WTI Crude Oil plunges as Iran reportedly fires missiles at US bases in Qatar

- Iran reportedly launched missiles toward US bases in Qatar, escalating regional tensions.

- WTI Crude surged to $76.74 but reversed sharply as traders booked profits and supply disruptions failed to materialize.

- The focus shifts to key support near $70.00 with technical momentum turning lower.

WTI Crude Oil saw sharp intraday volatility on Monday, jumping to its highest level since January before reversing all its gains. Prices initially rallied to $76.74 after Axios reported that Iran had launched six missiles at US military bases in Qatar, raising fears of a broader conflict in the Gulf.

The move was driven by immediate concern that escalating hostilities could threaten Oil transit through the Strait of Hormuz — a critical route for around 20% of global crude flows. Market reaction was swift, with traders rushing into long positions during the early US session.

But as the session progressed, the narrative shifted. With no confirmed damage or escalation beyond the initial missile launch, market participants began to reassess the situation. Profit-taking ensued, and WTI retreated sharply below key support levels to settle near $70.80, a decline of nearly 5% from its peak.

Iran’s latest military move comes after a weekend of heightened tensions following airstrikes on its nuclear facilities by US forces. Monday’s missile launch targeting US bases represents a significant escalation, but so far, the fallout appears limited.

Traders remain wary. Any new signs of retaliation, especially if US assets are hit or Gulf shipping is disrupted, could reignite price momentum. However, for now, the market appears to be pricing in geopolitical noise without a significant impact on supply.

WTI Crude Oil price action

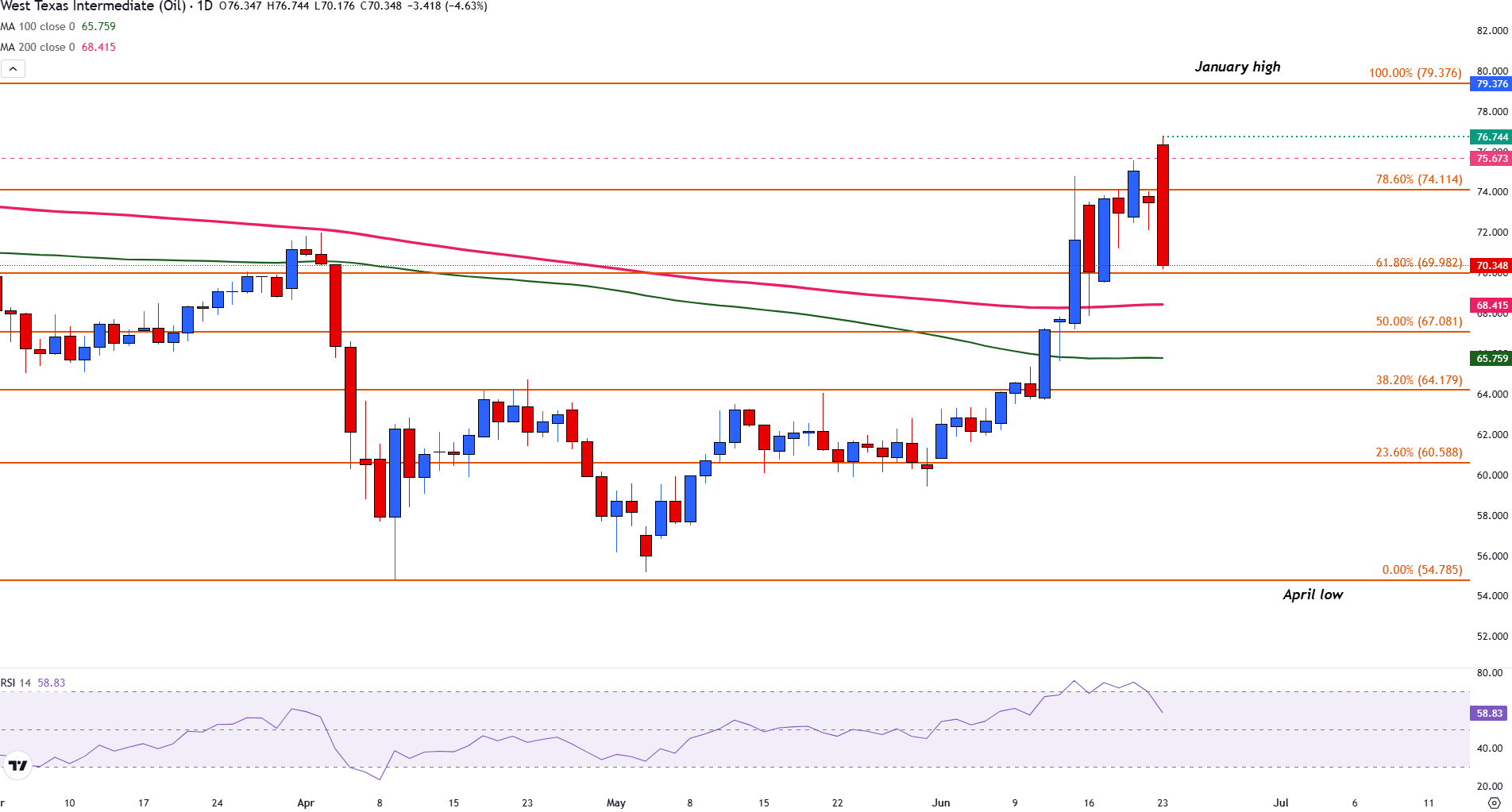

The rejection from the $76.74 high marks a decisive turning point. Price failed to hold above the 78.6% Fibonacci retracement of the January-April decline at $74.11 and broke through the $72.00 psychological level, shifting near-term momentum to the downside.

WTI is now hovering just above the 61.8% retracement at $69.98. A break below this area would expose the 200-day Simple Moving Average (SMA) at $68.42, followed by the 50% retracement level near $67.08.

WTI Crude Oil daily chart

The Relative Strength Index (RSI) has dropped to 63, suggesting that overbought conditions have eased and bearish pressure could intensify. Unless prices recover and close above $74.00 again, the bias for the week ahead may remain cautiously negative.

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.