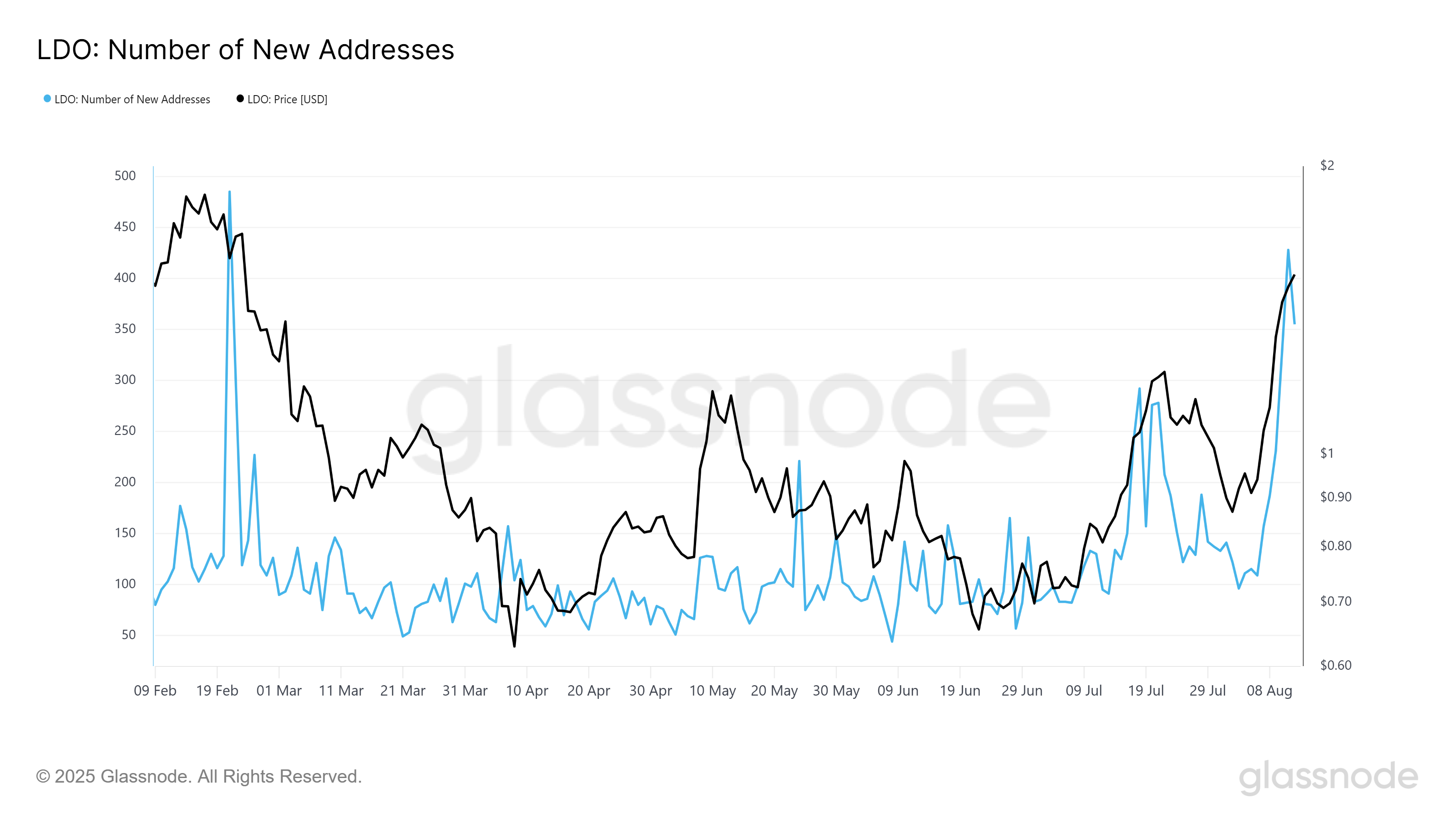

The recent surge in LDO’s price has been accompanied by a significant jump in the number of new addresses. Over the past week, new addresses rose by 292%, climbing from 109 to 428. This marks a five-month high, indicating that more investors are entering the market with a positive outlook on LDO’s future.

The sharp rise in new addresses is a clear sign that investor sentiment is overwhelmingly bullish. Many new holders are positioning themselves to benefit from potential price gains, spurred by the expected developments discussed in the Tokenholder Update.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Lido New Addresses. Source: Glassnode

