BlackRock to launch tokenized fund on Ethereum as battle for ETF intensifies

- Investment giant BlackRock says it wants to bridge TradFi and the crypto market.

- Ethereum is up 11% amid speculations of a real world assets bull run.

- ETH is a commodity and not a security, says Coinbase's chief legal officer.

Ethereum (ETH) could be set for further growth after $10 trillion asset manager BlackRock announced on Tuesday it's launching a tokenized asset fund on the largest smart contracts blockchain. However, the Security and Exchange Commission's (SEC) battle to classify Ethereum as a security may spoil the fun.

BUIDL to debut on Ethereum

Ethereum has been rising in the past 24 hours after BlackRock announced its decision to launch its first blockchain-based tokenized fund, BlackRock USD Institutional Digital Liquidity Fund (BUIDL), on the Layer One chain.

"BUIDL will offer investors important benefits by enabling the issuance and trading of ownership on blockchain," as stated on Business Wire. The announcement said this would “expand investors' on-chain offerings, provide instantaneous and transparent settlement, and allow for transfers across platforms.”

BUIDL aims to maintain a $1 peg per token as the fund would invest 100% of its underlying assets in cash, US Treasury bills, and repurchasable agreements. Investors who subscribe to the fund will earn yields paid as new tokens to their wallets at the end of every month.

Bank of New York Mellon will serve as custodian and administrator for BUDL's underlying assets, while Securitize will serve as the tokenization platform and transfer agent. BlackRock's partnership with Securitize also includes an investment into the latter to solidify bonds. Other key infrastructure providers for the fund include Coinbase, Fireblocks, Anchorage Digital Bank NA, and BitGo.

This comes a few months after the SEC's Bitcoin spot ETF approval saw BlackRock debuting their iShares Bitcoin Trust (IBIT). Additionally, BlackRock's CEO, Larry Fink, said in a recent interview, "I believe the next step will be tokenization of financial assets...tokenization of securities."

ETH price growth faces fierce battle from the SEC

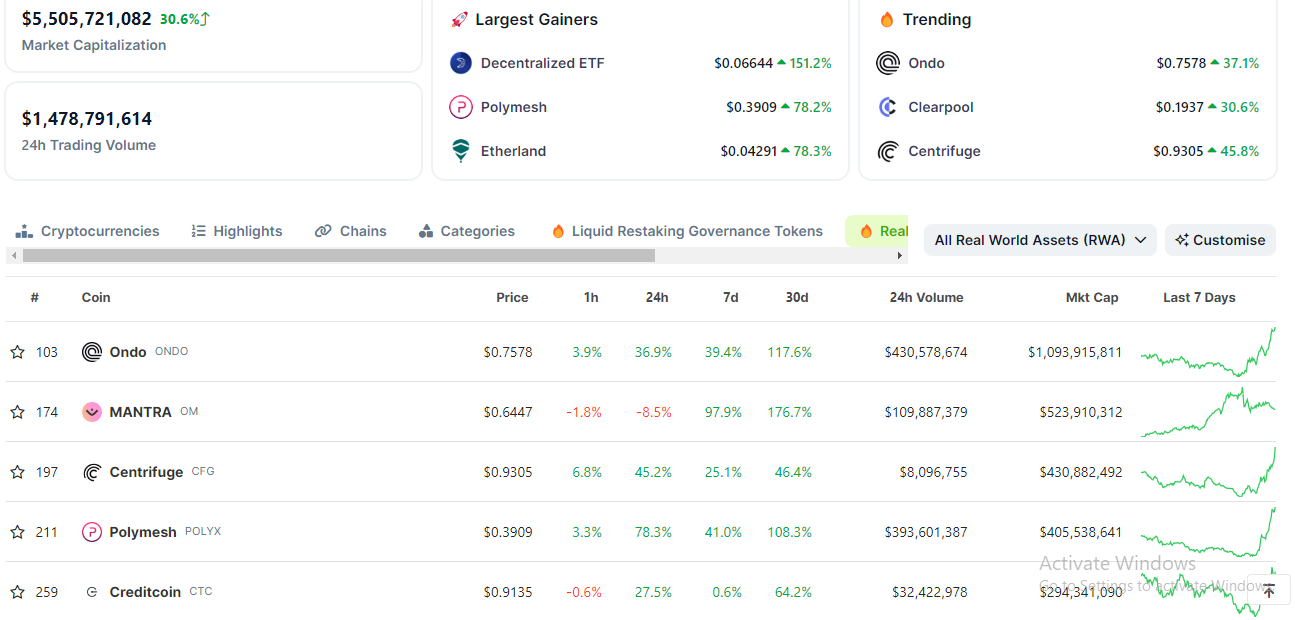

After the announcement, some analysts in the crypto community speculated that this was a potential igniter to spark real-world assets (RWA) narrative growth. The real world assets category has recorded huge gains in the last 24 hours according to data from Coingecko.