Lido New Addresses. Source: Glassnode

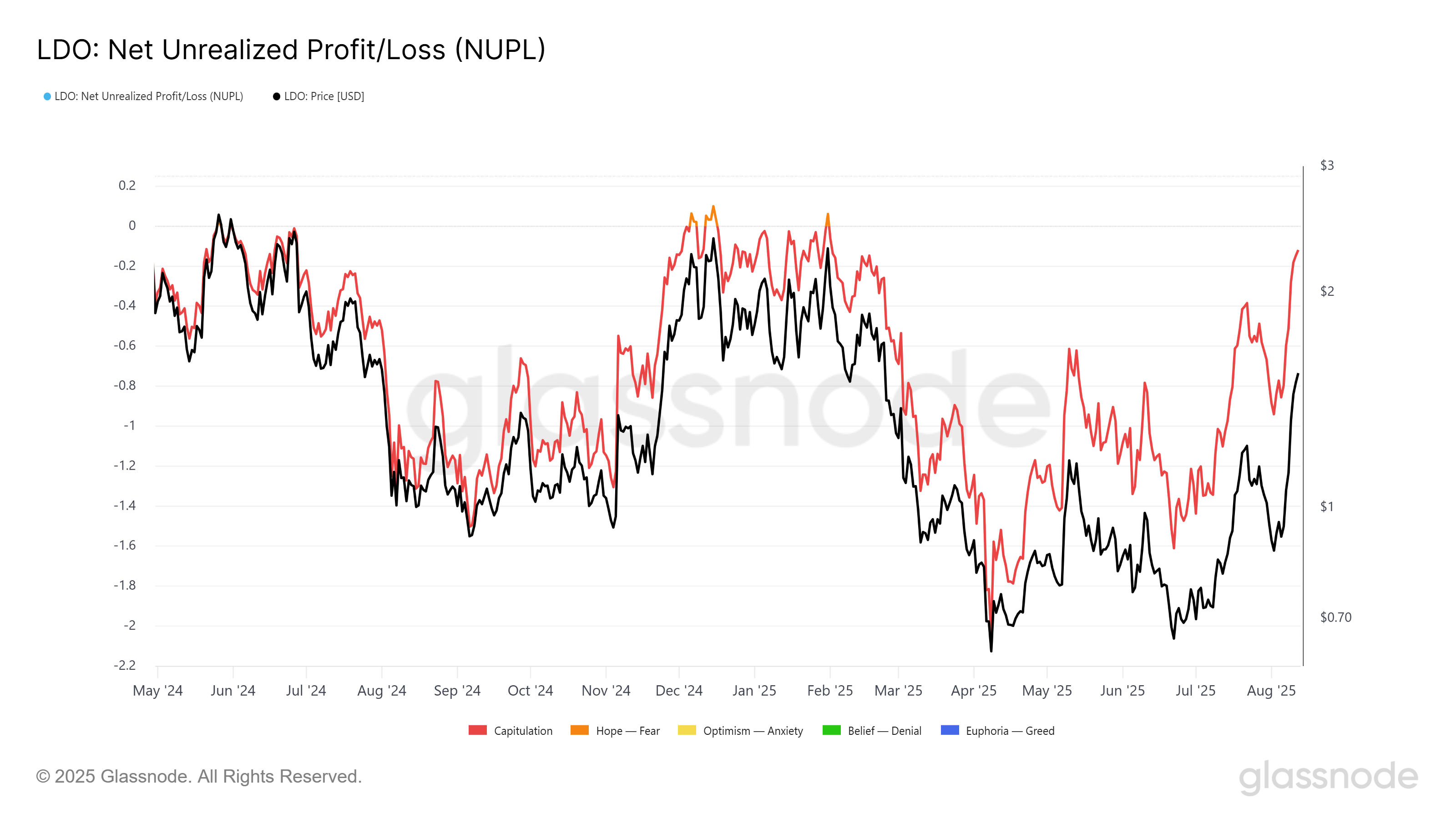

The NUPL (Net Unrealized Profit/Loss) metric for LDO is approaching a crucial threshold. Historically, when NUPL reaches the neutral mark of 0, it has often acted as a reversal point. This suggests that while LDO has been experiencing strong upward momentum, it could face a pullback if NUPL crosses this neutral zone.

If the NUPL indicator signals a shift from profit to loss for holders, it could signal a downturn in LDO’s price. While the altcoin is showing strong bullish sentiment, this key indicator suggests that traders should remain vigilant.

Lido DAO NUPL. Source: Glassnode

Lido DAO NUPL. Source: Glassnode

LDO Price Needs To Secure Support

LDO price surged by 68% in the past week, reaching $1.53, just under the resistance at $1.56. The upcoming Tokenholder Update has created a strong bullish sentiment, but for LDO to sustain its recent gains, it must breach the $1.56 resistance. A successful breakout above this level could propel LDO towards its next resistance at $1.82.

With the surge in new addresses and the growing hype around the Tokenholder Update, LDO is positioned to push past $1.56. If the momentum continues, LDO could reach $2.00, marking a significant milestone for the altcoin.

LDO Price Analysis. Source: TradingView

LDO Price Analysis. Source: TradingView

However, if investors decide to cash in on the recent price surge, LDO may experience a pullback. A decline below $1.34 could signal a reversal in momentum, with the price dropping to $1.18 or lower. If this occurs, the bullish thesis would be invalidated.