Top real world assets

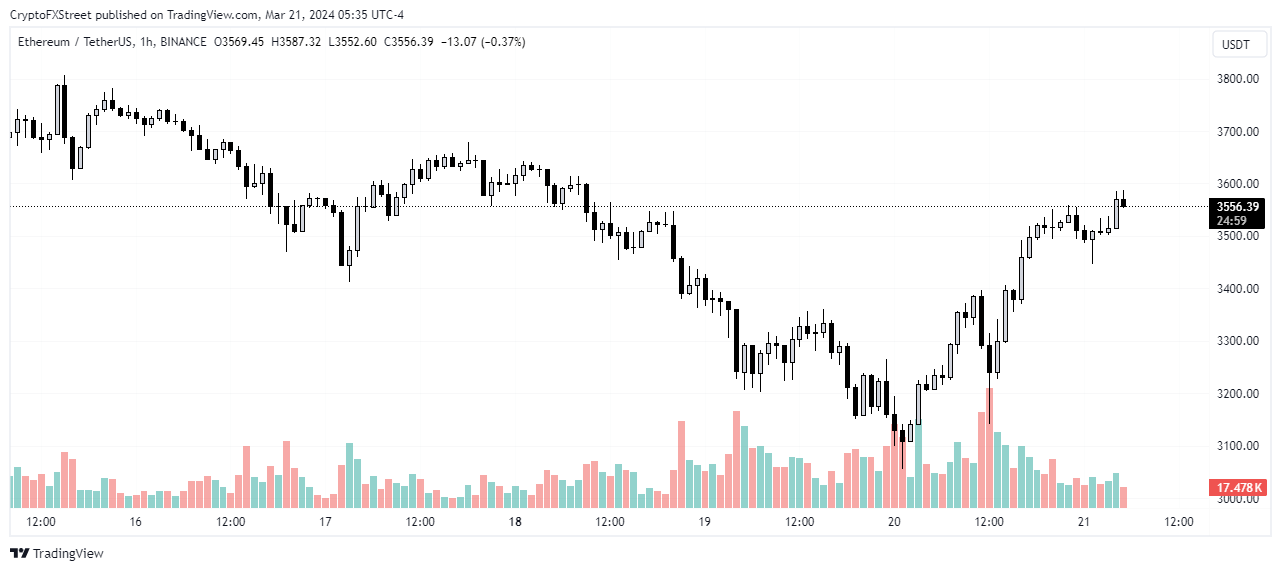

But more importantly, Ethereum reaped gains of about 11% in the last 24 hours following BlackRock's update and currently trades at $3,566.

ETH/USDT 1-hour chart

This follows the latest update on the spot ETH ETF, which saw the SEC issue subpoenas to three US companies dealing with ETH transactions, according to Fortune. Speculations are that the subpoenas are related to an investigation aimed at classifying Ethereum as a security. The investigation is said to be based on the 2022 timeline when Ethereum transitioned to proof of stake.

This would hurt any chances of the commission approving a spot Ether ETF, potentially causing a drop in Ethereum's price. Furthermore, the Ethereum Foundation acknowledged it has been receiving inquiries from "state authority," which many believe to be the SEC.

However, Paul Grewal, chief legal officer at Coinbase, has defended Ethereum in a recent post on X (formerly Twitter), stating that "ETH is a commodity, not a security," as confirmed by several federal courts and the Commodity and Futures Trading Commission (CFTC). He cited instances where senior SEC officials, including Gary Gensler, had said ETH isn't a security before he became SEC Chair.

"The SEC has no good reason to deny the ETH ETP applications. And we hope they won't try to invent one by questioning the long established regulatory status of ETH, which the SEC has repeatedly endorsed", he further expressed.